With the price of Bitcoin up nearly 10% this morning, it might be tempting to think about jumping into a position.

But I’m here to remind you exactly why I’ll continue to sit out of this market…

You see, I know I’m supposed to love Bitcoin. But I just don’t.

I love the idea of it…

A decentralized currency with no interference from central banks? I’m in!

Transferring money across the world in seconds instead of days with almost no fees? I like that, too!

A fixed supply the government can’t print more of to water down its value? Also great!

But here’s the thing… There are two big problems that keep me from falling in love with Bitcoin.

Problem #1

First… Bitcoin is too easy to lose.

My wife has no idea where our investment accounts are. Or how to access them.

But if I got hit by a bus tomorrow, the money would find its way to her.

She is the beneficiary on all of my accounts, so the banks and brokerage firms will make sure she gets the money.

But what if I had our nest egg in Bitcoin?

If she doesn’t know the password and how to access it, it’s gone forever… floating in cyberspace… never to be found again.

How many stories have we heard about people throwing away hard drives with Bitcoin on them that would be worth millions today?

In just one recent example, a man accidentally threw away his hard drive that held 7,500 Bitcoin…

At current prices around $21,000, that hard drive is worth nearly $160 million.

And that was simple carelessness… Plenty of other Bitcoin holders have been scammed out of their digital money over the years.

If you’re going to hold a digital currency, particularly a lot of it, then you have to be ultra-careful not to lose it.

I don’t like the idea of my life savings sitting on a flash drive that could fall down a sewer drain and wipe me out in the process.

So that’s problem #1.

But there’s another problem…

Problem #2

The other big issue is one that has become all too obvious over the last year or so.

Bitcoin is NOT a safe haven asset.

Russia and Ukraine are at war…

Financial institutions around the world are cutting off Russia’s access to banking networks…

And inflation is soaring!

This is exactly the situation Bitcoin was supposedly designed for.

So, you might expect that the price of Bitcoin is booming, right?

Well, it’s not.

In fact, it’s just above its 52-week lows…

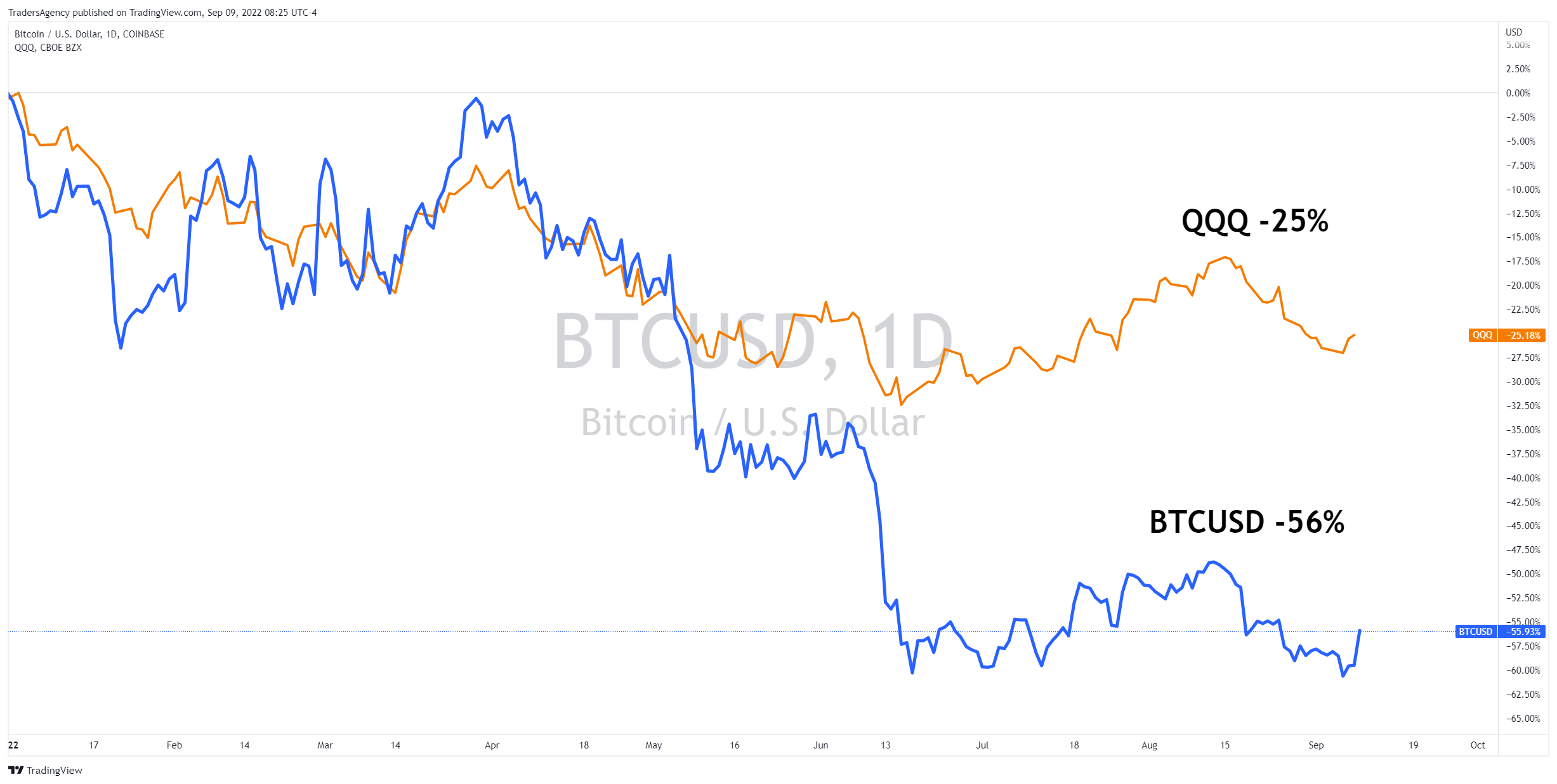

The orange line on the chart above is the recent performance of the Invesco QQQ Trust (QQQ), which tracks the Nasdaq index.

It has fallen by over 25% for the year to date.

The blue line is Bitcoin, which is down a whopping 56% this year.

So, how is this an inflation hedge?

How is it a safe haven asset?

And how does a “store of value” fall by a third in a few short months?

It’s not… It’s not… And it shouldn’t!

Cryptocurrencies are an exciting development.

And you can make a lot of money trading them.

But until my two big concerns go away, I’ll be keeping my money in US dollars.

Join Today’s Live Session

Now, if you’re like me and you want to try to turn those US dollars into more US dollars, check out my premium Alpha Stocks trading service.

We have plenty of long ideas for the right stocks… We recently generated a gain of 21.3% in just 15 days in Permian Basin Royalty Trust (PBT) as that stock broke out of its range.

And last month, we closed another winner in Enphase Energy, Inc. (ENPH) for a quick gain of 22.5%.

But we’re also not afraid to go short… We recently recorded a 21.6% gain on the downside in only eight days as Pegasystems Inc. (PEGA) stock plunged…

Of course, we also get together every Monday for an hour-long live session so that subscribers can ask questions and get guidance about our trades.

If you’re ready to see what you could be missing out on, I’m holding a special session this afternoon in which I’ll discuss my strategy in more detail…

Just click here to register and learn more about Alpha Stocks now!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily