Hey, Ross here:

As we run into choppy waters, let’s look at an interesting chart on where the market could be a year from now.

Chart of the Day

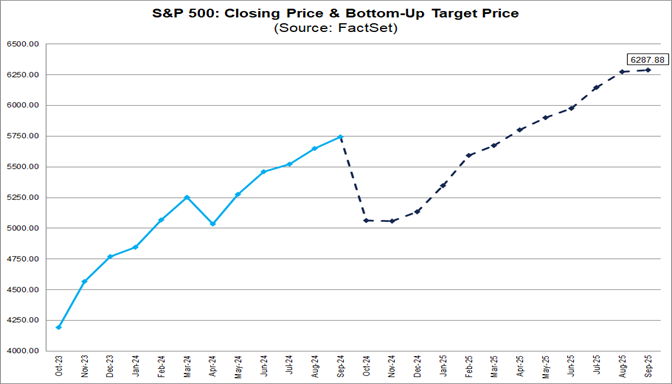

This is the S&P 500’s price target based on the aggregate one-year target prices of all 500 companies in the index.

In other words, if all 500 companies in the index hit their median target prices one year from now, the S&P 500 would be over 9% higher at 6,288.

This might seem optimistic. But the truth is, using this method of calculation has actually underestimated the index’s performance in the past.

If you had done this calculation on September 30, 2023 then the S&P 500 was only “supposed” to be at 5,146 on Sep 30, 2024.

Instead, the index closed at 5,761 – about 12% higher.

I like this bottom-up analysis better because you’re getting the combined result of 500 different analyses instead of just a single overarching one.

And yet, it still tends to underestimate the strength of the bull market.

This confirms what the market is already telling me – to keep playing the bull market.

Insight of the Day

The underestimation of the bull market’s strength is a prime source of opportunities.

Even the Wall Street pros do it.

It’s just human nature – we feel the pain of loss more keenly than the joy of gains.

And that means when the market falters a little, a lot more people than you’d expect tend to panic sell…

Especially when you factor in the doom-and-gloom the clickbait media loves pumping out.

Then, when these same people see the market recovering from the dips, they buy back in again – sending the market even higher.

Rinse and repeat – and you have a “bumpy” market that nevertheless keeps inching higher.

Strategically buy these dips, and you could beat even a roaring bull market.

And that’s why later this morning at 11 a.m. Eastern…

I’m going LIVE for a masterclass that will allow you to buy the dips in the most strategic way possible.

Because you’ll be following the market’s best dip-buyers – the corporate insiders.

They’re buying the dips in their own company stocks based on information no one else in the market has.

That’s why my strategy based around following these insiders has never had a losing year…

And has built up a 1,900% compounded return since inception.

This is the best dip-buying strategy I know.

So, if you haven’t yet, click here to “lock in” your spot for my live masterclass later this morning…

Where I’ll reveal:

- Where you can find the complete records of all these insider trades…

- Why so many traders fail when trying to follow these insiders (not all insiders are worth following)

- And the 3 most powerful – yet counterintuitive – insider buying signals you must know about to be successful

The login details will be in your inbox shortly.

See you at 11 a.m. ET sharp.

Customer Story of the Day

“Ross is an excellent teacher. I have watched three zoom meetings being new to trading and am really impressed.

I have stage 4 kidney cancer which God is fighting for me while I’m learning from Ross on how to make good investments. Thankful that his research includes a wide scope of companies”

Ross Givens

Editor, Stock Surge Daily