Hey, Ross here:

Last week, I showed you how retail investors are at maximum fear levels – levels exceeding even the August–October 2023 pullback – and why this was unjustified.

Today, I show you what the institutional investors – the real market-movers – are thinking compared to them.

Chart of the Day

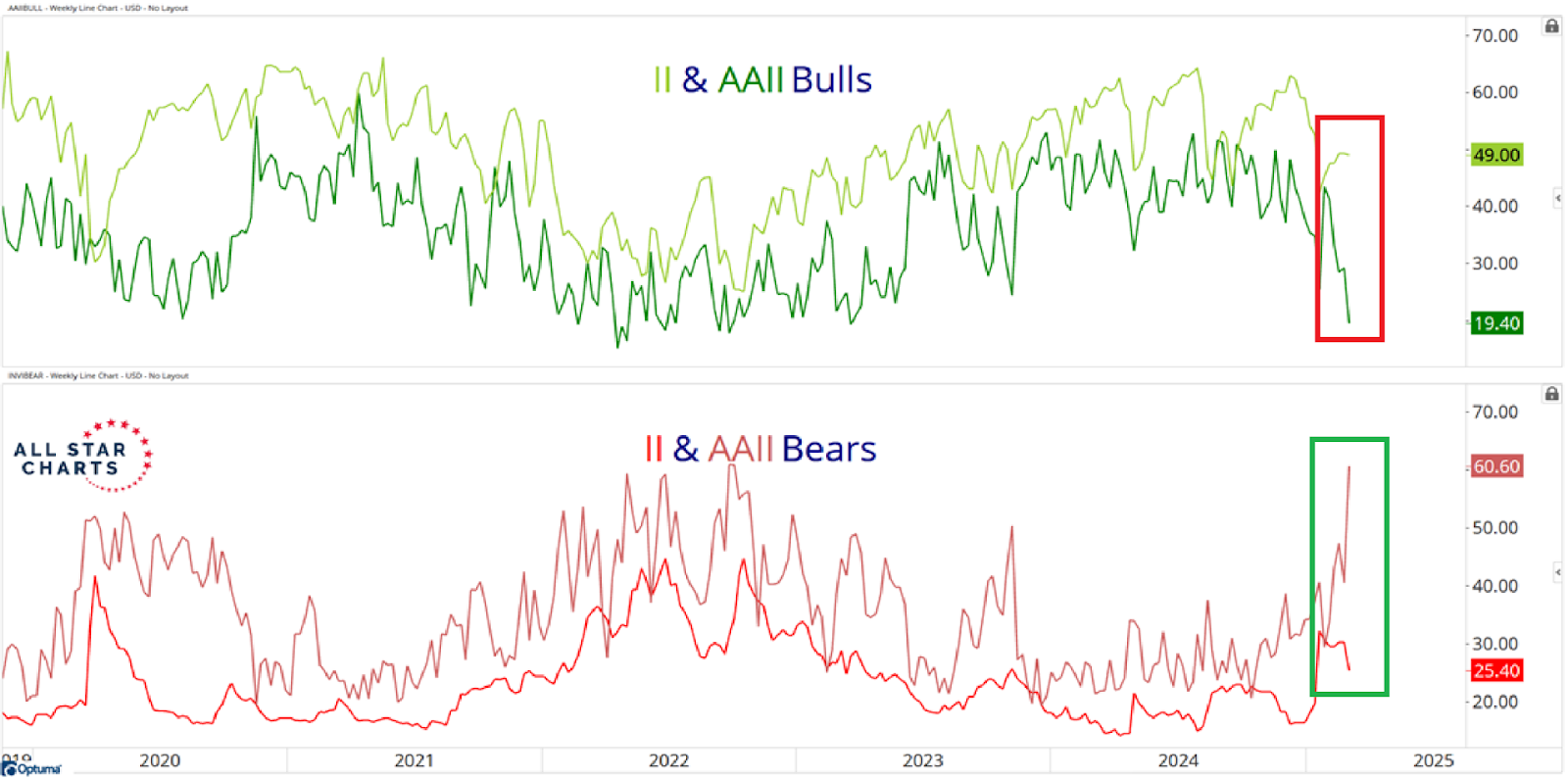

This chart shows the difference between the number of institutional investors who are bulls (or bears) compared to their individual counterparts.

In the above part of the chart, you can see how the number of individual bulls have sharply dropped – while the number of institutional bulls have modestly increased.

In the bottom part of the chart, you can see the number of individual bears spiking – while the number of institutional bears modestly decreased.

In short, institutional-investor sentiment is diverging again.

Make sure you position yourself to take advantage.

Insight of the Day

The institutional investors are following Warren Buffett’s advice – being greedy when others are fearful.

Sure, Warren is an ultra long-term investor – not a trader.

But one of his most popular sayings – being greedy when others are fearful – still applies.

We saw this right before the November 2023 rally, which kicked off right when the individual investors were at peak fear.

We’ve also seen it in other smaller rallies during this bull market – such as during the August 2024 “yen scare”.

And now, we’re seeing it again…

Right in the middle of earnings season – which is an opportunity in and of itself.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE for a training session that will show you to take full advantage of this situation.

After the session, you’ll understand exactly how to stack the odds in your favor and see opportunities most traders don’t even know exist.

So if you haven’t yet, click here to “lock in” your spot for my live session…

And I’ll see you at 11 a.m. ET in a few hours.

Earnings season is about to come to an end…

And this institutional-individual sentiment divergence won’t last much longer.

Capitalize on it while you still can.

See you soon.

Customer Story of the Day

“Great service! It has a great education component, which is great for those just beginning in trading.

I highly recommend them and I have done very well following their advice. A+++”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily