Hey, Ross here:

Thanks to the sharp pullback, we have so many traders screaming about how this is the “end of the bull market”.

But if we step back and put things into perspective…

We’ll see that drawdowns like this are not uncommon.

Chart of the Day

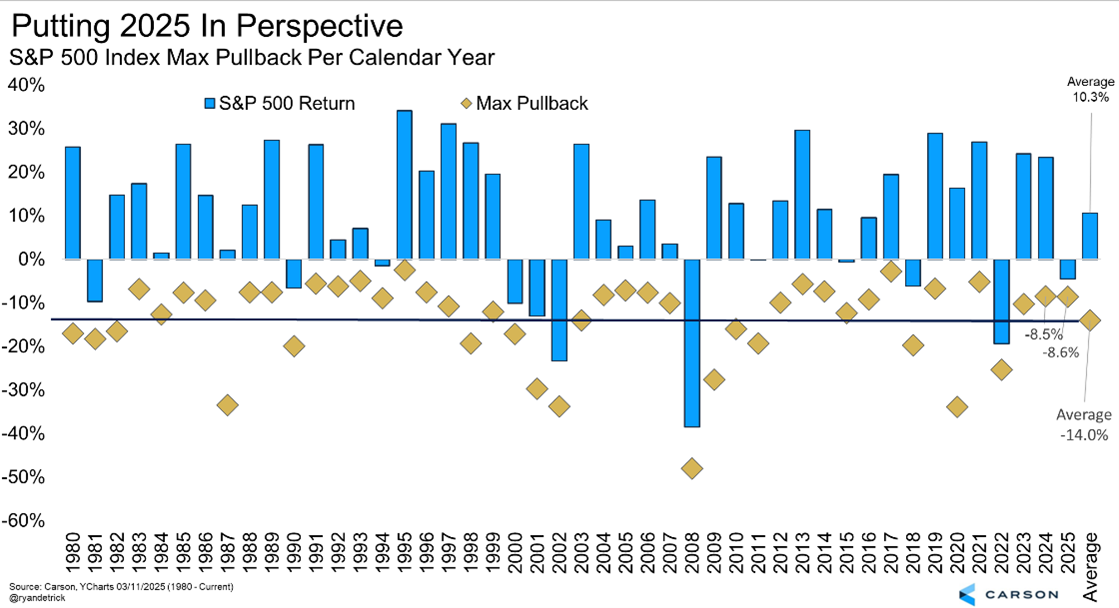

This chart shows the maximum the S&P 500 has pulled back in each calendar year from 1980 onward.

On average, the S&P 500 sees a maximum pullback of 14%.

Currently, 2025’s pullback is about on par with the maximum pullback we saw in 2024…

And is still smaller than the big pullback we saw in 2023.

This is why it’s important to be able to “zoom out” and keep things in perspective.

Because if you can’t, you’ll always overreact.

Insight of the Day

The goal is to exploit other people’s overreactions – not overreact yourself.

Remember, there’s always someone else on the other side of the trade.

Only one person gets the better of the deal.

The one who overreacts usually gets the short end.

That’s why you want to make sure you’re not the one who overreacts…

But the one on the other side of the trade.

Right now, the market is full of people overreacting – something the mainstream media is happy to keep encouraging to get more clicks.

That’s the opportunity.

And that’s why tomorrow morning at 11 a.m. Eastern…

I’m going LIVE to show you how the corporate insiders are taking advantage of the market overreaction…

And most importantly – how you can position yourself alongside these insiders.

They know the “on the ground” situation much better than any trader…

And they know what is being exaggerated – and what isn’t.

For them, this overreaction is their opportunity…

And after my live training session tomorrow, it’ll be your opportunity too.

My insider strategy has led to gains like 771% in 2 months, 157% in 2 weeks, and even 321% in 2 days…

But considering the size of this market overreaction – this could just be the start.

So click here to register for my live insider training session…

And I’ll see you tomorrow, Friday morning at 11 a.m. ET.

Customer Story of the Day

“I need an edge, a mentor, someone in my corner with my best interest in mind to teach and advise. Someone willing to have conversations relative to where I am as a trader now.

They can’t teach me everything they know at once, and I don’t expect to win every trade or get rich overnight, but I’m learning and I’m much more comfortable finding and making trades now than I was 6 months ago.

Traders Agency has a wealth of information to share and is sincerely interested in helping people. I sincerely appreciate all they do. Thanks Ross”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily