Hey, Ross here:

Markets dip for two days in a row to start the quarter and immediately the clickbait news media starts screaming about the “Dow plunging 400 points!” (aka a normal 1% decline).

Could a healthy pullback happen now? Yes, it most definitely could.

But that won’t mean the bull market is over.

Chart of the Day

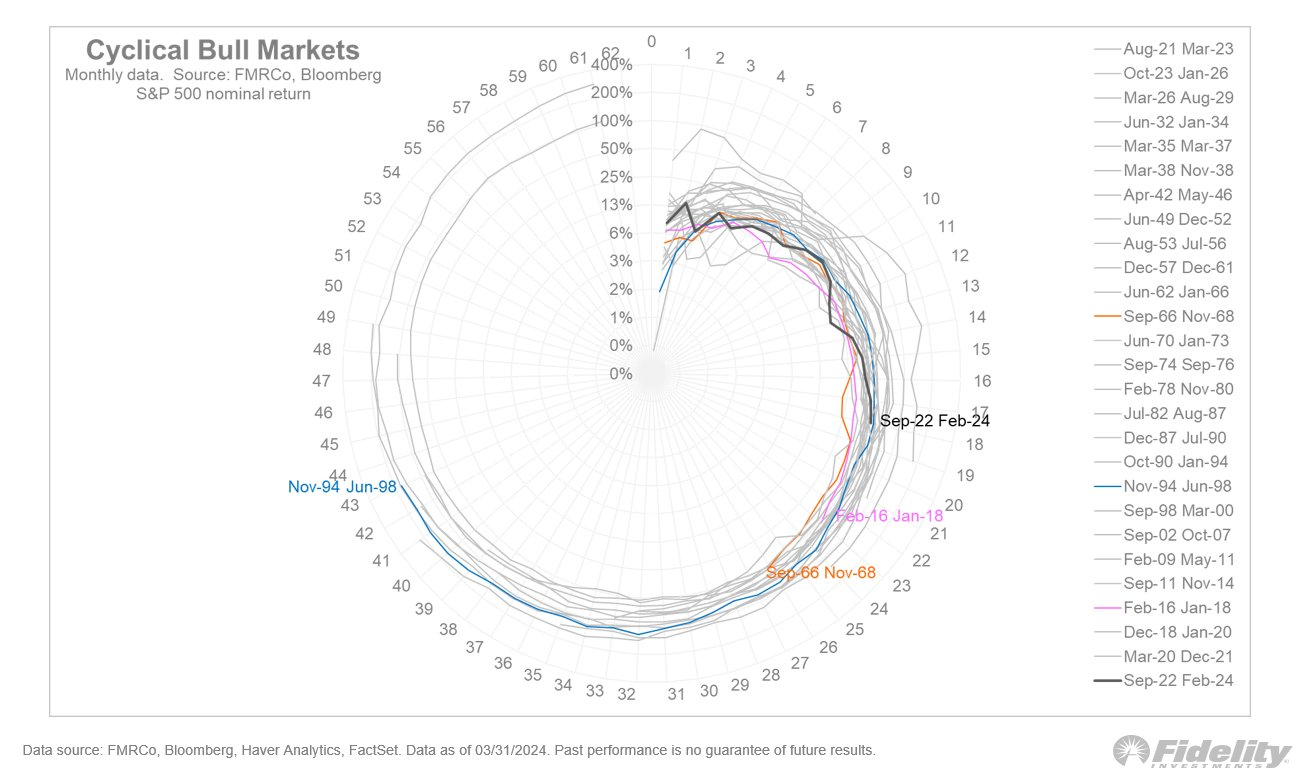

Here’s a very interesting chart that visualizes all past bull markets in a “clock” format.

The bull market starts at 12 o’clock – and ends when it comes full circle back to 12 o’clock on the chart.

So, where are we now according to this clock?

Well, if we compare it to the longest bull markets in history, we’re only at 3 o’clock – just a quarter of the way through.

If we compare it to the average bull market, we’re still only at 6 o’clock – only halfway through.

In short, stop worrying about a crash and just keep trading.

And if a pullback does happen, take it for what it really is – an opportunity.

Insight of the Day

As long as you’re positioned in the right stocks, pullbacks are just a chance to increase your returns by lowering your entry price.

In a healthy pullback, the market as a whole pulls back – then shoots higher.

But when it comes to individual stocks, it’s different.

Some stocks will pull back and shoot higher – much higher and faster.

But others will keep pulling back – and likely end up trading sideways for an extended period.

You obviously want to position yourself in the first group of stocks…

Because in those cases, pullbacks are just a chance to increase your returns by lowering your entry price.

And that’s why later today at 3 p.m. Eastern…

I’m going LIVE for a masterclass that will allow you to target these exact stocks by seeing which stocks the insiders are loading up on…

Because remember, pullbacks are an opportunity for them as well – which is why understanding how to “piggyback” their trades is such a good move.

So make sure you click here to save your seat for my masterclass later…

And watch out for the login details in your inbox closer to the start time.

I’ll see you at 3 p.m. ET today.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily