Hey, Ross here:

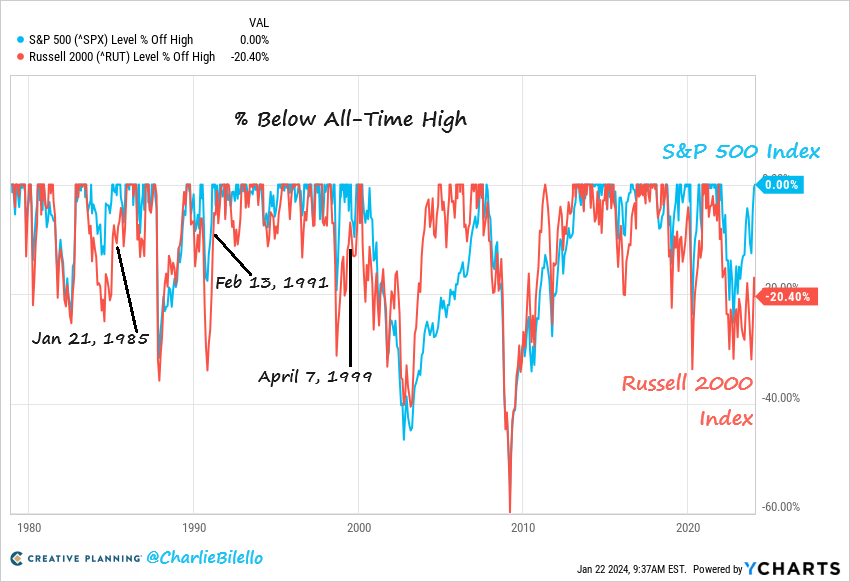

Yesterday, I highlighted that the small-cap Russell 2000 index was still down 20% from its highs – technically putting it in bear market territory – while the S&P 500 hit new all-time highs.

Yet, I maintained that I was still bullish on small-cap stocks.

Today’s Chart helps explain why.

Chart of the Day

This is a chart examining what happened the previous times the Russell 2000 was still in a large drawdown – all while the S&P 500 was at a record high.

Here’s the summary:

- On April 7, 1999, the S&P 500 was at a record high while the Russell 2000 was in a -19.2% drawdown. Subsequently, the S&P 500 gained 14.3% over the next year while the Russell 2000 gained 36.5%.

- On February 13, 1991, the S&P 500 was at a record high while the Russell 2000 was in a -13.5% drawdown. Subsequently, the S&P 500 gained 12.1% over the next year while the Russell 2000 gained 35.5%.

- On January 21, 1985, the S&P 500 was at a record high while the Russell 2000 was in a -13.3% drawdown. Subsequently, the S&P 500 gained 17.4% over the next year while the Russell 2000 gained 18.2%.

Now obviously, these are only a few data points, and they happened decades ago.

But, the point is that the S&P 500 being at a record high while the Russell 2000 is still in a big drawdown is not unprecedented…

And it is in fact a signal of bigger gains to come.

Insight of the Day

You can increase the probability of your small-cap bets by targeting those with price-moving catalysts few others know about.

History tells us the future is likely very positive for small-cap stocks.

Still, there’s no denying it can be emotionally challenging to buy into a sector that’s technically in a bear market while the rest of the market is flying.

So, what we want to do is to increase the probability of our small-cap bets.

And the best way I know to do that is to do the hard work of uncovering price-moving catalysts in specific stocks – catalysts most of the market are completely unaware about.

It’s a slog – but it pays off (for instance, it could have allowed you to nearly triple your money over the past 10 months).

But here’s the good news – you don’t need to do any of that hard work.

And later today, at 12 p.m Eastern…

I’m going LIVE for a masterclass explaining how you can target these stocks – without having to do any of the tedious research work yourself.

So click here to save your seat for my upcoming live masterclass…

And keep a look out for the login details in your inbox shortly.

See you soon.

Ross Givens

Editor, Stock Surge Daily