Prices are up for just about everything.

But don’t expect them to come back down.

At best, this is the new normal.

The New Normal

Of course, prices for some things will come down… Used cars, for example.

At one point during the pandemic, used cars were selling for as much or more than new cars.

This was the short-term result of kinks in the supply chain – primarily the semiconductor chips found in modern cars.

Used car prices spiked because there weren’t any new ones. That is correcting itself.

But here’s the thing… New cars will never be as cheap as they were.

The average price of a new vehicle rose by just under $1,800 in 2019… $3,301 in 2020… an incredible $6,220 in 2021… and $5,011 in 2022 already.

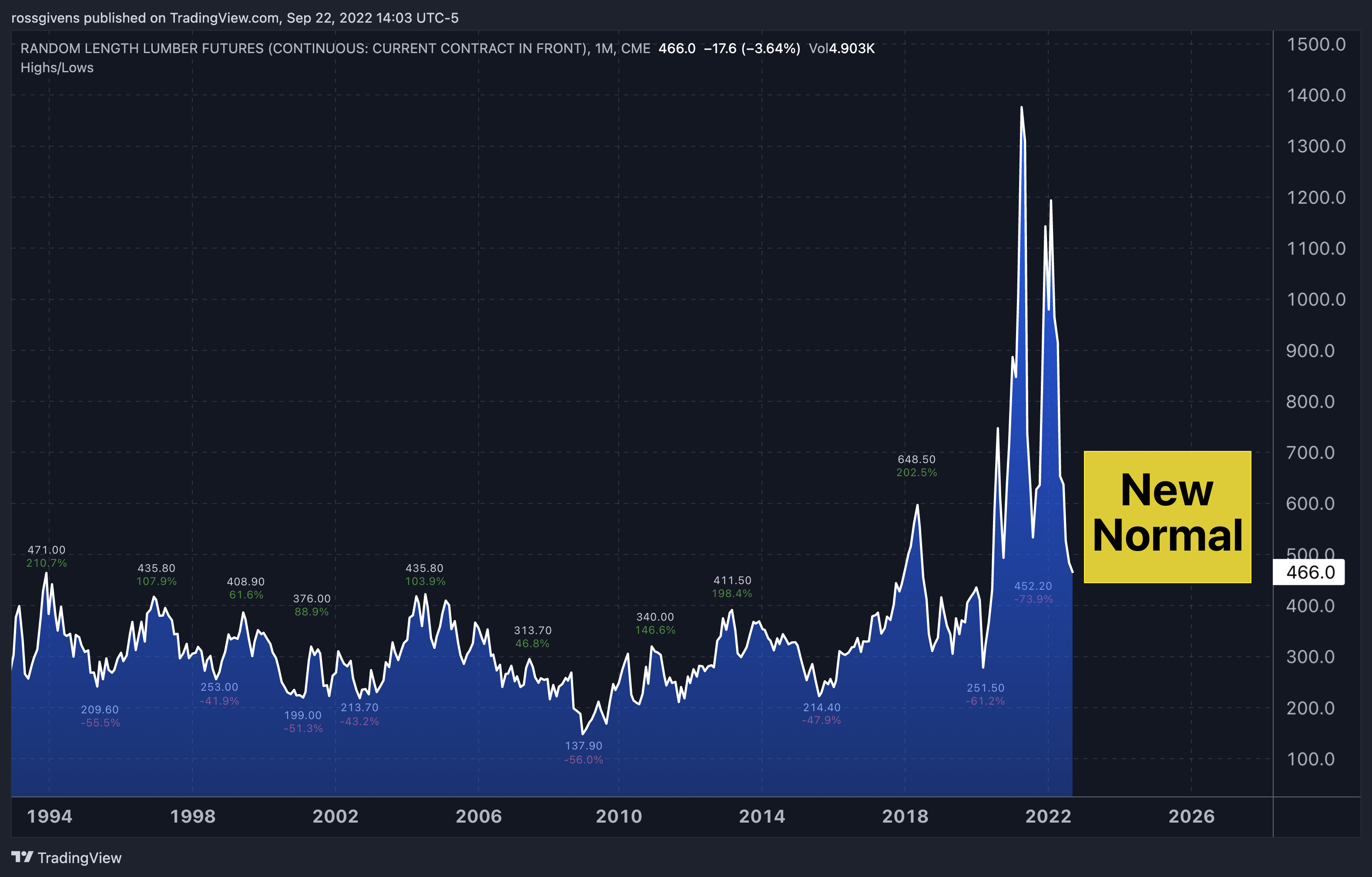

Commodities

Commodities have also surged higher.

The price of lumber, steel and other building materials rose more than 300% in 2020.

They’ve come down from the peak, but we will never see the prices we were used to again.

Below is a 20-year chart of lumber prices…

To be fair, a price hike in lumber was long overdue.

But we’ve grown accustomed to paying certain prices for wood over the last two decades, and we will never see those again.

My guess is that lumber settles around $600 per 1,000 board feet – roughly double where prices have stayed the last 20 years.

Houses are built out of lumber. So, it obviously costs more to build a house than it did before.

If new home prices are up, then guess what? Used house prices are going to rise as well.

So, while rising interest rates may squeeze home prices down a little, they’re never going back to 2019 levels.

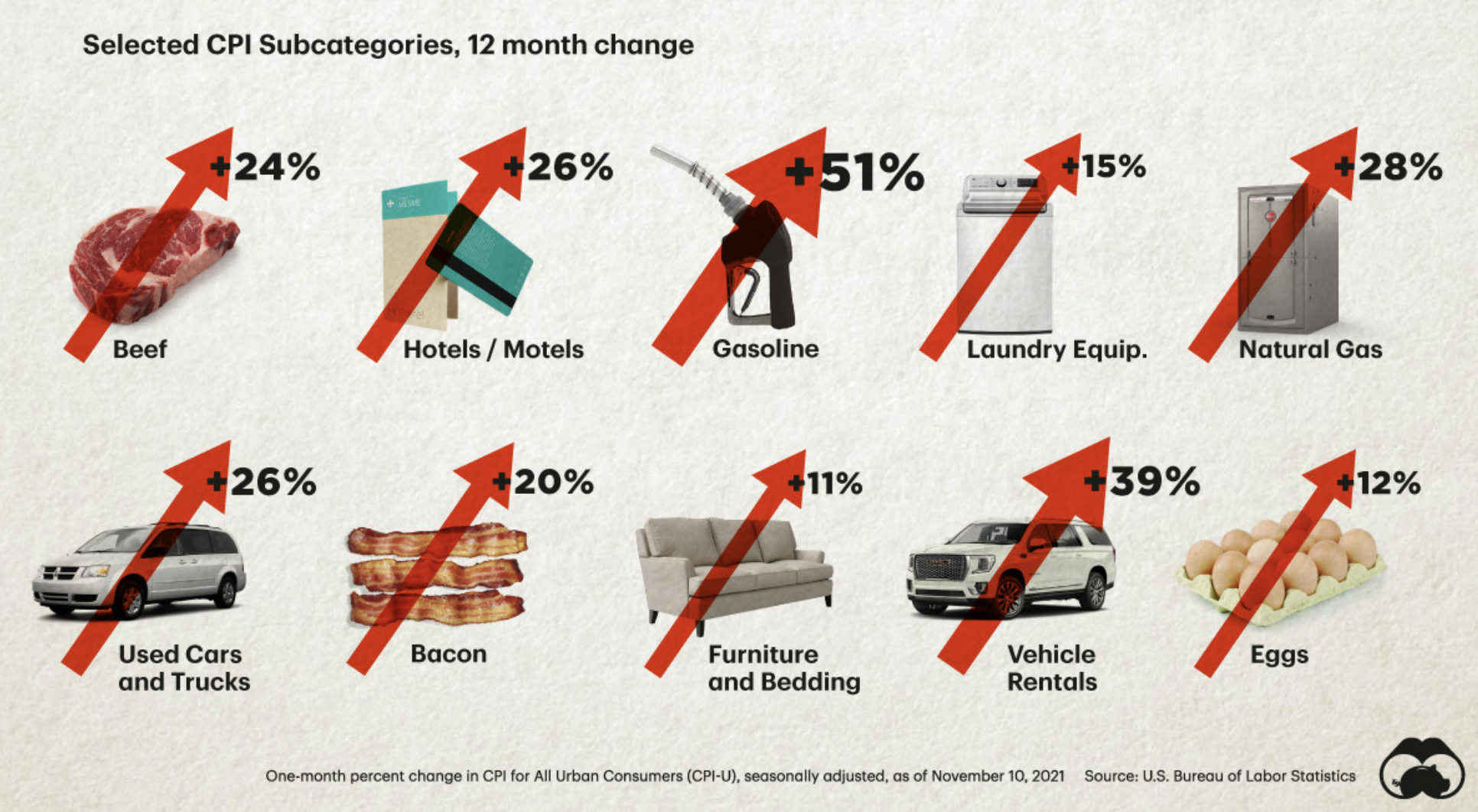

Inflation Everywhere

I talk about houses and cars because these are the biggest expenses for most of us.

But everything else is up too…

The increases shown in the image above are from November of last year… Some goods cost even more today.

Remember, inflation is the rate of change in the prices of various goods.

If the Federal Reserve meets its goal of slowing inflation down to 2%, that doesn’t mean prices will come down.

It means they will only go up another 2% the following year.

For prices to go down, inflation would have to be negative. And that hasn’t happened since the 1930s.

Join Today’s Live Session

Now, if you are looking for a way to navigate this new economic landscape, check out my premium Alpha Stocks trading service.

We have plenty of long ideas for the right stocks…

We recently generated a gain of 21.3% in just 15 days in Permian Basin Royalty Trust (PBT) as that stock broke out of its range, and another winner in Enphase Energy, Inc. (ENPH) for a quick gain of 22.5%.

And just last week, we closed out our position in Catalyst Pharmaceuticals, Inc. (CPRX) for a solid return of 11.5%.

But we’re also not afraid to go short… We recently recorded a 21.6% gain on the downside in only eight days as Pegasystems Inc. (PEGA) stock plunged…

Of course, we also get together every Monday for an hour-long live session so that subscribers can ask questions and get guidance about our trades.

If you’re ready to see what you could be missing out on, I’m holding a special session this afternoon in which I’ll discuss my strategy in more detail…

Just click here to register and learn more about Alpha Stocks now!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily