Hey, Ross here:

The market has retreated for a couple days, but it’s still way too early to call it a definitive pullback yet – not with the way the market has been lately.

So, for today’s newsletter, let’s look at one of the key factors that drive stock fundamentals – and what that might mean for the stock market.

Chart of the Day

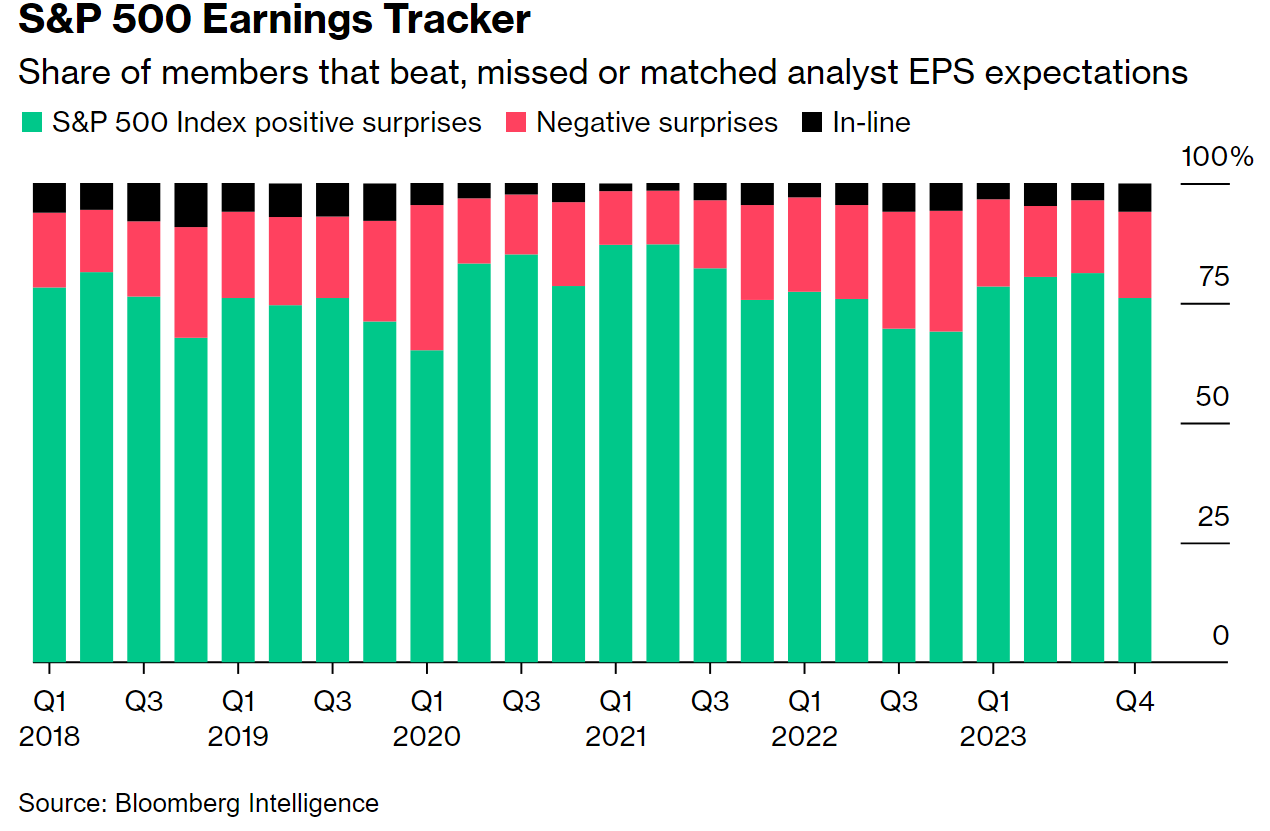

This is the percentage of S&P 500 companies that have exceeded, underperformed, or met quarterly earnings expectations dating back to 2018.

As you can see, most S&P 500 companies generally outperform earnings expectations – regardless of how the market is doing.

Still, we can see that in 2022, for instance, the percentage of outperformers steadily dipped throughout the year – something that did not happen in 2023.

Further, it’s worth noting that this chart shows outperformance relative to expectations…

And even though expectations for companies right now are higher than ever, most have still managed to outperform. The latest data shows 76% of S&P 500 outperforming expectations – above the 10-year average of 74%.

This tells me market fundamentals are still pretty healthy and that we shouldn’t be too concerned about any pullback.

In the meantime, don’t miss all the opportunities still out there right now.

Insight of the Day

As a pullback – even a healthy one – approaches, we need to be more strategic in our trade selection

Yes, the coming pullback will most likely be a healthy one that helps the market on its next leg higher.

But no, you can’t just blindly buy into the market in the hopes that the next leg higher will make it all better.

Markets right now exhibit diverging tendencies – the leaders do very well, and the laggards just keep falling further behind.

It’s hard to see this divergence by just looking at the broad indexes, as the leaders are influencing the indexes more than the laggards.

The same could very well happen on the next leg up as well.

And the last thing you want to happen is inadvertently positioning yourself in the laggards instead of the leaders.

That’s why later today at 4 p.m. Eastern…

I’m going LIVE for a masterclass that will allow you to laser focus on these leaders…

So you can set yourself up for big gains not just now – but post-pullback as well.

This strategy could have already handed you gains like 113% in 14 days… 82% in 143 days… and even 302% in 7 weeks…

But if we’re entering a pullback, the potential profits could turn out to be much bigger – if you act fast.

So make sure you click here to lock in your spot for my masterclass later…

And keep an eye out for the login details in your inbox closer to the start time.

See you later today.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily