Hey, Ross here:

Unless inflation posts a massive surprise, I’m still bullish on the markets. And as promised, here’s your actionable trade idea of the day.

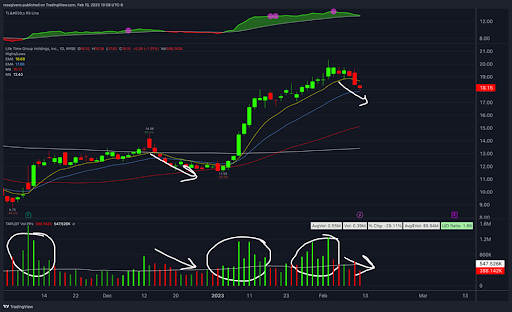

Chart of the Day

Life Time Group (LTH) owns and operates a chain of “athletic country clubs.” They are basically high-end gyms offering everything from free weights and elliptical machines to steam saunas and smoothie bars.

The company went public in late 2021, right before the bear market began. But the stock is now soaring.

I’ve highlighted the signs of accumulation in the volume candles on the bottom. Notice the huge influx of buying on the way up and the relatively light volume on retracements. This is evidence of institutional buying and a sign that buyers are still in control.

In my opinion, this week’s pullback to the 21-day moving average is buyable, and should be a good entry point as long as the overall market holds up.

P.S. If you want special trade prospects and potential market moves sent directly to your phone from me – just text the word ross to 74121.

Insight of the Day

The Fed has shown evidence that it’s not being overly reactive to economic data – a good sign for the markets.

Listen, we all know the Fed screwed up with its whole “transitory inflation” debacle back in 2021. And we’re all still paying for its mistakes.

Still, even though they’ll never publicly admit it, they have shown signs of being more careful in managing the market’s expectations lately.

For instance, it took 3 “soft” inflation reports before Powell dared to use the word “disinflation”. Meaning they’re unlikely to make any drastic moves in the face of one single inflation or jobs report.

Combine this with the real market momentum we’ve been seeing – even in the face of the expected pullbacks these past couple weeks – and I’m still bullish on this market. I’m seeing opportunities everywhere, and sharing some of those for free right here on this newsletter.

If you want more opportunities just like what I’ve been sharing, then make sure you take a look at this. It details how to spot when institutional cash is about to pump a stock – so you can get in right before. The best part? It’ll only cost you $5.

Embrace the surge,

Ross Givens