Hey, Ross here:

Welcome to a new trading week – and it’s a big one with the Fed meeting this week. To start, let’s review the divergent nature of the current markets.

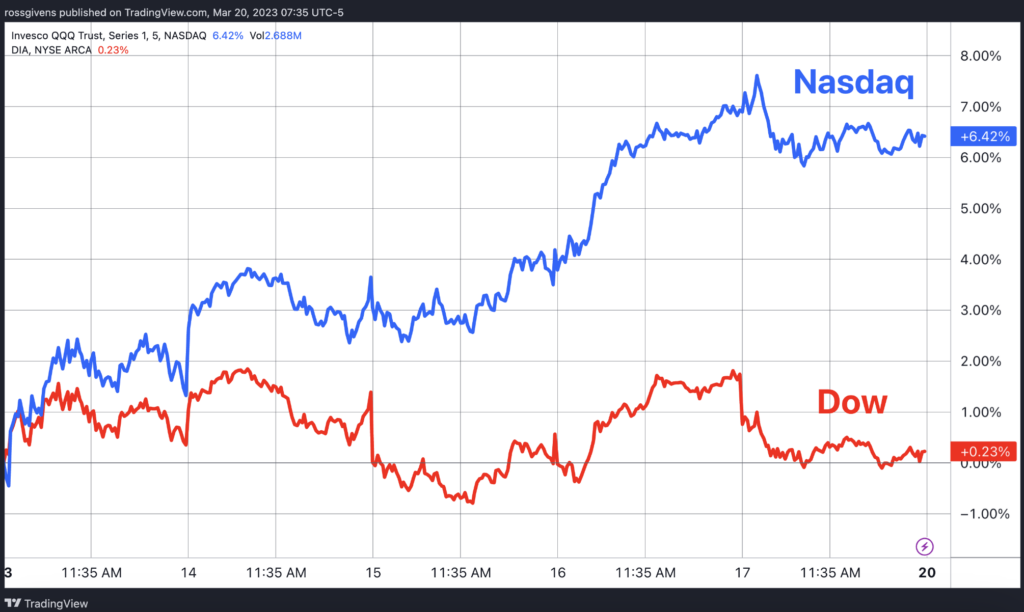

Chart of the Day

In general, the major market indexes move together. The Dow, S&P and Nasdaq all move higher in a bull market and lower in a bear market.

Yes, there are differences – but in most cases they are minimal.

That was not the case last week – the Nasdaq was up a solid 5.3% for the week while the Dow was essentially flat.

This is rare.

The Dow Jones Industrial Average is composed of traditional blue-chip stocks – Caterpillar, Chevron, Boeing, etc. These names, especially the industrial and energy companies, are showing weakness.

The Nasdaq index, on the other hand, is made up of high-growth tech stocks like Microsoft, Apple, Nvidia, and Broadcom.

Unlike the Dow stocks, many of the Nasdaq names are at or making new highs.

This contrast in performance shows a tug of war taking place in the stock market and leads me to believe that a strong move is about to occur.

But in which direction?

I tend to have a pretty firm bias for which direction I believe the market will go over the coming week. But right now, it’s a coin toss at best.

The bull case goes something like this…

We have already seen inflation peak, and the numbers are trending down. The bank crisis was essentially solved when the treasury stepped in to insure depositors above the FDIC limits, and jobs numbers came in better than expected. So even with record inflation and skyrocketing interest rates, the economy has shown a lot of strength.

The bear case comes down to price action…

The S&P 500 has been trending lower for six weeks and is flirting with breaking back below its bear market trendline. The price of gold – a historic flight-to-safety trade – has also been soaring. It is up 8% in the last week and a half and moving higher.

How can we as traders best play these divergent markets? Well, that brings us to today’s Insight of the Day…

Insight of the Day

Preparation beats prediction any day.

Not knowing which way markets are likely to move in the short term is an uncomfortable feeling. But the worst thing you can do is to try to get rid of that feeling by selectively ignoring evidence in favor of what you want to happen.

As the great physicist Richard Feynman said, “You must not fool yourself, and you are the easiest person to fool.”

But when you can’t predict, you better prepare.

That’s why for the rest of the week, I’ll be sharing BOTH long and short trade ideas. That way, regardless of which way the market moves, you’re prepared – and can still potentially pocket a healthy profit.

And if you want to “skip the line” and get a hold of these trade ideas days before the rest – all you have to do is sign up for my Stealth Trades Gold service here. For a limited time, all it’ll cost you is $5 for an entire year – an absolute no-brainer deal.

P.S. Want me to send you special trade prospects and potential market moves directly to your phone? Text the word ross to 74121.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily