Hey, Ross here:

10-year Treasury yields are at their highest levels in five months.

Recent economic data has once again come in strong, and this has contributed to the higher yields.

But let’s be clear – rate cuts are still very much on the table. And that’s good for the markets.

Chart of the Day

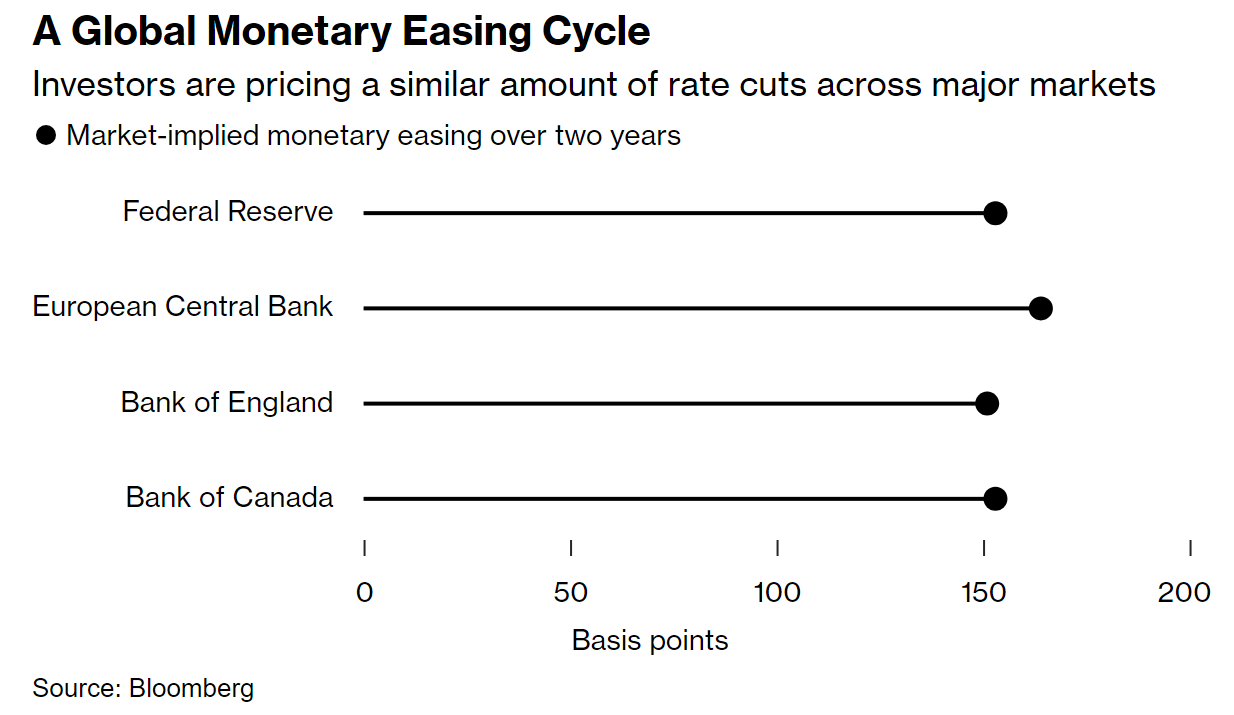

Here’s a chart from Bloomberg showing how much rate cuts investors are pricing in for the major central banks.

For the Fed, they’re pricing in a 1.5% cut over the next two years, which would be six 0.25% cuts.

This is also in line with the three expected cuts this year that Fed itself has offered as a baseline.

But notice that it isn’t just the Fed that’s expected to slash rates – the central banks of England, Canada, and Europe are all expected to cut rates by just as much or more.

This will likely lift the entire global stock market up – not just the U.S.

And as I’ve shared before, global stocks have been rising in tandem with the American stock market as well.

In short, things are still looking good.

Insight of the Day

When the market goes too long without a necessary pullback, it will feel emotionally more painful.

We all know that markets do not – and cannot – just go straight up.

They need healthy pullbacks along the way to flush out the over optimistic weak hands to start the next runup.

But, when the market has kept going up without any pullbacks – like it has been for the past five months…

When that pullback hits, it can feel much more worrying than it should be – even if you logically know that it’s overdue.

We might be entering that overdue pullback right now.

Expect it to feel emotionally painful in the short term if so.

But remember that the longer-term trajectory of the market is upward – meaning we should still keep participating.

I’m going LIVE tomorrow morning at 11a.m. Eastern for a masterclass that will allow you to participate in this ongoing bull market in the smartest way possible…

By following the money trail of the corporate insiders into the highest-potential stocks that could even defy any market pullback and just keep rising.

So please click here to secure your seat for my masterclass tomorrow…

And I’ll see you Friday at 11 a.m. ET sharp.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily