Hey, Ross here:

Yesterday, I spotlighted the “weekly pattern” the market has been following in 2025.

Today, let’s look at another pattern – why market troubles this month should also be expected – and what we can do about it.

Chart of the Day

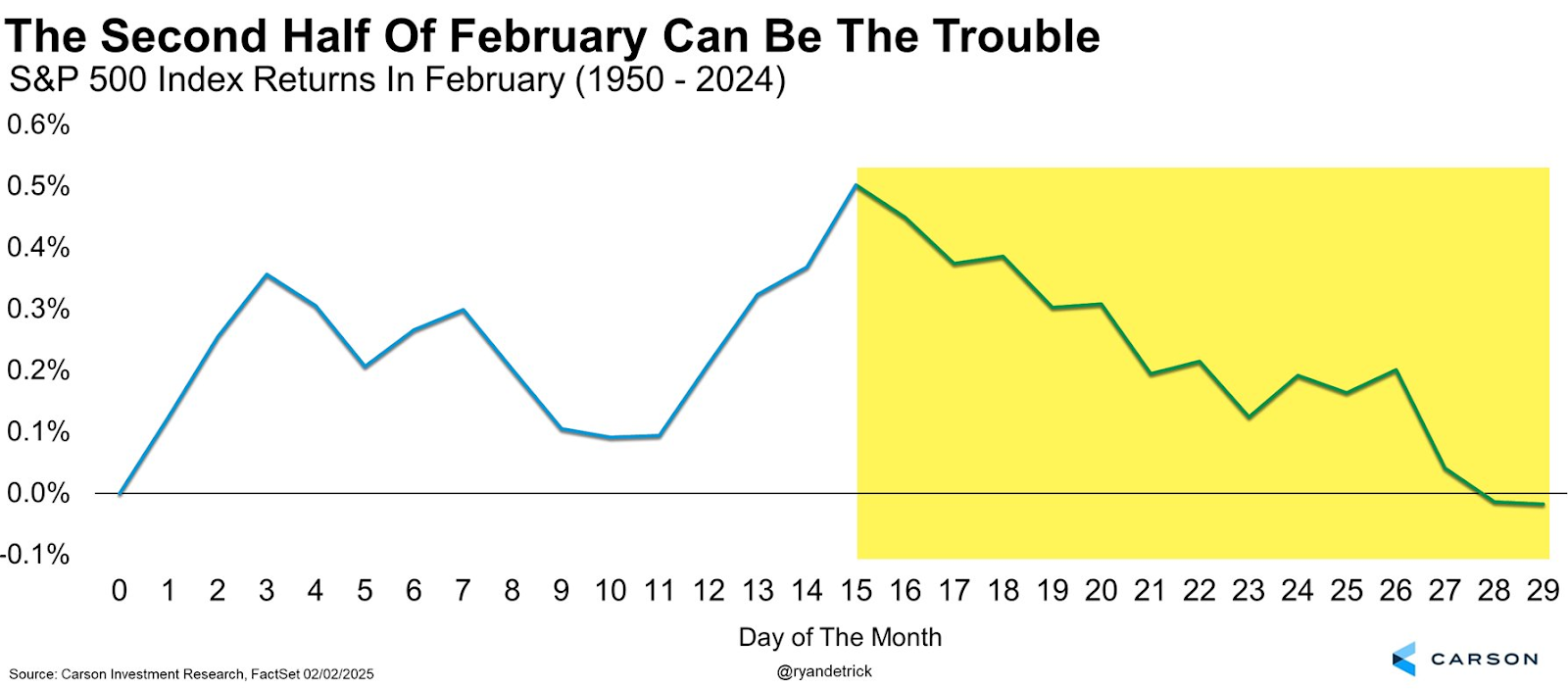

This chart shows how the S&P 500 has cumulatively performed during February for the past 75 years

As you can see, the second half of February typically spells trouble.

And if you look at the S&P 500’s performance in February so far, the seasonal pattern appears to be playing out almost perfectly.

In short – don’t be too surprised by how markets have been dipping lately – it’s all following an established pattern.

As for what to do about it?

I explain below.

Insight of the Day

Use the market’s pattern to your advantage

How many traders and investors out there panicking about the market selloff this month even realize that it’s just following the seasonal pattern?

Very few, I’d wager.

It’s hard to blame them – we’re constantly bombarded with “news” as to why the market is selling off…

And it’s different every time.

But if we understand how to ignore all that noise – and objectively look at what the market’s pattern is…

We can set ourselves up to reap the rewards.

You see, many of the most bullish chart patterns actually require the market to pull back as part of their setup.

Meaning now – while everybody is fearful – is the time to position yourself within these patterns.

That’s why later this afternoon at 1 p.m. Eastern…

I’m going LIVE for a training session on the single most profitable stock pattern in our arsenal.

Members who used this powerful pattern could have been up 413% in 8 months on a stock we bought last June…

And be sitting on a 124% open gain on a stock we bought just last month.

But with the market pulling back in February, we could see the opportunity for even bigger, faster gains…

So don’t miss the free training on my #1 chart pattern later this afternoon.

Just click here to guarantee your seat if you haven’t yet…

And I’ll see you at 1 p.m. ET later today – don’t be late.

Customer Story of the Day

“Top drawer recommendations for portfolio growth and trade advice. Good for learning how to manage the bank.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily