Hey, Ross here:

The S&P 500 is now about 6% down from recent highs. The Nasdaq is down about 9%.

Both are now “officially” out of correction territory.

There’s still quite a lot of ground to make up before we see new all-time highs again.

But as the data shows, when markets move out of correction territory – the odds are on their side.

Chart of the Day

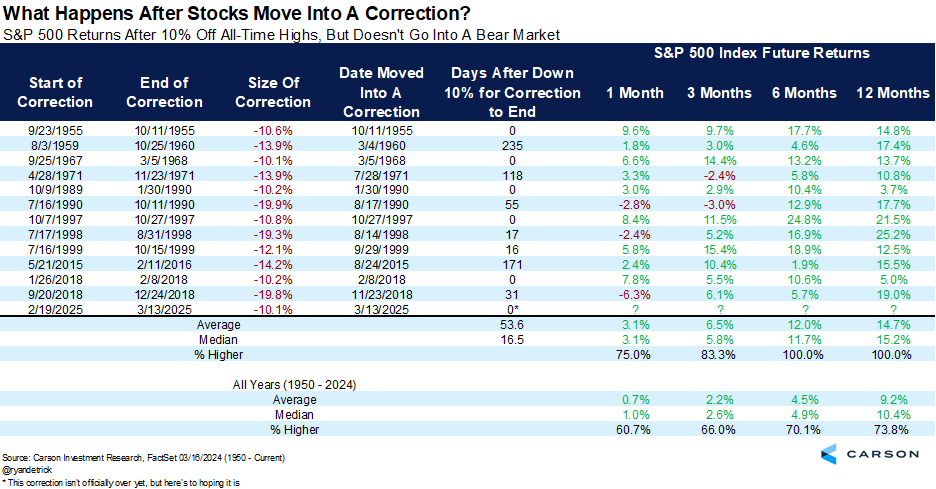

This chart shows all the instances where the S&P 500 moved into correction territory (down 10% from highs)…

But didn’t enter a bear market (down 20% from highs).

As you can see, in all these cases, returns were mostly positive 1 and 3 months later – and were 100% positive 6 and 12 months later.

Again, these are just odds.

But with the indexes already having moved out of correction territory…

The odds of the market continuing to recover seems to be even more on our side.

Playing the start of a recovery is also where the biggest opportunities are.

But you need to be smart about it – I explain how below.

Insight of the Day

Use position sizing and “smart money” following to mitigate risk while playing the beginning of a recovery.

We still need to see more follow through from the markets to really confirm the recovery.

And yet, we don’t want to miss out on the opportunities available right now.

That’s why we want to mitigate our risk by being a bit more conservative with our position sizing…

As well as by following the “smart money” – those who already have an informational advantage over the rest of the market.

Being conservative with position sizing is easy.

Following the “smart money”? That’s more of a challenge.

That’s why later this afternoon at 3 p.m. Eastern…

I’m going LIVE to show you how to harness one of the most powerful informational edges in the market for yourself.

This edge has allowed corrupt politicians like Nancy Pelosi to amass fortunes of over $100 million…

With over two dozen of them even beating Warren Buffett himself in 2024 (alongside a host of the top hedge funds on Wall Street).

And after my live training this afternoon…

You’ll know exactly how to use this edge for yourself to play the start of this recovery.

So, if you haven’t already, click here to confirm your spot for my live session later…

And I’ll see you at 3 p.m. ET.

But act fast – you don’t want to wait until the recovery has picked up too much steam, and all the best opportunities are snapped up.

Customer Story of the Day

“Ross and Jean are real pros.

They absolutely know what they’re talking about and provide real strategies and information on how to make educated and informed trades with no sugar coating.

They are up front about the risks and enable you to take a lot of the emotion out of the process.

If you’re serious about trading, you should check them out.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily