Hey, Ross here:

The S&P 500 just reclaimed its 200-day moving average. It first fell below this level two weeks ago.

We’ll still need to see more follow through to confirm any sort of real bounce.

In the meantime, let’s look at something a little different today…

Which sectors the analysts are most bullish on for the second quarter.

Chart of the Day

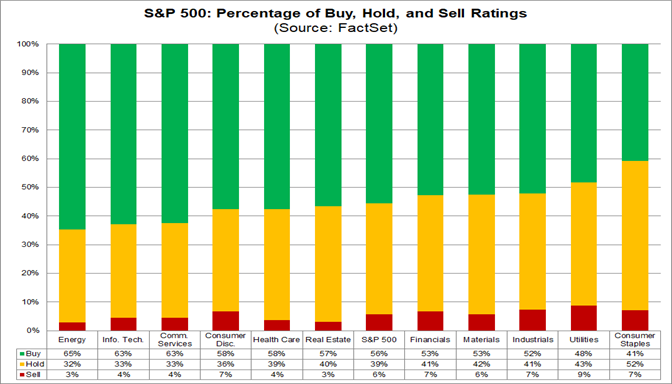

This chart shows the percentage of buy, hold, and sell ratings – represented by green, yellow, and red, respectively – across the various S&P 500 sectors.

It gives you a quick look at which sectors analysts are most bullish on in Q2…

Which in this case, appears to be Energy (with them being the least bullish on Consumer Staples).

Now, I’m certainly not telling you to go out and start scooping up energy stocks.

But even though I don’t put too much weight on the ratings of these stock analysts…

It’s still helpful to get a broad picture of their collective views.

But there is a group of people whose views I put a lot of weight on…

I explain more below.

Insight of the Day

When it comes to gauging a company’s stock – the insiders will always know more than the analysts.

During select periods from 2023–2025, we were in what I call a narrow bull market…

Where the top-line indexes kept moving up…

But market breadth keeps worsening.

In other words, a small percentage of stocks were pulling the indexes up.

Based on the data, we may enter a “narrow recovery” first…

Where a small percentage of stocks start to lead the recovery, before the rest of the market follows.

These are the stocks we want to target.

And tomorrow, Tuesday afternoon, at 1 p.m. Eastern…

I’m going LIVE to show you my top strategy for going after these stocks.

It’s all about following the footsteps of a group of traders who have an incredible advantage that allows them to almost always be ahead of the market.

And after my live training session tomorrow…

You’ll know exactly how to stay ahead of this market too.

So click here to save your seat for my live training session on Tuesday…

And I’ll see you tomorrow afternoon at 1 p.m. ET.

Don’t wait for the recovery to go “full steam” – get in now when the potential opportunities are the biggest.

Customer Story of the Day

“Ross Givens is an excellent teacher, and his trading techniques work very well. I have been with him for about one and a half years and have made excellent money.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily