Hey, Ross here:

The S&P 500 has registered weekly losses for the past two weeks.

The cumulative effect of these two weekly losses? A decline of 0.4% – that’s right, it barely budged.

It seems that bulls and bears are currently at a stalemate.

But as today’s chart shows, that doesn’t mean there aren’t some lucrative opportunities.

Chart of the Day

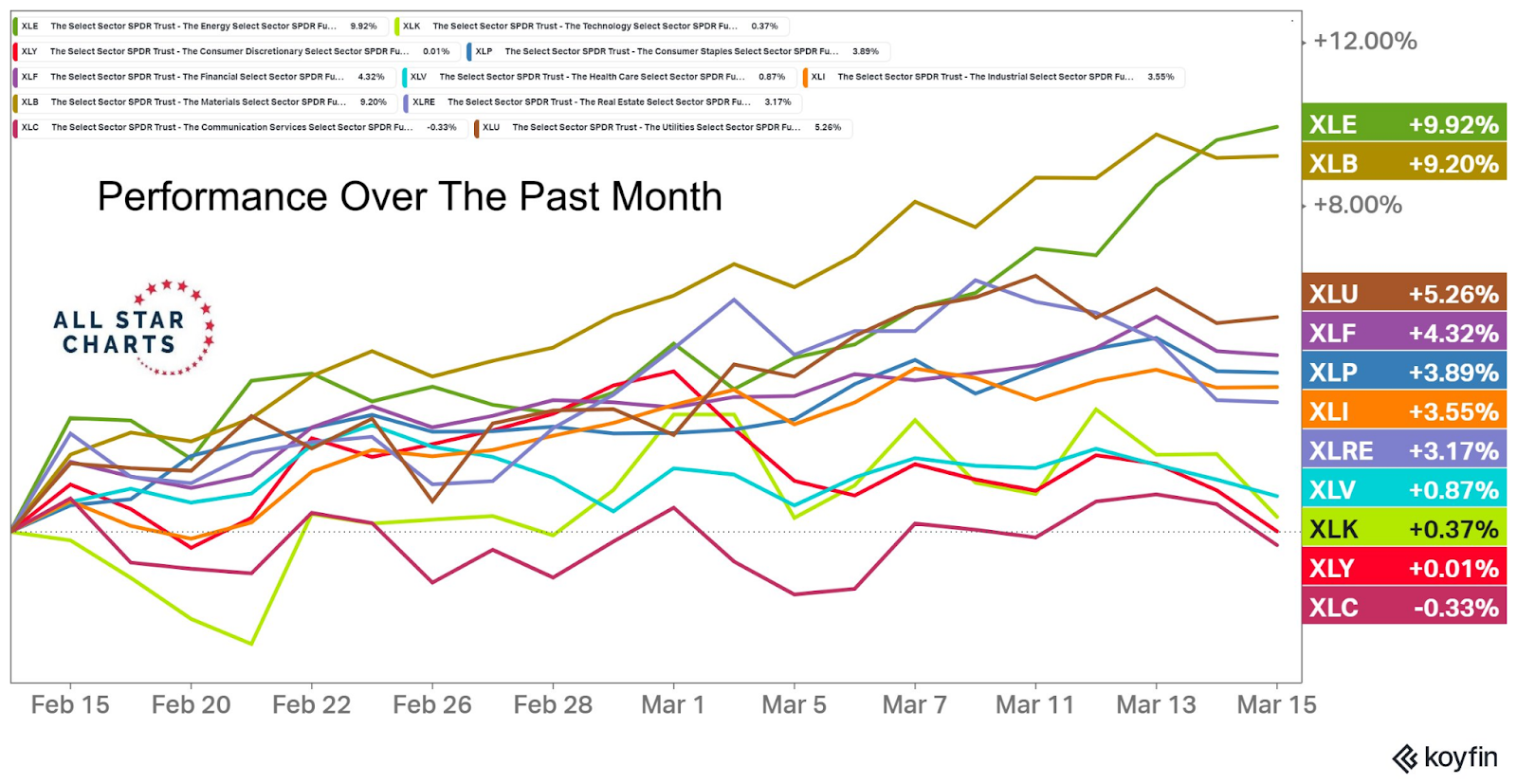

This is a sector-by-sector breakdown of the S&P 500 over the past month.

The top three performing sectors are energy, materials, and utilities, while the bottom three are communication services, consumer discretionary, and tech.

The difference between the highest and lowest performing sector is over 10%.

And remember, that’s just over a single month – and solely focused on large-cap stocks. It’s a huge difference.

The lesson here is simple – and one I’ve repeated time and time again.

Always look beneath the surface – because that’s where the biggest opportunities are.

And as I explain in the Insight of the Day, you want to take it one step further and target stocks at a very specific stage.

Insight of the Day

One of the highest-percentage strategies is to target “Stage 1” stocks.

Richard Wyckoff’s stage analysis theory is the backbone of my entire investment philosophy. Here’s a chart that quickly explains it.

Stage 1 is the accumulation stage – where institutional investors begin building positions in a stock they believe to be undervalued based on future expectations.

This stage can last for months – and nothing exciting happens here.

Stage 2 is known as the Markup Stage, and this is where 90% of your gains as an investor will come from.

Stage 3 is distribution and that’s when the stock starts to falter. Stage 4 is markdown, and this is what you want to avoid unless you’re shorting the stock.

You want to target stocks at the beginning of a Stage 2 rally for the highest and most consistent gains.

That’s why tomorrow at 11 a.m. Eastern time…

I’m going LIVE for a masterclass that will give you the exact playbook for targeting these “early Stage 2” stocks.

The strategy I’m showing could’ve allowed you to book a 12% gain since last Friday (that’s one trading day)…

And that’s likely just the start.

So make sure you click here to save your seat for my masterclass…

Block your calendar…

And look out for the login details in your inbox tomorrow morning.

See you then.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily