Hey, Ross here:

The “pullback or not” question will likely be answered by the end of this week. We’ll just have to wait and find out.

But to start the official trading week, let’s examine how market sentiment has been shifting lately.

Chart of the Day

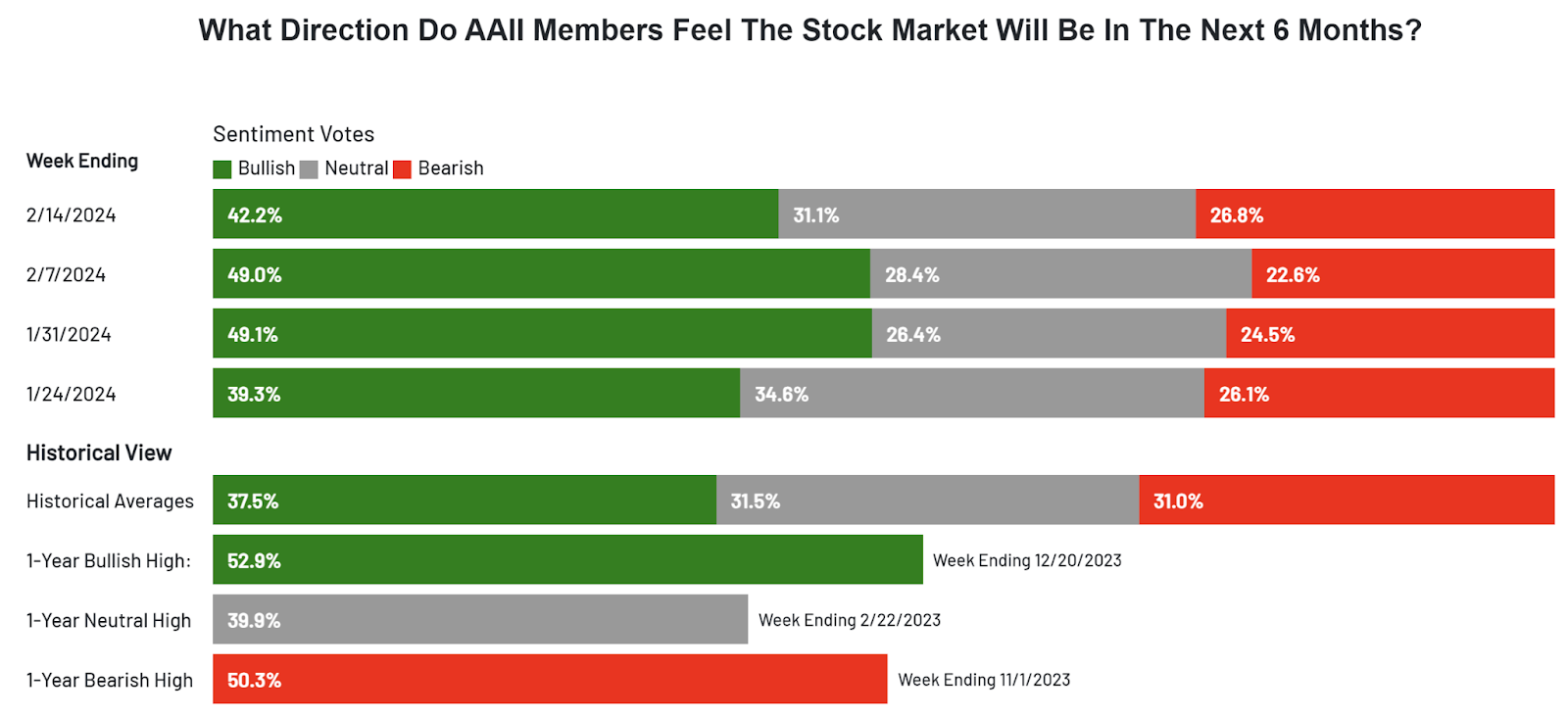

This is the latest results of the American Association of Individual Investors (AAII) sentiment survey.

Obviously, this doesn’t include what the institutional investors – the real market movers – think, but it can still give us clearer insight into current market sentiment.

As you can see, bullish sentiment has dipped significantly from the past couple weeks, while bearish sentiment has correspondingly increased.

That’s on a relative basis. On an absolute basis, however, bullish sentiment still remains higher than it was in the second half of January, when the indexes broke out again.

This supports my view that a pullback or pause is coming – but that the market will break out even stronger than before once it’s over.

I explain how the two relate in the Insight of the Day.

Insight of the Day

Profit taking stalls upward market momentum, which then flushes out the naive bulls who believe the market can only go up – leading to a pullback.

And once these naive bulls are flushed out, the market is then free to resume its advance upwards.

That’s how the pattern always goes – it’s as close to clockwork that you’ll ever get from the market.

And yet, because many people are simply naive – they want to believe the market will keep going straight up – this pattern ALWAYS creates opportunities for savvy traders.

These people will always be there, meaning the opportunities they create will always be there too.

And that’s why later today at 12 p.m. Eastern…

I’m going LIVE for a masterclass that will allow you to exploit this historical pattern to target big gains in a short amount of time.

The strategy I’ll be demoing could already have allowed you to be sitting on gains like 71%, 39%, and 108% – all in the past couple months…

But with how strong the market has been lately, this could just be the start.

So don’t miss this opportunity…

Click here to save your seat for my live masterclass later…

And watch out for the login details in your inbox in a bit.

See you at the masterclass.

Ross Givens

Editor, Stock Surge Daily