Hey, Ross here:

And let’s start with a trading idea that’s already paying dividends – but could still have room to run.

Chart of the Day

Collectible company Funko (FNKO) took a beating in last year’s bear market.

But the stock is quickly coming back to life. FNKO surged on earnings a couple weeks ago and has given back almost none of the initial move.

Shares barely retraced – and when they did, they did so on minimal volume. This is a sign that no one is selling.

This trade is pretty simple – draw a trend line and buy when it breaks above it.

I recommended this one to my Stealth Trade subscribers last Friday, at the bottom point of the white line in the above chart.

And as you can see, that trade is already bearing fruit, with the stock almost 10% up since then.

But as long as the breakout doesn’t retrace to the low point of last week’s consolidation, FNKO could still have room to run.

P.S. Would you like special trade prospects and potential market moves sent directly to your phone? Text the word ross to 74121.

Insight of the Day

Don’t let the broader market limit your potential.

Yesterday, I talked about how your trading identity can limit your potential.

Today, I want to talk about how the broader market can also do so.

For instance, the S&P 500 is up about 9% in 2023. After the beating it took last year, many traders are breathing sighs of relief.

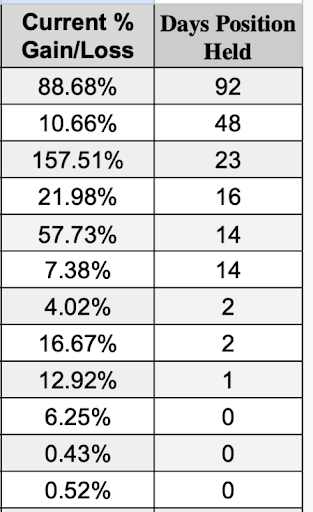

But take a look at the latest stats on this open portfolio right now.

You can see we’ve beat the S&P 500’s 2023 performance in as little as a single day – and did nearly 20x better in just a few weeks.

For the many traders who believe that it’s not possible to beat the broader market by that much, their first instinct might be denial.

They may dismiss it as fake, bury their heads in the sand, and pretend it’s not possible.

That’s why you shouldn’t let what the broader market is doing influence your trading too much – because you’ll only limit your own potential.

Oh, and if you’re interested in using the same strategy that got the above results in your own trading…

I’m going LIVE later today at 12 p.m. Eastern to show you exactly how you can do that.

Make sure you click here to save your seat…

Because with market-crushing results like that, I can guarantee it’s going to be a packed room.

See you at 12 p.m. ET.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily