Hey, Ross here:

And here’s an interesting “ratio” chart (courtesy of All Star Charts) that cements my view that tech is where we should be looking for breakouts right now.

Chart of the Day

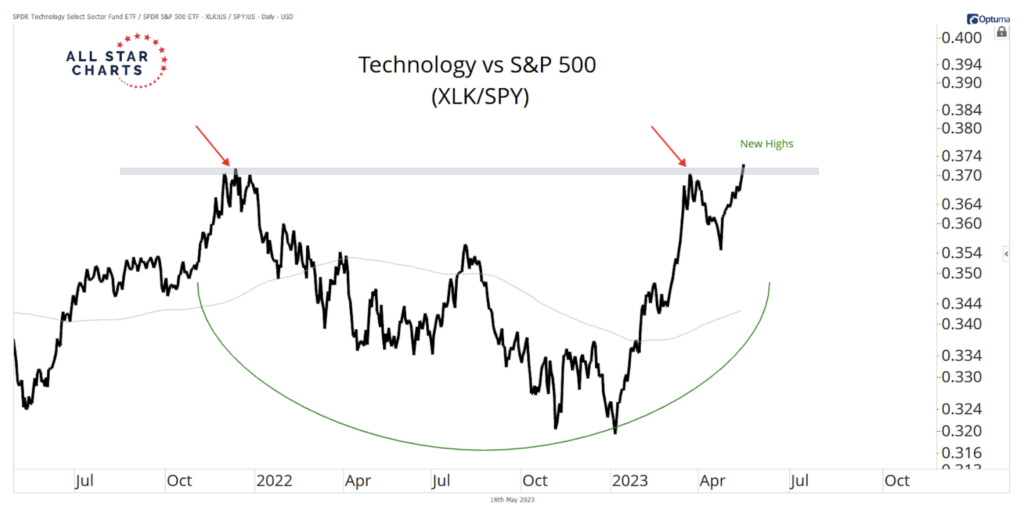

The chart above shows the ratio of the XLK – the Technology Select Sector SPDR Fund – to the S&P 500.

Essentially, what this chart shows is how the tech sector is moving relative to the S&P 500.

If the chart is moving in a horizontal line, then it means the XLK and S&P 500 are moving exactly in tandem.

If the chart is going down, then it means the XLK is doing worse than the S&P 500. And if the chart is going up, it means the XLK is doing better than the S&P 500.

As you can see since November 2021 – the height of the last bull market – tech has been underperforming relative to the S&P 500.

But since early 2023, that pattern has reversed.

And now, tech has actually broken higher relative to the S&P 500 compared to the previous November 2021 highs.

The pattern is pretty evident.

In short, most of the potential breakouts in the market right now are likely to come from tech – and I’ll share more of those opportunities right here.

P.S. Would you like special trade prospects and potential market moves sent directly to your phone? Text the word ross to 74121.

Insight of the Day

Your “trading identity” can actually limit your potential.

As humans, it’s natural for us to take on identities.

We see it all the time in trading and investing. People call themselves “value investors”, “tech investors”, “day traders” and so on.

But those identities can actually limit our potential.

Look at today’s chart as a quick example.

If you identified yourself as a “tech investor” – would you short your beloved tech stocks when they were falling?

If you identified yourself as a “value investor” – would you invest in these breakout tech stocks now?

You probably wouldn’t – and you’ll miss out on a lot of opportunities.

That’s why the only identity you should have is to “follow the money”…

Because where the money goes – profits usually follow.

And here’s the best way I know to “follow the money”.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily