Hey, Ross here:

The CPI print came in hot.

The PPI (Producers Price Index) data actually came in below estimates – though it was still the highest readings in nearly a year.

And the latest swap pricing implies that the Fed will only cut rates twice this year.

Is this good for the markets? Definitely not.

But does this mean the bull market is over? Definitely not as well.

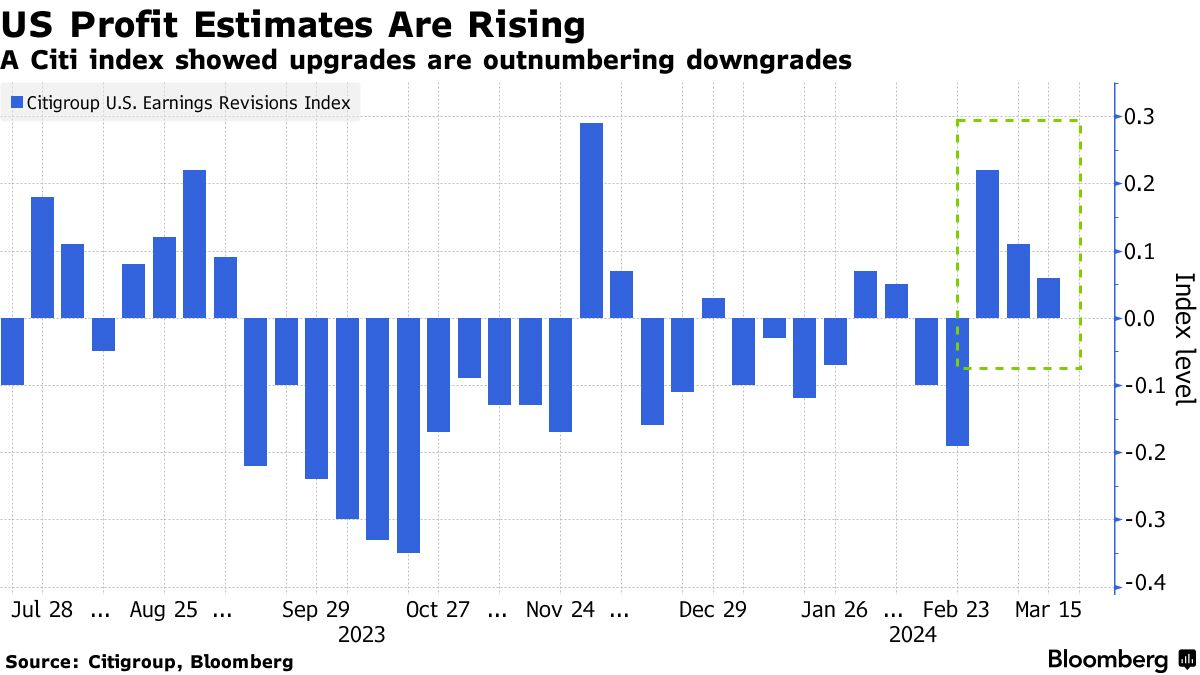

And today’s chart helps show why.

Chart of the Day

Sometimes, we as traders tend to forget that, ultimately, buying a stock is buying a piece of a business.

And when you buy a business, the most important thing to pay attention to is earnings.

So, with earnings season starting next week, what can we expect?

Well, as you can see from today’s chart – we can expect pretty good things.

Earnings upgrades are significantly outnumbering downgrades…

Which should provide support for the market – even in the absence of rate cuts.

Now, is anything guaranteed? Of course not.

But it is way too early to switch to defense…

Especially since earnings season itself creates its own unique opportunities.

Insight of the Day

Earnings season hands you independent opportunities for fast gains – no matter what’s happening in the markets.

Because individual stocks WILL make big moves – both up and down – regardless of the broader market.

And that’s where having an informational edge is so critical…

Because it will allow you to go after these fast-moving opportunities even if the market is falling.

That’s why in just a few hours at 11 a.m. Eastern…

I’m going LIVE for a masterclass that will allow you to target these exact opportunities by following the footsteps of the corporate insiders.

This strategy works in any market (it just pinpointed an urgent opportunity in a sector that’s rising even as the market is pulling back)…

But it’s particularly effective during earnings season.

Now is the best time to add this strategy to your arsenal.

So make sure you click here to lock in your spot for my masterclass later…

Watch out for the login details in your inbox shortly…

And I’ll see you later at 11 a.m. ET sharp.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily