Hey, Ross here:

Check out today’s chart about the Fed’s favorite inflation gauge.

Chart of the Day

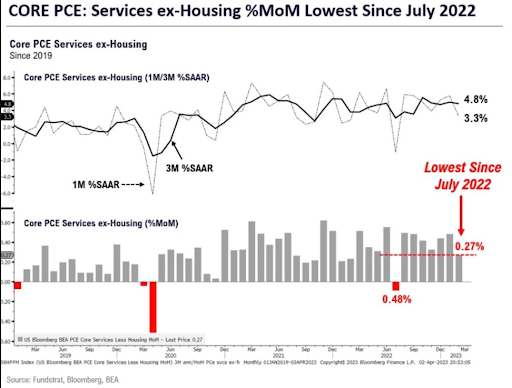

When you strip out housing, the gain in core PCE (Personal Consumption Expenditure) prices was the lowest since July 2022.

And remember, this was data for February – before the collapse of Silicon Valley Bank caused banks to pull back lending (a deflationary move).

We’re also seeing signs that the labor market is softening.

All this to say that I like what I’m seeing – at least in the short term.

P.S. Want me to send you special trade prospects and potential market moves directly to your phone? Text the word ross to 74121.

Insight of the Day

You need to be able to flip the switch from short to long, from bearish to bullish, from defensive to aggressive (and vice versa) in an instant.

As I said earlier this week, I believe a rally is inbound. That’s what the data is telling me, which is why I’ve flipped from shorts to longs in many of my trades. I’m betting bullish.

Could I be wrong? Absolutely (and don’t trust anyone who tells you differently).

But here’s what’s important – I’m staying agile. If a recession hits and the market falls again, I’m 100% ready to flip the switch again and adjust my trades for a bearish market.

The “smart money” knows this. It’s why they seem to make money no matter what’s happening in the markets – unlike most retail traders.

That’s why, instead of worrying about the Fed or the economy, I’m leveraging these “smart money” trades – and “using” them to target fast profits. I explain more here.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily