Hey, Ross here:

Yesterday, stocks recovered plenty of their losses from the day before.

So, the question is – are we entering an actual pullback, or is this just a brief “buy the dip” selloff that will bounce back in no time?

We’ll just have to see how the market plays out in the coming days (expect heightened volatility).

Even if it turns out to be a pullback, I’m not worried.

So let’s look at a chart that helps reinforce why I still believe this year will be a positive one for the markets.

Chart of the Day

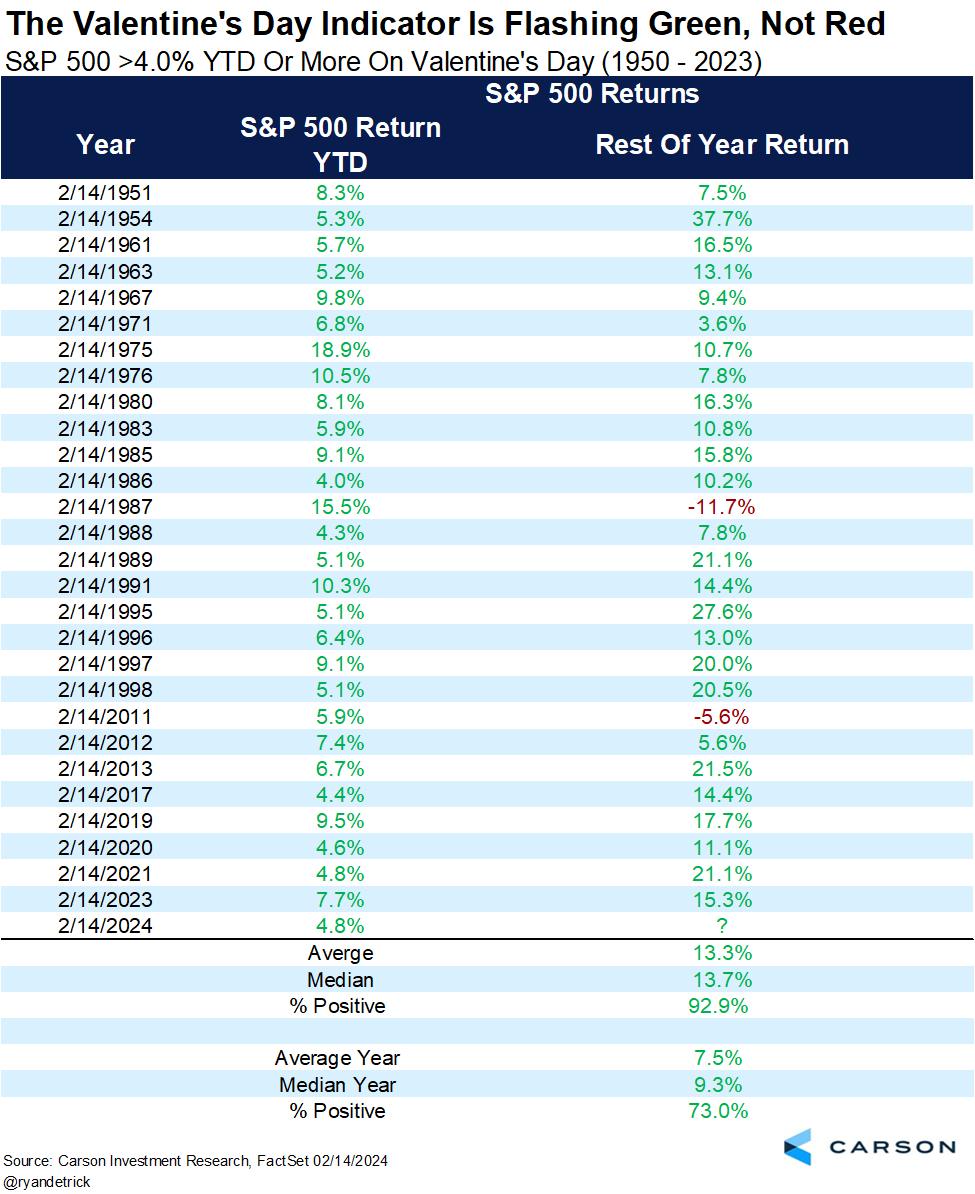

This is the “Valentine’s Day Indicator” – a summary of how the S&P 500 has performed for the rest of the year in the years where it’s up over 4% YTD on Valentine’s Day.

As the data shows, there have been only two years out of 28 where the market has closed the rest of the year down after being up at least 4% on Valentine’s Day.

And on average, the market has been up 13.3% the rest of the year when this Valentine’s Day criteria was met.

Of course, there’s no absolute guarantee that the market will close the rest of the year up.

But it does show that history is firmly on our side.

Insight of the Day

Just because a pullback is due doesn’t mean you need to wait for it to participate in the market.

Yes, a pullback is overdue.

No, this doesn’t mean you should wait until then to participate in the market.

Yes, a pullback means being able to scoop up the leading stocks for cheaper…

But waiting for a pullback incurs opportunity costs that will likely negate any excess returns you get from buying only during a pullback.

Regardless of whether the pullback happens now or later, I’m still going to be targeting the leading stocks.

Of course, if the pullback gets pushed back, I’ll be making sure to systematically take more profits along the way.

But I’m not going to sit on the sidelines – not in this kind of market. And I don’t think you should either.

You just have to be smart about how you play it.

And the smartest and easiest way to target the leading stocks is to look at what creates market leaders in the first place – institutional money.

Ross Givens

Editor, Stock Surge Daily