Hey, Ross here:

Welcome to a new trading week.

Small-cap stocks have been the biggest winner thus far of Trump’s election.

The small-cap Russell 2000 index is up over 6% in the last three days of the previous week.

So today, let’s look at a chart that helps explain why small-cap stocks have been surging.

Chart of the Day

Source: @LizThomasStrat via X

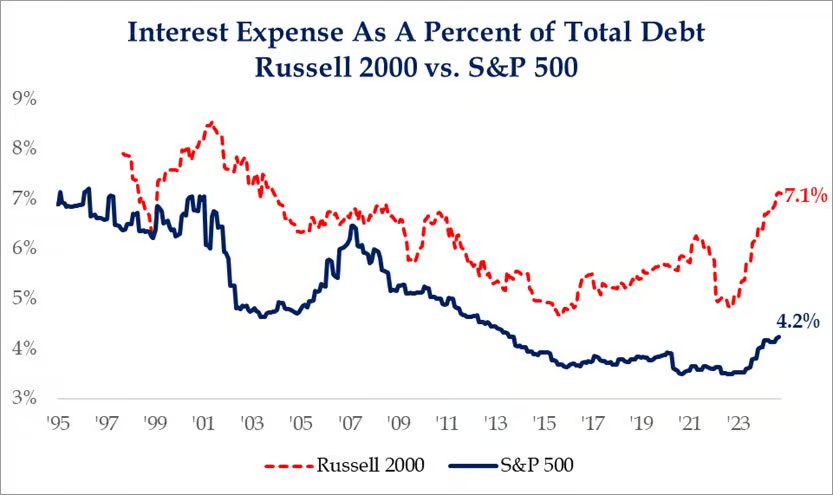

This chart shows how much the average Russell 2000 and S&P 500 company is paying in interest as a percentage of their total debt.

As you can see, the percentage of interest expense is far higher for the smaller Russell 2000.

This means that higher interest rates place far more strain on them.

But it also means that lower interest rates provide them far more relief.

President-Elect Trump has repeatedly promised to push rates lower.

And while the President does not have full control of the Fed, he most definitely has influence.

This is a big reason why we see small-cap stocks surging.

But there’s also a second reason why – which I explain below.

Insight of the Day

The institutional money is also ramping up their bets on small-cap stocks.

Here’s a chart I shared right here on this newsletter a few weeks ago.

It showed that the institutional money was betting big on small-cap stocks.

And with Trump’s win, I believe the money floodgates are about to be thrown wide open.

Now is the time to position yourself.

And that’s why tomorrow morning at 11 a.m. Eastern…

I’m going LIVE for a masterclass that will allow you to target the exact stocks the institutional money is pouring into.

The key is using my unique “buying pressure” indicator, which I built solely to do this.

This year alone, this indicator could have handed you rapid gains like 95%, 92% and even 362%.

But with the institutional money flooding in the aftermath of Trump’s win – we’re just getting started.

So click here to save your spot for my LIVE masterclass tomorrow…

And get ready to walk away with everything you need to use this “buying pressure” indicator for yourself, including:

- How to detect when buying pressure is building up in a specific stock…

- Why most traders are blind to this buildup of pressure (and miss out on big gains)…

- The formula for determining the exact point to jump into one of these “pressurized” stocks for maximum gains.

Let’s close out the rest of the year strong.

I’ll see you tomorrow morning at 11 a.m. ET sharp.

Customer Story of the Day

“I find Ross to be inspirational, motivational and completely tenacious and enthused to be doing what he’s doing and living his life. I want those attributes.”

Ross Givens

Editor, Stock Surge Daily