Hey, Ross here:

Another day, another record close for the S&P 500 – with an added serving of much better-than-expected GDP growth (3.3% actual versus 2% consensus)….

Plus another 2% annualized reading for the Fed’s favored inflation gauge – giving them the room they need to cut rates.

All this is great.

For today’s chart though, I want to “zoom in” a little and highlight something of critical importance this earnings season.

Chart of the Day

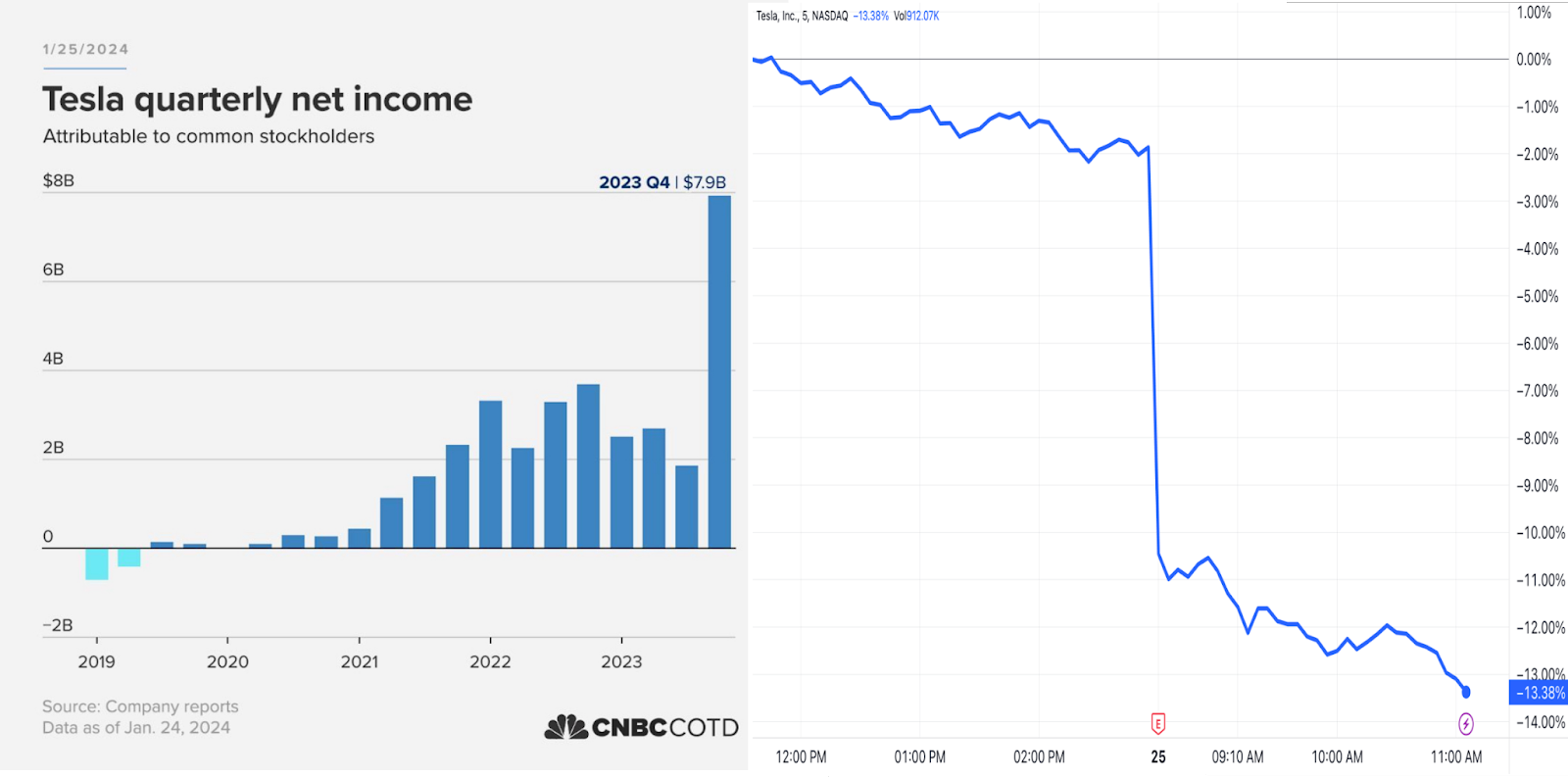

This is a chart showing Tesla’s just-reported quarterly net income that absolutely dwarfed previous quarters…

Next to a chart of its stock price plunging by double-digits on the news.

Imagine how traders who bought more Tesla stock in anticipation of such “blockbuster” earnings must feel.

This is why I laugh at those who keep harping on about stock “fundamentals”.

Yes, they matter – but much much less than most think.

The thing that matters most when it comes to making fast money in the markets? I explain in the Insight of the Day.

Insight of the Day

Understanding market expectations is the key factor for making fast money in the markets.

Stock prices trade on expectations.

And often, as in the case of Tesla, the expectations that have been priced-in already exceed that of the fundamentals (even if they are good).

That’s why blindly looking at fundamentals – without understanding what expectations have already been priced in – is a losing game.

Those who can identify mismatches between a stock’s expectations and fundamentals win.

The thing is, fundamentals are obvious – anyone can pull up an earnings report – whereas market expectations can be very difficult to gauge.

That’s why I’ve come up with a strategy for accurately targeting these mismatches between a stock’s expectations and fundamentals…

By tapping into knowledge that is unlikely to be reflected in stock’s price.

And later today at 12 p.m. Eastern…

I’m going LIVE for a masterclass on how you can use this knowledge to target fast market moves – no matter what’s happening in the broader markets.

This strategy works all year round – but it’s especially powerful during earnings season.

So don’t waste your chance.

Click here to save your seat for my live masterclass later…

And watch out for the login details in your inbox shortly.

See you soon.

Ross Givens

Editor, Stock Surge Daily