Hey, Ross here:

Let’s start the day by looking at a chart that explains a so-called “bearish” signal.

Chart of the Day

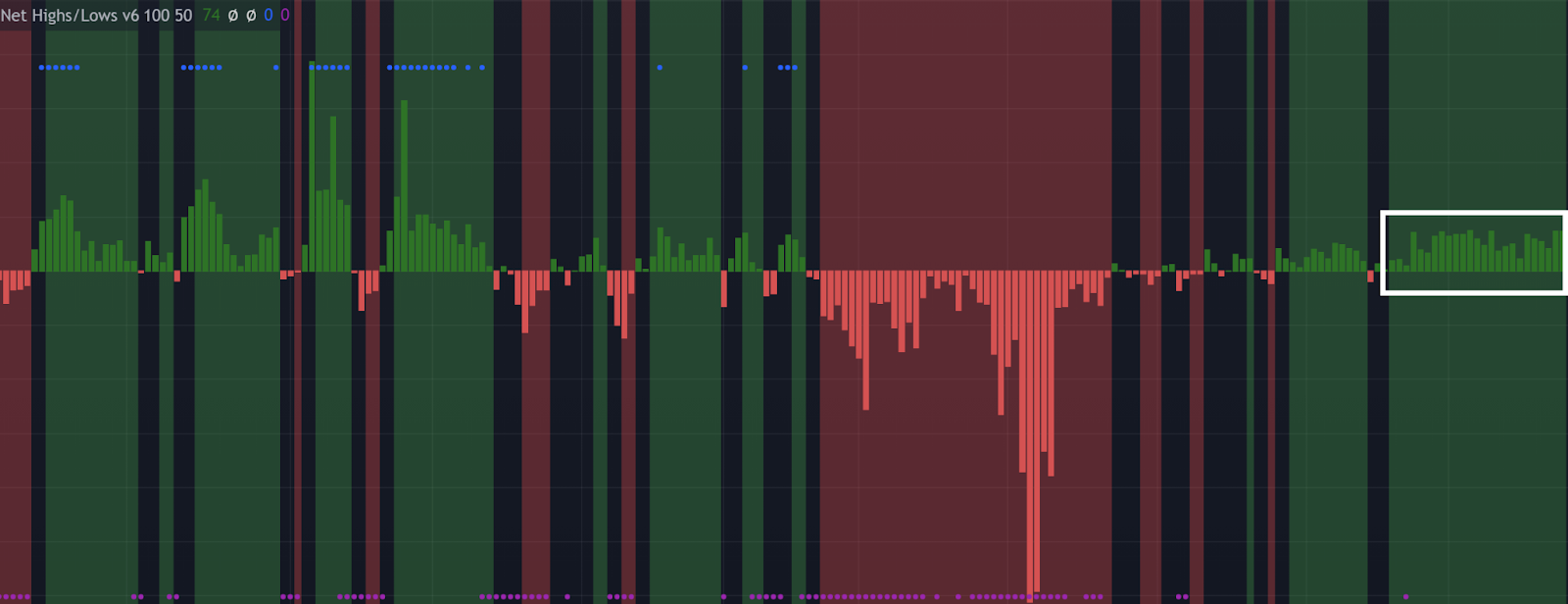

This chart shows the percentage of companies experiencing net buying from the corporate insiders.

For a company to “count” in this ratio, it means more insiders must be buying than selling within that company.

Right now, only a very small percentage of companies are seeing net insider buying…

Which the chart creator labels as “record bearishness”.

Now, I admit – on the surface, this chart does seem very bearish.

But consider that many insiders receive shares as part of their regular compensation, with their share-based compensation often dwarfing the cash component.

And with markets now at all-time highs (just look at the streak of net new highs below)…

It makes perfect sense that these insiders would be selling a lot of their shares to lock in profits and get the cash (which they need to finance their lavish lifestyles).

That’s entirely rational, and in no way indicates bearishness.

In fact, it likely indicates the opposite.

Further, this lack of insider buying actually makes it easier for us to spot opportunities.

I explain more below.

P.S Stop wasting your time digging through your inbox to find this newsletter. Text the word “trade” to 87858 and we’ll send it straight to your mobile instead.

Insight of the Day

Less insider buying makes it easier to spot the signal among the noise.

Most of the gurus out there won’t tell you this…

But most insider buying is noise.

They don’t indicate anything about whether an insider is exploiting their inside knowledge to seize an opportunity…

And if you follow this kind of insider buying, you could do real damage to your account.

That’s why I look for a few highly specific signals that indicate an insider is truly exploiting their insider knowledge to take advantage of a big opportunity.

These are the signals that make an insider buy a high-percentage opportunity we want to follow…

And with lesser insider buying, these signals are easier to spot.

Combine that with earnings seasons, which often creates major price dislocations and overreactions…

And there’s never been a better time to capitalize on these insider signals.

That’s why in just a few hours at 11 a.m. Eastern later this morning…

I’m going LIVE to show you every single insider signal I look for.

After my presentation, you’ll know exactly which type of insider buying to follow…

And which type to avoid like the plague.

Following the right kind of insider signals have led to returns like 131%, 670%, and even 1,560%.

So you don’t want to miss this – not in the middle of earnings season.

Click here to lock in your seat for my live insider reveal if you haven’t done so yet…

And I’ll see you in just a bit at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Traders Agency is awesome.

I have motored through multiple online high-brow investment people with their proprietary methods and none match the insight, supportive instruction and explanations of the vagaries of stock trading as I find with Ross Givens.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily