Hey, Ross here:

To kick off the final trading day of the week…

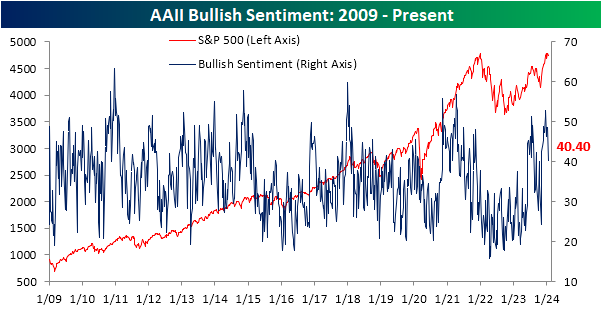

Let’s look at a chart examining how market sentiment is faring after weeks of sideways market movement.

Chart of the Day

This is a chart measuring bullish sentiment as indicated by surveys from the American Association of Individual Investors (AAII).

It shows that about 40% of individual investors are bullish right now – the lowest since the first week of November 2023.

Meanwhile, bearish sentiment is picking up – with nearly 27% of investors surveyed reporting bearish.

Many people would look at this as a negative signal.

And as I explain in the Insight of the Day – that’s precisely what makes it an opportunity.

Insight of the Day

Market breakouts happen when sentiment is at the lowest – not the highest.

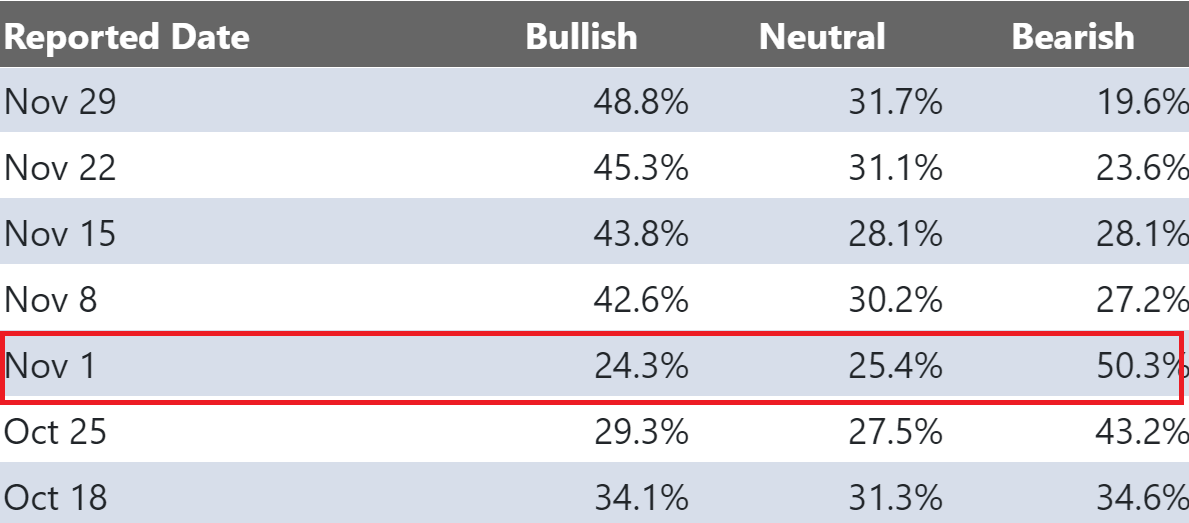

Look at the AAII bullish and bearish readings from late last year.

Notice that bearish sentiment was at its absolute highest – over 50% – right before the entire market broke out strongly.

That’s why I’m actually glad that bullish sentiment is falling and bearish sentiment is rising…

Because it signals to me more bargains up for grabs right now before the market breaks out again.

And here’s even better news…

You don’t even have to wait for a market breakout to happen…

Because, earnings season is just kicking off – meaning companies with positive surprises could see big price moves…

And the best way to find these surprises is to mirror what the corporate insiders – those who know every last detail about their own companies – are doing.

Earlier this morning, I went LIVE for a masterclass on my strategy for mirroring these insider trades to target these “surprises”…

So, if you missed it, make sure you click here to watch the replay now…

Or click here to book a call with one of our Education Specialists to find out how this strategy can help you hit your goals.

Don’t miss your chance to keep going after big gains this earnings season.

Ross Givens

Editor, Stock Surge Daily