Just like the “double bottom” pattern we’ve covered previously, the “triple bottom” is a trend reversal pattern.

These patterns are similar in a lot of ways, but the big difference is that a triple bottom has one more low point before the reversal.

So, instead of looking for a “W-shaped” pattern on the chart, you want to look for a pattern with three clearly defined lows.

While this may sound obvious, triple bottoms tend to form at the end of a down trend and can often result in big shifts in momentum.

So, it can pay to know what to look for…

Trend Change

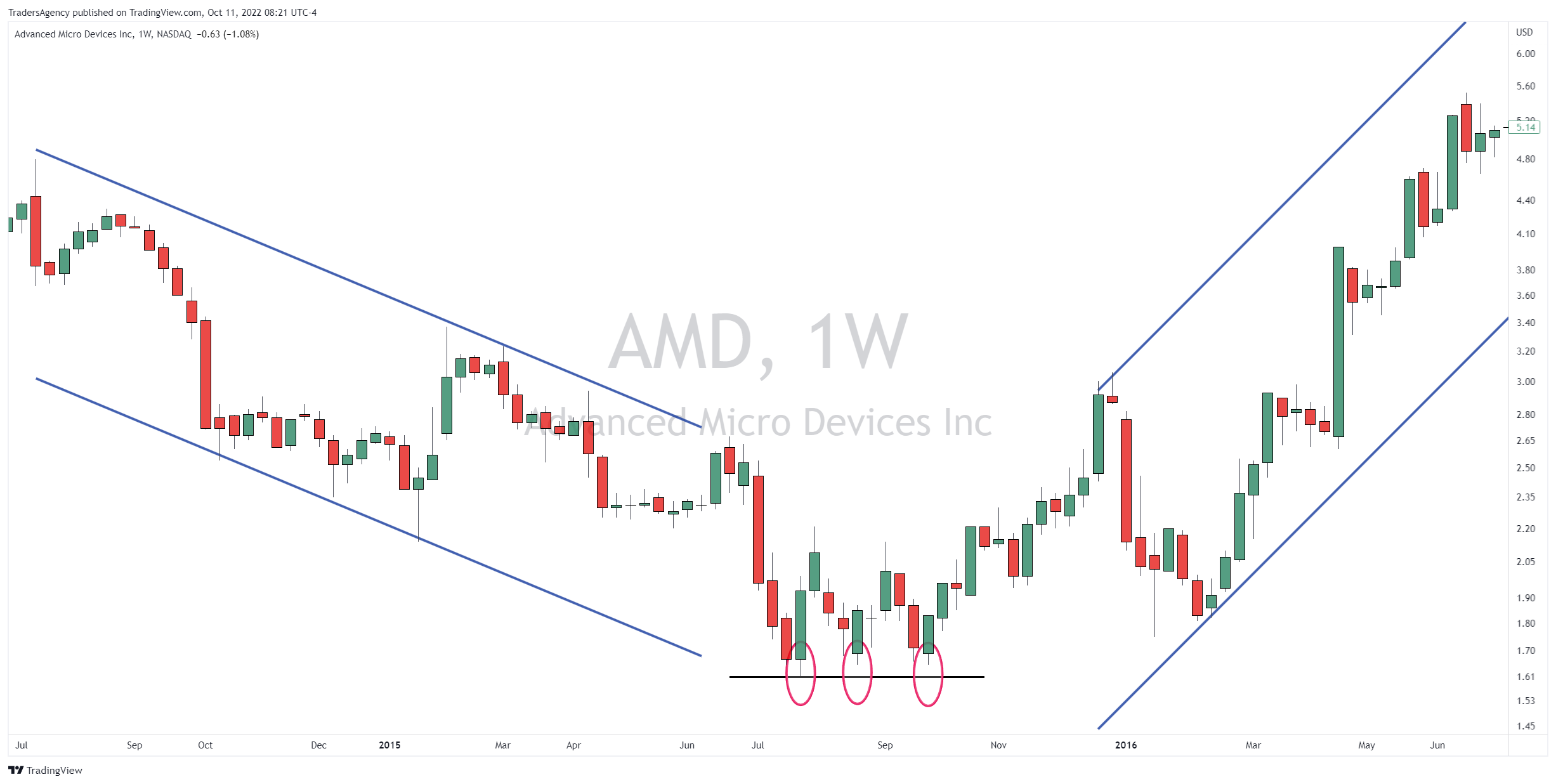

For example, take a look at the weekly chart of the Advanced Micro Devices, Inc. (AMD) below…

As you can see, the chart was in a steady downtrend for several years prior to the bottom.

Prices ultimately fell below $2 in mid-2015 after trading over $40 in 2006. That’s a drop of 96% at the lowest point!

But then, something interesting happened… The price stopped going lower and began to stabilize.

Take a look at the daily chart to see it in more detail…

After the first low price was made in July 2015, the stock bounced slightly and then fell back down near the same level again in August.

This happened once more the next month…

Turnaround Time

However, after the third low was in, the stock continued to rally and eventually broke through overhead resistance around $2.20 per share.

As you can see towards the right side of the chart, that overhead resistance then became support and propelled the stock higher.

Now, not every triple bottom is going to lead to the kind of bullish run that AMD experienced over the last few years…

Since the first low of the triple bottom, the stock soared over 10,000% to its peak in 2021!

But it’s important to keep this pattern in mind so you’ll be ready to take action when you see it in the wild.

Insiders Lead the Way

Now, if you want a different kind of strategy for getting ahead of big market moves before they happen, consider this…

When corporate insiders like CEOs, CFOs, executives and board members put down their own hard-earned money to buy shares of their own companies, it’s a huge vote of confidence.

After all, these folks have a footing of knowledge about their companies that Main Street investors simply do not.

It’s absolutely free to attend, so I really hope you’ll check it out.

I’ll cover my strategy for trading alongside corporate insiders and generating potentially massive gains with less risk.

Just click here to register for this special Insider Effect LIVE session now!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily