Hey, Ross here:

I hope you all had a fantastic Thanksgiving.

One week ago, I said that Thursday, November 20 was likely the bottom for the month – and shared three reasons why that was likely the case.

I was right.

Since then, the indexes have been posting consecutive gains…

And are essentially back to where they were before the pullback.

Of course, they still ended slightly lower for the month… but the price action is looking highly constructive.

And yet, despite this price action…

Sentiment can make it seem like a crash is due to happen any moment.

I explain my take on it below.

Chart of the Day

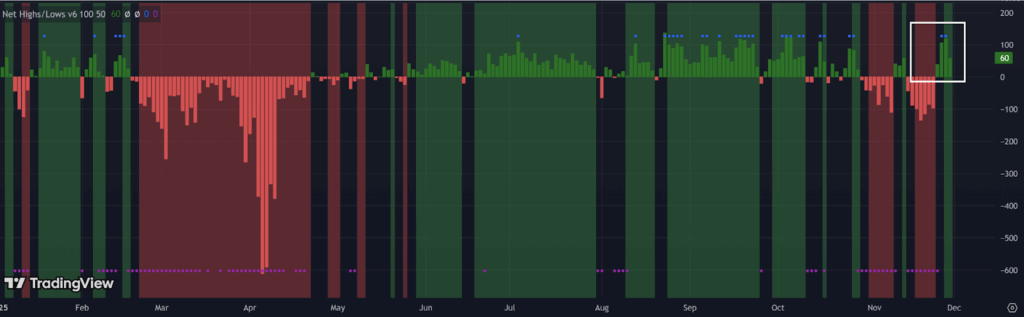

First, let’s look at the Net New Highs indicator.

I love this indicator because of one simple reason…

If there are more stocks making new highs than new lows – how can you say the market is faltering?

And as you can see below, for the past four trading days, we’ve seen net new highs return to positive territory.

The Equal-Weighted S&P 500 (RSP), which again, is the S&P 500 assuming every component is given equal weighting…

Is now at new all-time closing highs.

And here’s the kicker…

It’s doing this even though the cap-weighted S&P 500 is NOT at new all-time highs.

It’s been very rare for the RSP to outperform the S&P 500 these past few years, because of how “top heavy” the index is.

So to see it do so now as we emerge from the pullback is a very positive sign.

Because it means that the average stock is participating in this rebound, and it’s not just concentrated with the big dogs.

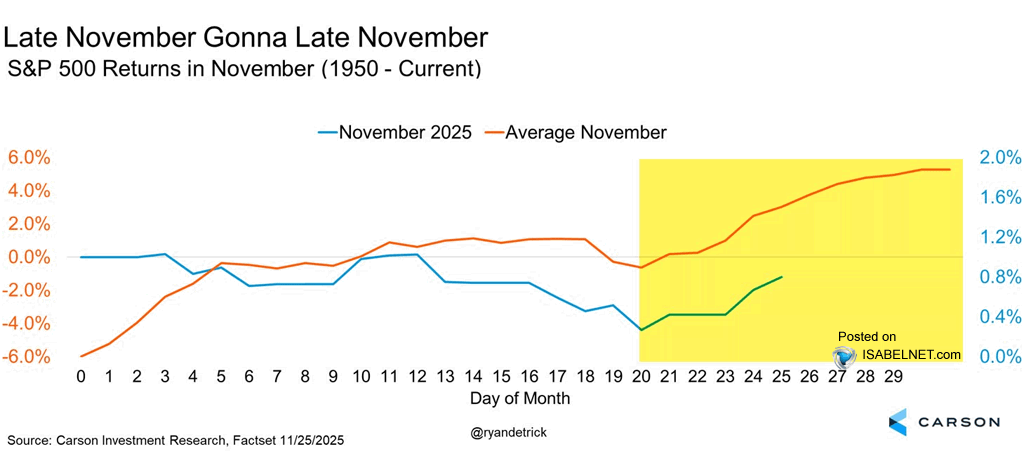

Finally, from a seasonality perspective…

That late November rebound is pretty much bang on in line with history.

Now again, like I said last week, I don’t put that much weight in market seasonality.

But this adds at least a little more evidence to the positive momentum I’m seeing right now.

Still, like I said – despite all this…

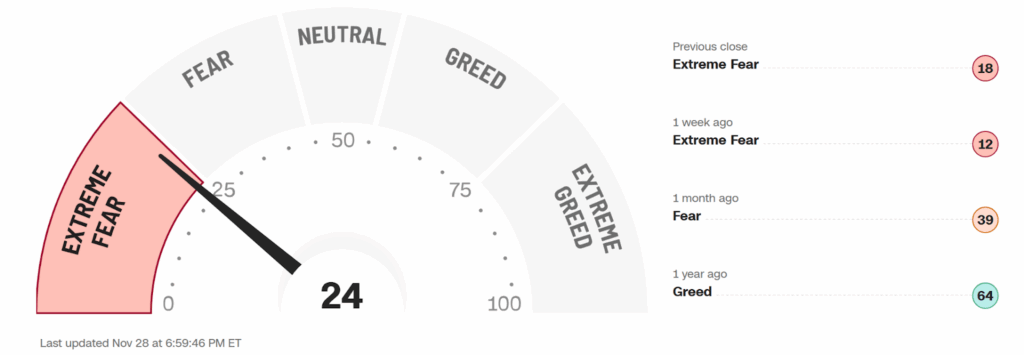

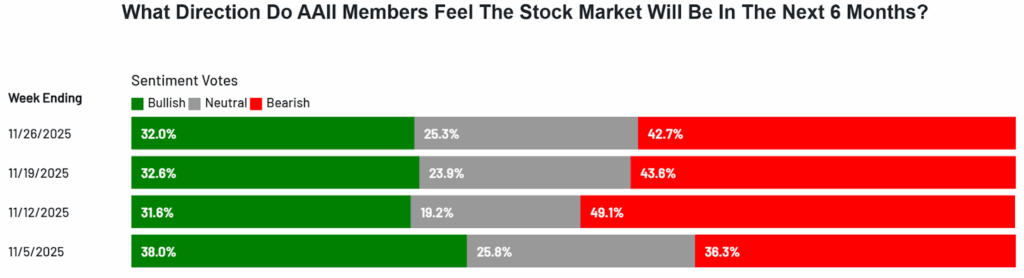

Sentiment is still weak.

The CNN Fear & Greed Index is still showing “Extreme Fear”…

And the latest AAII Survey shows there are still more bears than bulls.

What’s going on?

I explain my take below.

Insight of the Day

Market sentiment – especially retail sentiment – is constantly oscillating between fear and FOMO

The average investor’s view of AI is right now oscillating between two extremes…

It’s the next best thing that will change the world, or…

It’s a hype bubble that’s about to burst and take the whole stock market down with it.

The media plays both ends up – just take a quick glance through the financial news to see for yourself.

And that means sentiment is also constantly bouncing between fear and FOMO…

With so many investors not sure which narrative to trust.

Well, let me share something I’ve learned in all my years of trading.

When you can’t trust the narrative – trust the price.

And right now, the price is telling me that momentum is on our side – and that we should take advantage of it.

Because make no mistake…

The institutional traders absolutely are.

And tomorrow, Tuesday December 2, at 11 a.m. Eastern…

I’m going LIVE to show you how to flip the tables on the “big money” who’ve been ruthlessly exploiting the retail fear..

I developed this strategy while working for one of the biggest banks on the Street.

I saw the exact patterns they follow when they make their buys…

Which allows me to target the exact same stocks as they are – essentially using them for your profits.

I’ll show you everything in my free live presentation tomorrow..

Just click here to save your seat…

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I guess I have been a newbie in the stock market for years. Buying a stock and just letting it ride.

Yes, I made a little money, but after finding Ross Givens and his educational methods a few months ago, I have moved the stocks in my portfolio to ones with more potential than ever before.

I am so impressed I purchased a lifetime membership and learned a new selection method daily.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily