Hey, Ross here:

After yesterday’s PPI data, the Fed is almost certain not to deliver a half-point cut next week.

Will that lead to another painful second half of September?

Let’s take a look.

Chart of the Day

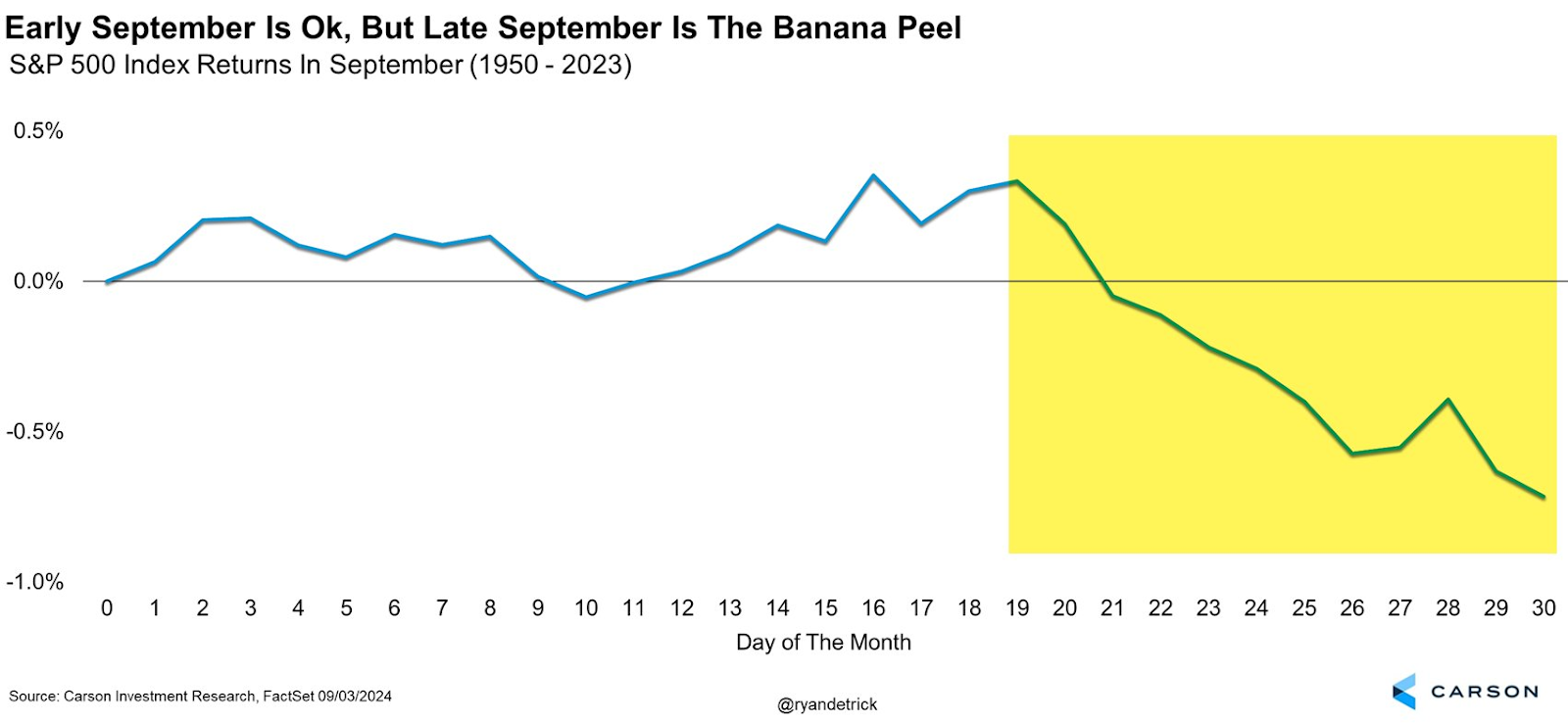

As you may know, September is historically one of the worst months of the year for the S&P 500.

But if you delve deeper, you’ll see that it’s the second half of the month that’s typically the weakest.

Will the Fed manage to lift the market up despite historical seasonality next week?

We’ll have to see.

But as I explain below, there’s always good news.

Insight of the Day

No matter what happens, there are always pockets of strength in the market we can take advantage of.

This is my proprietary Industry Strength gauge.

And as it shows, even during periods of market weakness, there are still entire sectors making healthy gains in short timeframes.

This means individual stocks within these sectors can do even better – if you know how to spot them that is.

The best bet right now is to follow the institutional money into the stocks within these market-defying sectors.

These big buyers can move entire sectors, which is why they try to hide their trading footprints.

They don’t want retail traders like us from using their money for our profit.

But after years in the heart of Wall Street, I know exactly how to spot their footprints.

I shot a presentation a while ago revealing everything you need to know to use this institutional money to target rapid gains – no matter what the market is doing.

Some of the info is a little dated, but it’s all still 100% relevant.

So, before the weekend hits…

Ross Givens

Editor, Stock Surge Daily