Hey, Ross here:

Powell has a consistent habit of disappointing the economy and the stock market.

Yesterday, he took a decisive move by delivering a “jumbo” 0.5% rate cut.

While stocks rallied following the news, that didn’t last, with most indexes ending the day slightly lower.

I’ll explain what happened in a bit.

But first, let’s look at a chart that tells us here the market is still likely headed in the longer term.

Chart of the Day

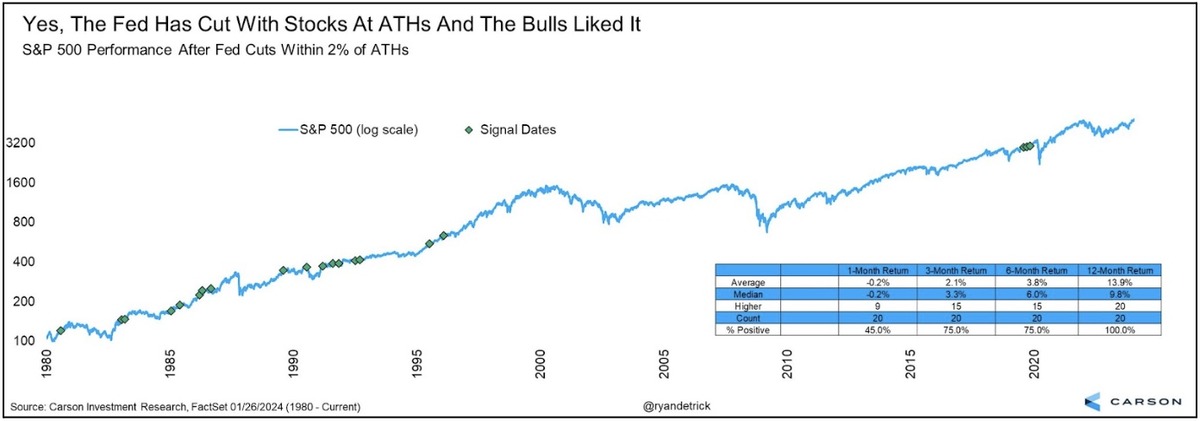

This chart shows what the S&P 500 has looked like a year after the Fed cut rates when the index was at or near all-time highs (like it is now).

And what the data shows is that every single time the Fed has done this, the S&P 500 has been up by a median of 9.8% a year later.

But if we look at how the index does just one month after the Fed cuts rates in these circumstances, the median result is negative.

In other words, don’t be surprised if the market is lower one month from now – especially considering September seasonality.

The most likely outcome for the markets in subsequent months is for it to keep moving higher.

Insight of the Day

We likely saw a “sell the news” phenomenon yesterday

One of the worries around a 50-basis point cut is that it could signal that the Fed was concerned about the economy.

But in his press conference, Powell explicitly said he “doesn’t see anything in the economy right now that suggests that the likelihood of a downturn is elevated.”

So the end-of-day selloff and rally reversal we saw was likely just a “sell the news” phenomenon after they “bought the rumor” last week.

Again, this doesn’t say anything about the longer-term prospects of the stock market.

This was just a short-term move – and we’ll have to see how it all plays out in the following days.

But this just shows how powerful the “buy the rumor, sell the news” phenomenon can be.

The corporate insiders take advantage of it all the time – because they know when a rumor is actually news.

Yesterday, I went live for a masterclass detailing my strategy for following these corporate insiders.

The corporate insiders have such a huge edge in the market that even capturing some of that edge has allowed this strategy to build up a 1,900% compounded return since inception with zero losing years.

And with volatility swirling amid the Fed rate decision, we can use it to get in on the highest-potential opportunities at better prices.

So, if you missed yesterday’s masterclass…

Make sure you click here to watch the limited-time replay now.

Customer Story of the Day

“These guys know what they are doing. Also, they are very helpful and supportive of their customers.

I was nervous at the beginning since the services are not cheap and I bought the most expensive bundle. But in less than 5 months I doubled what I paid to Trader’s Agency and the account keeps growing. Now I only have to worry about how much taxes I have to pay, so don’t rush to spend all your profits. Save some for Uncle Sam.

The crew responds quickly to your questions and helps relieve your anxiety which you will certainly have at the beginning of your trading experience. Ross’s team helped me navigate though very turbulent times in the market in August and September of 2023 pretty much unscathed.

As long as Trader’s Agency is in business I will continue using their services. I still have my day job and I am not quitting it. But it feels good to stop worrying about the money.”

Ross Givens

Editor, Stock Surge Daily