Hey, Ross here:

The S&P 500 just closed at a new 52-week high – past the 4,300 resistance level.

I like what I’m seeing in the markets. So let’s start the day with an actionable trade idea.

Chart of the Day

UBS analysts doubled down on its bullish view on OnCloud’s (ONON) stock last Friday. They have a buy rating on ONON and a price target of $42.

This stock has been a favorite of mine for several months. It went public in late 2021. It performed great initially. But the 2022 bear market gave it a beating.

ONON has more than doubled off its 2022 lows and the company is growing sales at an astounding 80% quarterly rate.

Shares dipped below the 50-day moving average (red line on chart) in May and did an “undercut & rally.” This is where a stock will breach a previous support area triggering thousands of stop losses and taking investors out.

Institutions often buy here and drive the price back above support (dashed line on chart) to continue the move higher.

Investors may consider buying here with a 10% stop loss near $27.25.

P.S. Would you like special trade prospects and potential market moves just like the above sent directly to your phone? Text the word ross to 74121.

Insight of the Day

The breaching of a major psychological resistance level can have a major snowball effect.

A lot of the reason why support and resistance levels work comes down to psychology.

When a major resistance level – such as the 4,300 mark for the S&P 500 – is breached, many traders (often rightfully) assume that others will join in the buying and drive it up even further.

So they themselves cover any short positions and go long – further adding to the buying pressure.

It’s a positive feedback loop – the snowball effect.

And with the S&P 500 having breached the long-held 4,200 resistance level back at the beginning of June…

Only to blow past the 4,300 mark not even 2 weeks later…

I can see many individual stocks surging as traders come to accept that we are indeed in a bull market.

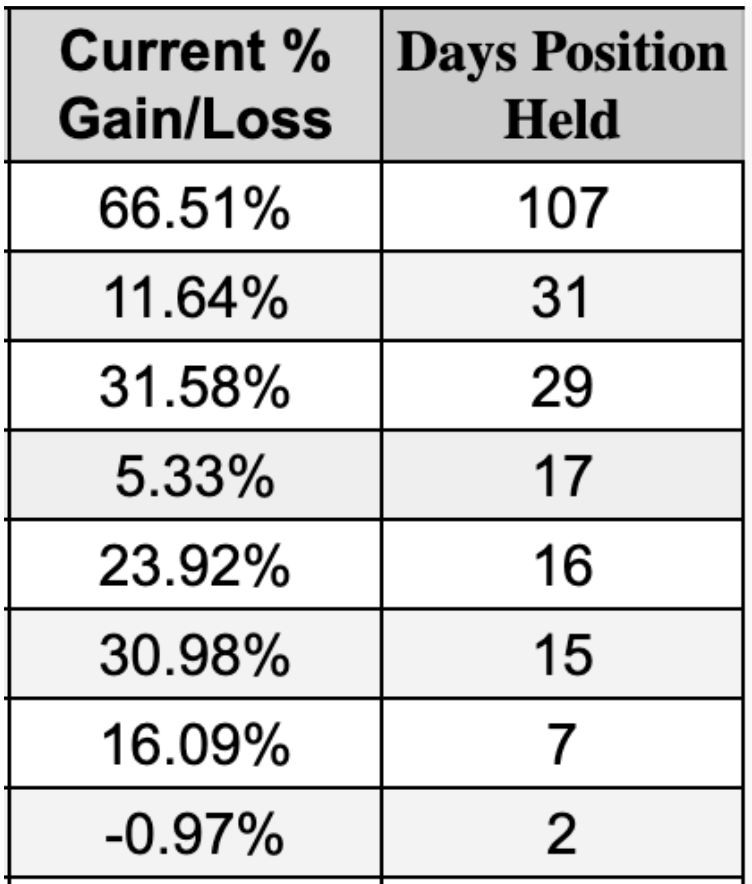

And these are perfect conditions for my FIRE Strategy, which has already delivered gains like these:

…even before the S&P 500 had breached the 4,200 level.

I’m expecting this strategy to pay off even more now that the market is picking up serious momentum…

Which is why I’m going LIVE later today at 12 p.m. Eastern to show you how to start using this strategy right now – so you can start exploiting these hot market conditions.

Just click here to save your seat…

Because once the Fed moves tomorrow, the market could explode even higher…

And you want to position yourself before then.

See you soon.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily