Hey, Ross here:

Another day, another trading idea to put in your arsenal. Here’s what I’ve got.

Chart of the Day

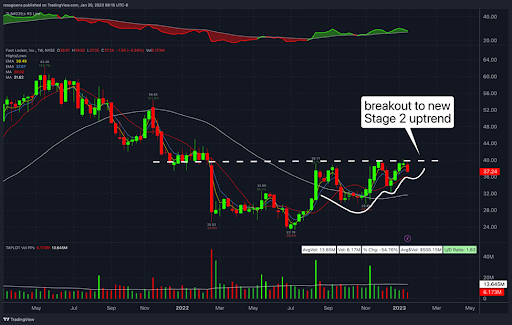

One of the best-looking charts in the retail sector belongs to Foot Locker (FL). The weekly chart above shows the full picture.

Notice that FL has been in a Stage 4 decline since early 2021. Shares bottomed this Summer and have slowly formed a rounded bottom to complete a new Stage 1 base.

The stock is now consolidating in a pattern of shallowing retracements just as we like to see.

Resistance is clearly defined at $40 – a key support zone from the end of last year. A move above this level would trigger my entry for a potential multi-month move higher.

Tactical traders may instead choose to build a smaller position here in the $35–$40 range and add on if and when the stock breaks out.

Insight of the Day

You always have to look deeper to find the best opportunities.

Check out yesterday’s headline on CNBC.

The article talks about how, over the past three months, other stock markets have registered much better performance compared to the US. The main reason for this is the heavy weightage of large cap growth stocks and tech in the US.

This makes perfect sense. But it does not necessarily mean that traders need to look outside US borders for serious profits.

But it does mean they need to look beneath the surface – past all the popular large cap tech stocks that dominate the market to find the hidden gems beneath.

I’ve been uncovering some of these hidden gems for you every single trading day on this very newsletter.

And make no mistake, following the ideas in this newsletter could give you some very healthy profits. But if you want to take things to the next level, to where you could literally 100x your starting capital – then check this out instead.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily