Hey, Ross here:

As expected, the Fed just cut rates again yesterday.

Before the cut, indexes were within spitting distance of all-time highs.

So today, let’s see how that has tended to play out in the past.

Chart of the Day

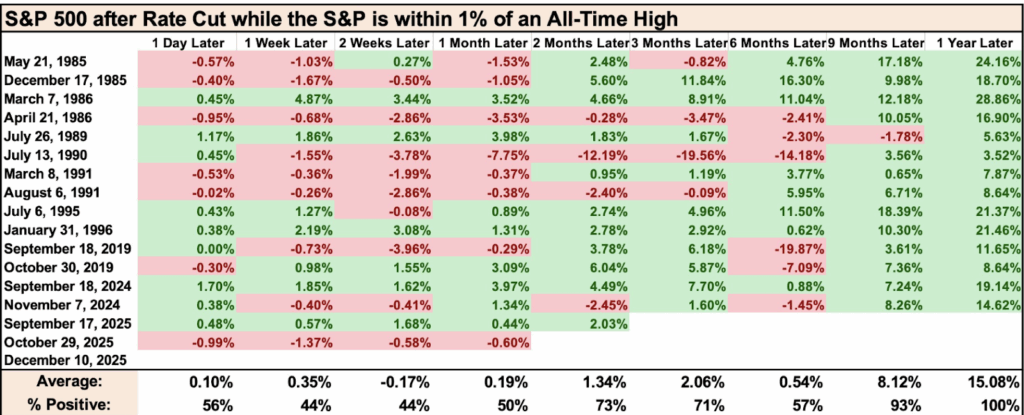

This table shows how the S&P 500 has performed 1 – 12 months after the Fed cut near all-time highs.

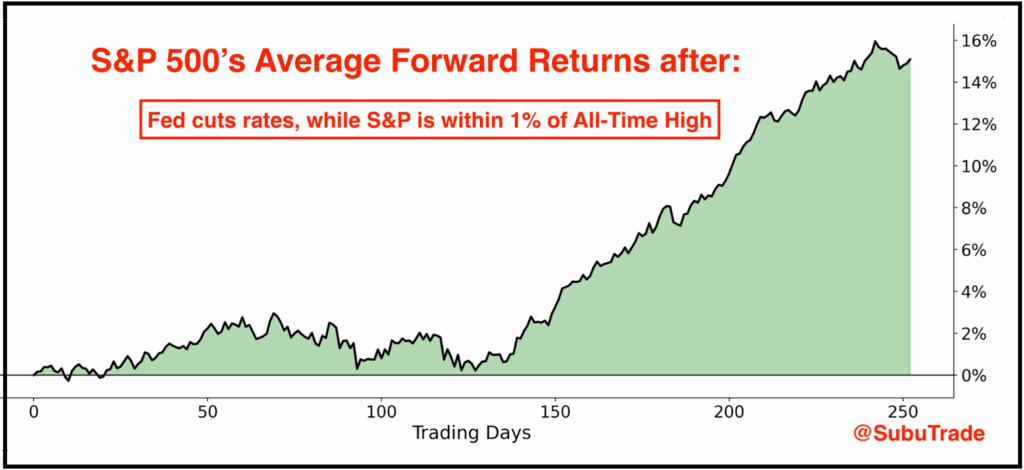

As you can see, the picture is extremely positive – especially as you keep extending the time horizon.

However, there is one important caveat…

Near-term choppiness is NOT uncommon. In fact, it should be expected.

Take a look at a similar table, this time including much shorter timeframes.

As you can see from the first four columns…

When it comes to timeframes of under a month, things look much choppier.

In other words, don’t be surprised if we see markets bounce around or even dip lower in the coming days or weeks.

But again, as you look further ahead, things are looking good.

Combine this with a resumption of the risk-on mood – something that happened even before the Fed cut rates again…

And I like what I’m seeing in the markets.

Insight of the Day

Most people will NOT be expecting choppy action after the third consecutive Fed cut – and that’s something we can use to our advantage.

You now know that the markets will most likely keep going up into 2026.

And you also know that choppy price action in the coming days or weeks will be perfectly normal and in line with history.

But most people don’t know that.

They see the Fed cut rates again and automatically assume it means “stocks go straight up” from here on out.

And what that means is that when we run into some choppy price action…

Their expectations get shattered – and they panic in the other direction instead…

Causing them to get “flushed out”.

That’s the opportunity savvy traders can take advantage of.

That’s why tomorrow, Friday December 12, at 11 a.m. Eastern…

I’m going LIVE to reveal a strategy that will allow you to exploit the current market by following some of the savviest traders in the world.

Case in point, a couple weeks ago, this strategy pinpointed a beaten down biotech stock that had seen its price get crushed by as much as 80%.

Since we recommended it, it’s up 72% – in a matter of weeks.

But with how the market’s been looking, I believe gains like these could just be the start.

And tomorrow, I’ll show you exactly how to go after these gains.

The presentation is completely free…

But you do need to click here to save your seat for my live reveal.

I’ll see you Friday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross Givens from Trader’s Agency is an awesome resource to help you with your investing needs and investing education.

I waited about three months to write this review to give myself time to see the impact on my portfolio and I have been completely satisfied.

Ross has a no nonsense, simple approach that makes it easy for all investors and he takes the time to answer all questions on a weekly basis.

Thanks, Ross and Traders Agency!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily