Hey, Ross here:

The latest CPI report showed negative 0.1% for the month and 3% year-over-year – the lowest level in more than three years.

So to end the week, let’s see how many rate cuts the market is expecting.

Chart of the Day

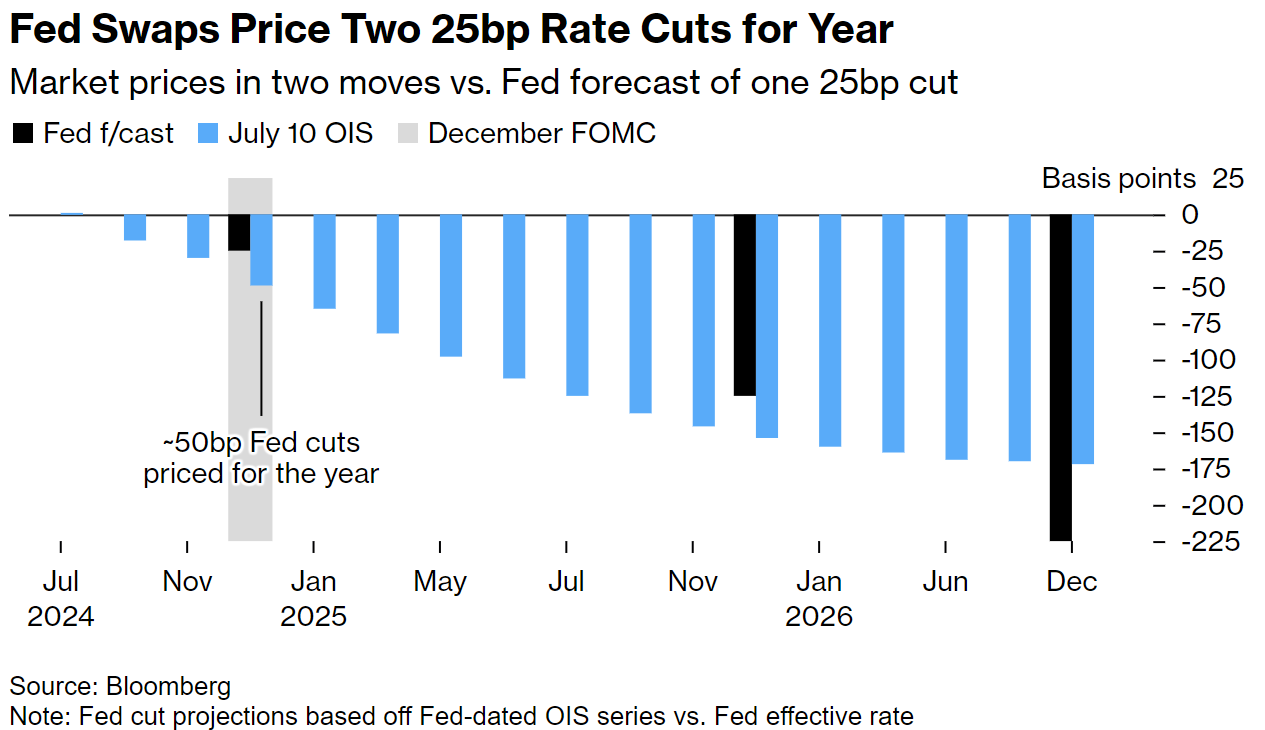

In their last monetary policy meeting, the Fed forecasted just one rate cut this year.

Swap traders don’t believe them – pricing in two instead.

After yesterday’s cooler-than-expected CPI report, those traders will likely be proven correct.

Now is not the time to sit out of this bull market.

But you should be mindful of how it may be shifting.

Insight of the Day

Look for buyers to turn to “ignored stocks” to keep the bull market going.

Small caps appear to be breaking out…

While the dominant tech stocks look to be faltering a little.

This doesn’t surprise me one bit.

I pointed out the potential small-cap breakout earlier this week…

And I’ve long said that the multi-trillion-dollar megacaps are unlikely to be able to keep going up given their size.

I believe that the bull market will shift to these “ignored stocks” in this next phase…

Which is why later this morning at 11 a.m. Eastern…

I’m going LIVE for a new masterclass that will allow you to target the specific “ignored stocks” the buyers are shifting to…

By using a unique indicator that detects when buying pressure is building up in a stock.

After you attend my masterclass later, you’ll know:

- How to detect when buying pressure is building up in a specific stock…

- Why most traders are blind to this buildup of pressure (causing them to miss out on big gains)…

- And how to use my “PSI Gauge” to determine the exact point to jump into one of these “pressurized” stocks for maximum gains.

So, if you haven’t already, make sure you click here to “lock in” your spot for my live masterclass later…

And watch out for the login info in your inbox shortly.

I’ll see you at 11 a.m. ET later. Do try to login early if you can.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily