Hey, Ross here:

Although yesterday morning’s CPI data was mixed, investors took it very positively.

It was a good day for the bulls – but I want to see more confirmation first.

In the meantime, let’s look at a chart on a massive market stock traders often ignore – the bond market.

Chart of the Day

The general rule is – the higher the 10-year Treasury yield, the lower the stock market.

This hasn’t always held true during this bull market…

But it’s been generally true over the past month or so, with yields steadily rising as stocks struggled.

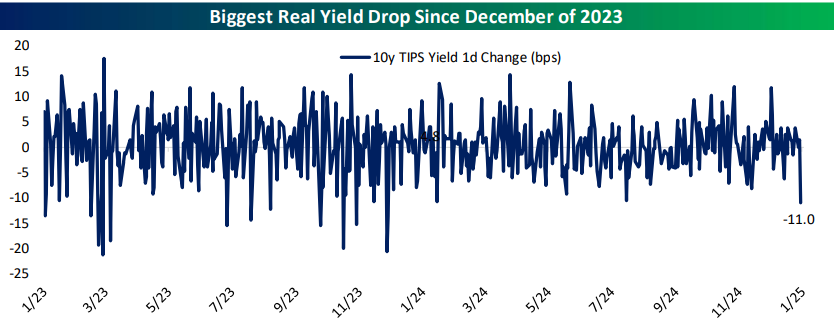

Yesterday’s drop in the 10-year Treasury yield was the largest drop since December 2023.

This is a good sign for the markets, though like I said, I want to see more confirmation first.

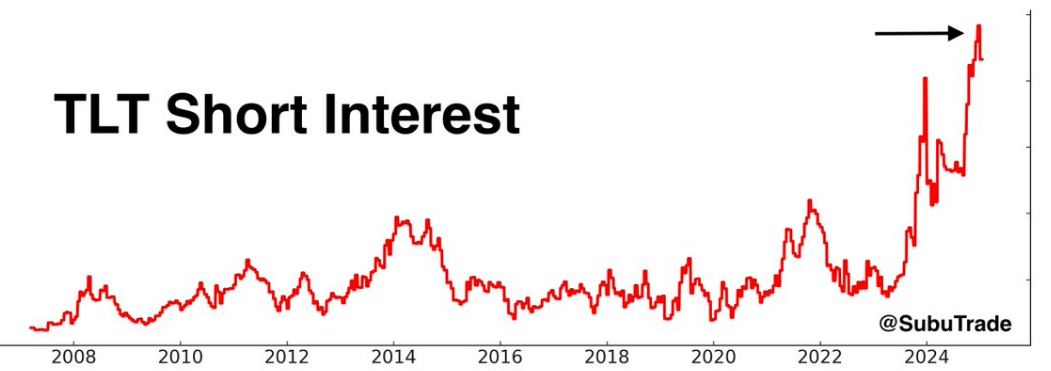

Here’s another interesting chart – the level of people shorting the Treasury bond market (aka expecting yields to rise further) is the highest in years.

If yields continue to drop, these shorts could get squeezed out…

Which would in turn cause yields to drop even more.

And that again, would be good for stocks.

Insight of the Day

The combination of renewed bullish momentum plus earnings season is a rare opportunity.

The signs of renewed bullish momentum are promising…

Especially because we’ve just entered one of the most lucrative periods of the year – earnings season.

As companies report their latest quarterly earnings, analysts and investors around the world place huge bets on whether a business will beat or miss their earnings…

Which creates the kinds of conditions a very specific kind of trader knows how to profit from.

That’s why tomorrow morning at 11 a.m. Eastern…

I’m going LIVE to show you a little-known method I’ve been using for nearly a decade to sniff out extraordinary opportunities during earnings season.

I’ve seen gains like 287%… 527%… even 1,091%, all from this one method – in both bull and bear markets.

But with the market on the verge of recapturing its bullish momentum during the start of earnings season…

Now is the perfect time to put this method to work.

Don’t miss this window.

Click here now to save your seat for my live training session tomorrow…

And I’ll see you Friday morning at 11 a.m. ET.

Customer Story of the Day

“I’ve been an extremely happy customer for over a year. I’ve doubled my money and would have made more money had I not ventured off and did my own thing. (a learning experience, but much wiser now).

I signed up with the deluxe package that includes 1) Insider Effect 2) Alpha stocks, 3) Fire Trader, and 4) Stealth Trades.

Ross and his team send out alerts of when to buy and sell different stocks based on different criteria. They make it easy no matter what your experience is. There are also plenty of easy-to-follow trading videos that go over different strategies and must take actions such as setting an automatic stop loss to ensure that you never lose a ton of money (like I did in the past).

TA’s tech support is top notch and always thoughtfully replies until the issue/question is resolved.

In short, I finally have multiple winning strategies and knowledge to buy CALL and PUT options and know exactly what my risks are. This is an EXCELLENT program, and I am very glad that I joined.”

Ross Givens

Editor, Stock Surge Daily