Hey, Ross here:

Market leader Nvidia slightly beat earnings on both the top and bottom line.

Yet, the stock closed 0.8% lower yesterday – likely because data center revenues came short of estimates.

Despite this, markets closed at fresh highs.

That’s a positive sign, because it shows this bull market is not as reliant on Nvidia as many thought.

In fact, as today’s chart shows – breakouts are working.

Note: As US markets will be closed on Monday for Labor Day, this newsletter will resume Tuesday.

Chart of the Day

Regular readers would probably recognize this chart by now.

It’s the Net New Highs/Lows indicator – showing the net difference between stocks making new highs versus new lows.

Stocks making new highs means one thing – breakouts are working.

And not only that, we’re seeing new highs at some of the highest levels this year.

Things are looking good.

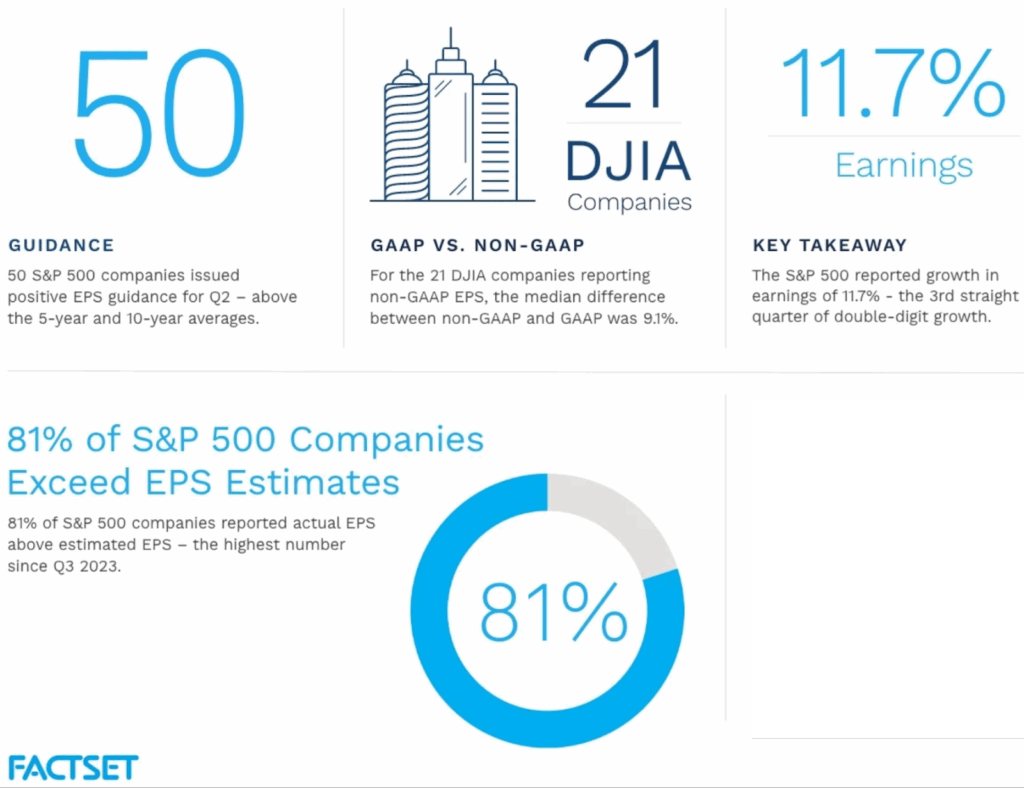

The recent earnings season has also played out nicely – with 81% of S&P 500 companies beating estimates, the highest level since the third quarter of 2023.

And yet, as the latest American Association of Individual Investors weekly sentiment survey shows…

There are still more bearish retail investors than bullish ones.

This is a classic opportunity setup.

I explain more below.

P.S. Next Tuesday – the first trading day of the week – I’m releasing my next edition of 2 Trades in 2 Minutes. If you want to get them as soon as they’re released, just text the word “trade” to 87858.

Insight of the Day

The classic opportunity setup is a strong market but weak sentiment.

We’ve seen this setup so many times during this bull market.

Honestly, it’s happened so often already that I’m surprised we keep seeing it.

That just goes to show how easy it is to sway the herd.

But hey – if the opportunity is there, it would be silly to not to exploit it once again.

You can’t force things in the market, you have to take what it gives you.

Right now, it’s handing us the classic opportunity setup of weak sentiment in a strong market.

On top of that, it’s also doing so right after earnings season has ended…

A time when many stocks are still reeling from a post-earnings selloff.

That’s when we typically see the corporate insiders stepping in.

They know the selloff is an overreaction, or that there are major catalysts coming down the pipeline.

So they take advantage of the post-earnings selloff to scoop up their own company shares.

This is the classic insider setup.

And I’m seeing it crop up a lot right now.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE to demo my strategy for following the right insiders to target wins like 1,090%, 520%, and even 1,787%.

After my demo today, you’ll know exactly which kind of insiders you want to follow…

And which ones you want to avoid.

So click here to guarantee your seat for my insider strategy demo if you haven’t already…

And I’ll see you in just a bit at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I followed Ross for approximately six months before joining.

In those six months, I honestly could have doubled if not tripled my money invested in stocks, not including what I could have banked with options.

Ross, as well as his staff, are pleasant and convenient regarding communication, but most important, they are knowledgeable and experienced.

They have educated me that the little guy can still profit with guidance and education.

I’m a member of two platforms (Insiders and FIRE) looking at a third (Alpha). T.A. is definitely worth the investment, as I am continually capitalizing on their recommendations on entry and exit.

I recommend you follow and see if you could come close to the detailed analysis these platforms provide.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily