Last week, I told you I have been seeing some signs that should lead lower prices for BTC…

The biggest headwind, in my view, is still the strong US dollar. That is one of the main reasons BTC has been so weak this year.

Investors from around the world have been seeking out the safety of US investments, which has been driving the value of the US dollar higher.

However, the dollar is now starting to retreat from its recent highs, and already we are starting to see digital assets like BTC react.

So today, we’re going to look a bit closer at both the dollar and BTC and try to determine what comes next…

Strong Dollar Easing?

The US Dollar Index (DXY) tracks the US dollar against a basket of other currencies used by US trade partners.

And as noted above, it has been on a tear…

In the daily chart of the US Dollar Currency Index (DXY) above, you can get an idea of the slow and steady uptrend that’s taken place this year.

DXY had gained nearly 20% for the year at its peak in September, and it is currently still up by 15%.

You’ll notice that the index has been moving along with its up trending 50-day moving average (MA), which is the red line on the chart above.

But with the dip this week, DXY has fallen back below its 50-day MA for the first time since early August.

Each time the index has interacted with its 50-day MA this year, it has proceeded to bounce and start another leg higher.

That could be the case again this time, but this could also be a sign that the dollar rally is coming to an end.

BTC Benefits?

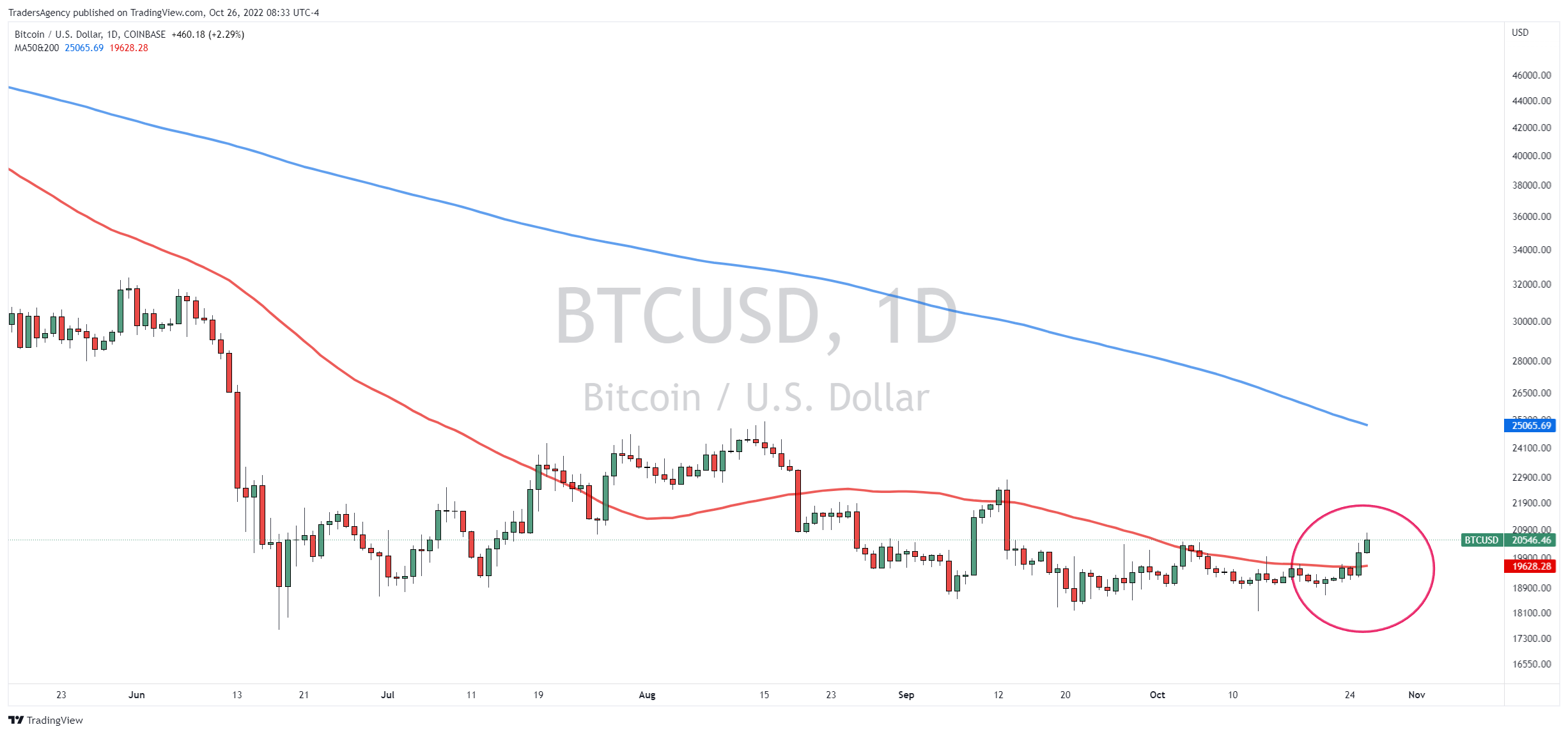

Let me be clear… The weekly chart of BTC still looks bearish.

The market is still hovering just above a key support level that stems from the 2017 peak, which I think will crack sooner or later.

But on a daily chart, the bulls just got an encouraging sign…

Just like DXY, BTC has been bumping against its 50-day MA (red line) over the past few months.

And as DXY is now breaking down below its 50-day, BTC is breaking up and through its 50-day MA.

You can see that this has happened several times throughout the year, but in each instance the BTC price has fallen back as the dollar has rallied.

If the dollar continues to move lower or simply stops rising, this BTC bounce could continue to the upside.

However, it’s impossible to say at this point whether this is the start of the next big move for BTC or just another bear market rally.

The determining factor will likely come down to which way DXY trends next…

Trade with the Tide

My colleague and expert futures trader Josh Martinez happens to agree with my bearish call on BTC…

He’s set his target for BTC all the way down at the $11,000 level, which represents a potential drop of over 40% from current levels.

And when it gets there, he’ll be waiting to play it with his Tunnel Trader strategy.

You see, if you are looking for a system that can help you start racking up more consistent wins on the downside as well as the upside, you need a way to find intraday opportunities…

That’s what Josh’s Tunnel Trader strategy is all about.

Utilizing this strategy, Josh has been identifying shorter-term up and down entry and exit levels for profitable trading opportunities along the way as markets move toward their full price targets.

Josh is going to teach you the simple, systematic approach to trading that is the basis of his Tunnel Trader tool.

If you can follow basic instructions, you can definitely follow along with Josh as he walks you through his approach.

So, don’t wait…

Register for today’s 12 p.m. ET session with Josh and his team by clicking right here.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily