Last week was a big one for stocks…

After the CPI report showed that inflation was cooling faster than expected, the indexes took off and posted their best day in two years.

The S&P 500 climbed 5.9% for the week, and the Nasdaq surged 8.84%.

While these numbers are impressive, I am not yet convinced the bear market is over.

The biggest one-day gains in the market almost always come in the middle of bear markets. Stocks simply do not surge in the same manner under bull market conditions.

During the bear market of 2008, the S&P 500 climbed over 4% in a day 14 different times. The index did not bottom until March 2009.

It is important to not get carried away and change one’s view on the market based on any one candle.

The Nasdaq Composite index rallied 25% off its lows from June to August before rolling over and making yet another new multi-year low.

Few Stock Standouts

Big picture, the market is still trading beneath a declining 200-day moving average, and stocks are not progressing in a healthy way.

At a true bottom, we should see new leadership emerging. A new investment “theme” containing specific groups of stocks should be rallying into new highs and leading the market higher.

So far, we have not seen that.

Solar and biotechs have been the standouts so far, but only a handful of the solar names I was watching a few months ago still look healthy.

Thursday’s bounce was largely made up of what I consider “trash” stocks bouncing off the bottom.

It felt more like a short-covering rally to me, as the biggest winners were beaten-down names with heavy short interest.

For the time being, I remain focused on the short side, and I am unlikely to change that view until we see real progress.

Will I buy the absolute low? No.

But I don’t want to get suckered into yet another bear market rally only to watch it fizzle on a single piece of bad news like we have seen recently.

With that in mind, here are a few stock ideas I’m watching this week…

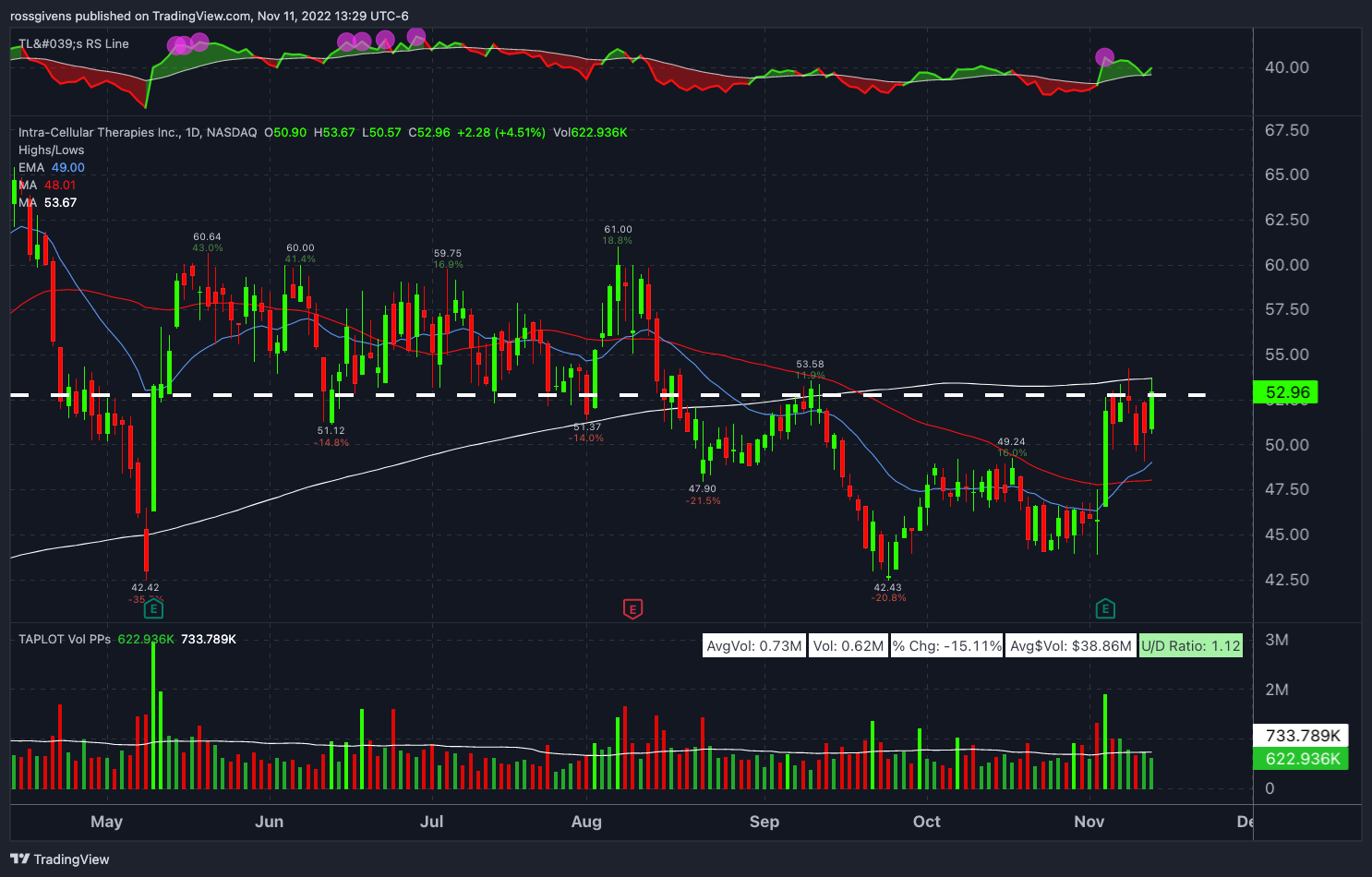

Intra-Cellular Therapies (Short Idea)

Intra-Cellular Therapies (ITCI) formed a multi-month base that ended in August when the stock breached the $51 support level.

What was support often becomes resistance, and that is exactly what we are seeing in ITCI.

Shares surged on earnings two weeks ago before finding resistance at the same level as before. So far, the stock has been unable to rally.

I would consider a short trade here with a tight stop.

Cheniere Energy (Short Idea)

Cheniere Energy (LNG) is failing, and even Thursday’s big rally couldn’t save it.

The high-volume days of the last month have all been on the short side – a signal that institutions are exiting their positions and taking profits near the highs.

I would consider a short on LNG here with an expected move down to its 200-day moving average.

Consol Energy (Short Idea)

Recently, President Biden had some disparaging remarks aimed at coal companies like Consol Energy (CEIX).

“No one is building new coal plants because they can’t rely in it… we’re going to be shutting these plants down all across America and having wind and solar,” the President said.

Unsurprisingly, CEIX did not participate in last week’s market rally. The stock is sitting on a crucial support level that could be breached any day.

A break below $57 would trigger a short trade on this one.

Join the “Powerhouse Trio” This Week!

Three of the top trading experts in the industry are seeing opportunities in the market right now that are some of the biggest they’ve seen in years.

That’s why on Wednesday, Nov. 16, at 12 p.m. Eastern…

Josh Martinez, Anthony Speciale and I – the trading world’s “powerhouse trio”…

Are hosting a special LIVE broadcast to reveal $150,000 worth of opportunities we’re seeing right now.

So click here to register for this FREE event…

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily