Editor’s Note: All major U.S. stock markets are closed today, Sept. 5, in observance of Labor Day.

As I write this update on Friday afternoon, the S&P 500 is down just over 2% on the week.

Stocks sold off hard last Friday and then continued that trend during the first three days of this week.

The market was able to recover early morning losses on Thursday, however, and actually ended the day in positive territory.

This is what is known as an “upside reversal day.”

Without getting too technical, this is when the market makes a new low but manages to recover and finish the session higher on the day.

We often see these when a downtrend has come to an end.

I have pointed out Thursday’s action as well as two previous examples on the chart below…

Hopefully, the market has now priced the new interest-rate expectations laid out by Federal Reserve Chairman Jerome Powell last week.

This makes sense as a good area for the market to turn back higher, so I am looking for long ideas this week.

Here are three stocks I’m watching right now…

Daqo New Energy Corp. (Long Idea)

Daqo New Energy Corp. (DQ) is a Chinese solar stock showing signs of big institutional buying.

I’ve been pounding the desk telling people to keep an eye on solar for months now, and this is one of the top players in the space.

A strong move through the $72 area would make me consider taking a position in this stock.

Neurocrine Biosciences, Inc. (Long Idea)

Neurocrine Biosciences, Inc. (NBIX) emerged from a textbook breakout pattern last month, surging 13% in just three days.

However, market weakness seems to be holding back a larger move.

Shares have drifted sideways to form a handle for the last few weeks.

I’m watching for a move above $108 to consider taking a position in NBIX.

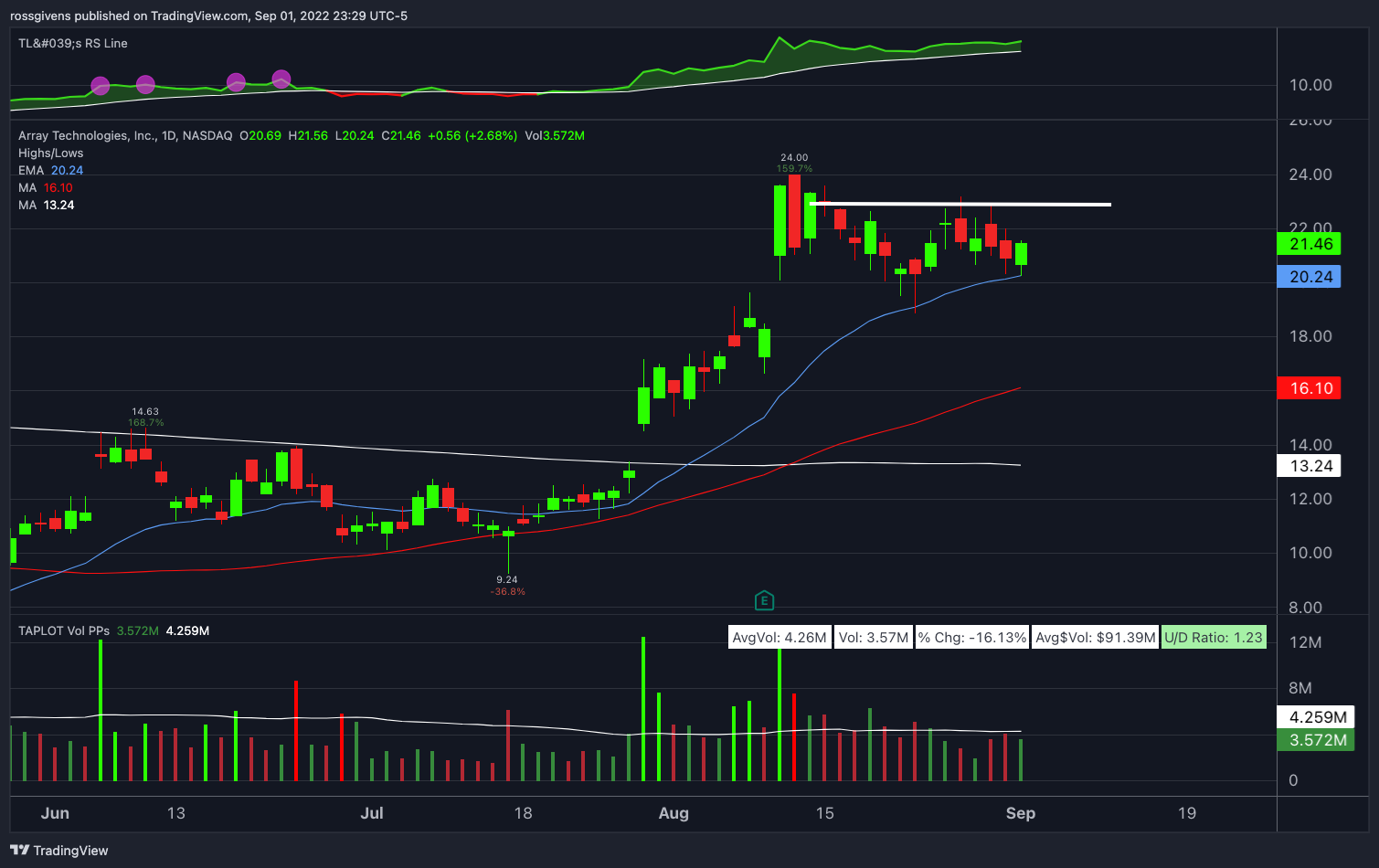

Array Technologies, Inc. (Long Idea)

Array Technologies, Inc. (ARRY) is also in the solar sector. But instead of making solar panels, this company manufactures ground-mounting systems used in large solar energy projects.

ARRY stock has been an absolute monster the last couple months.

Shares surged more than 150% in 30 days before taking a breath and consolidating in the low $20 range.

If the stock breaks through $23 on above average volume, it could see another big leg higher.

Join the Stealth Team

Institutional investors like pension funds, mutual funds, hedge funds and other large players make massive institutional buys that fly under the radar of most individual investors.

But if you know how to spot those buys in real time, you can potentially follow the big money to big gains.

This is what I focus on inside my premium Stealth Trades research service.

To learn more about the service and how you can get involved for just $0.99, click here now.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily