Stocks continued to rally last week, with the S&P 500 reaching its 50-day moving average.

The market, as tracked by the SPDR S&P 500 ETF Trust (SPY), is now up roughly 10% from the lows.

Bear market rallies are not uncommon, and it is important to maintain a big-picture outlook.

The S&P 500 is still down 20% from its 2021 highs, and the Nasdaq 100 is off more than 30%.

Tech Trounced

Technology stocks have been hit harder than other areas of the market this year, and many of the biggest names made new lows last week.

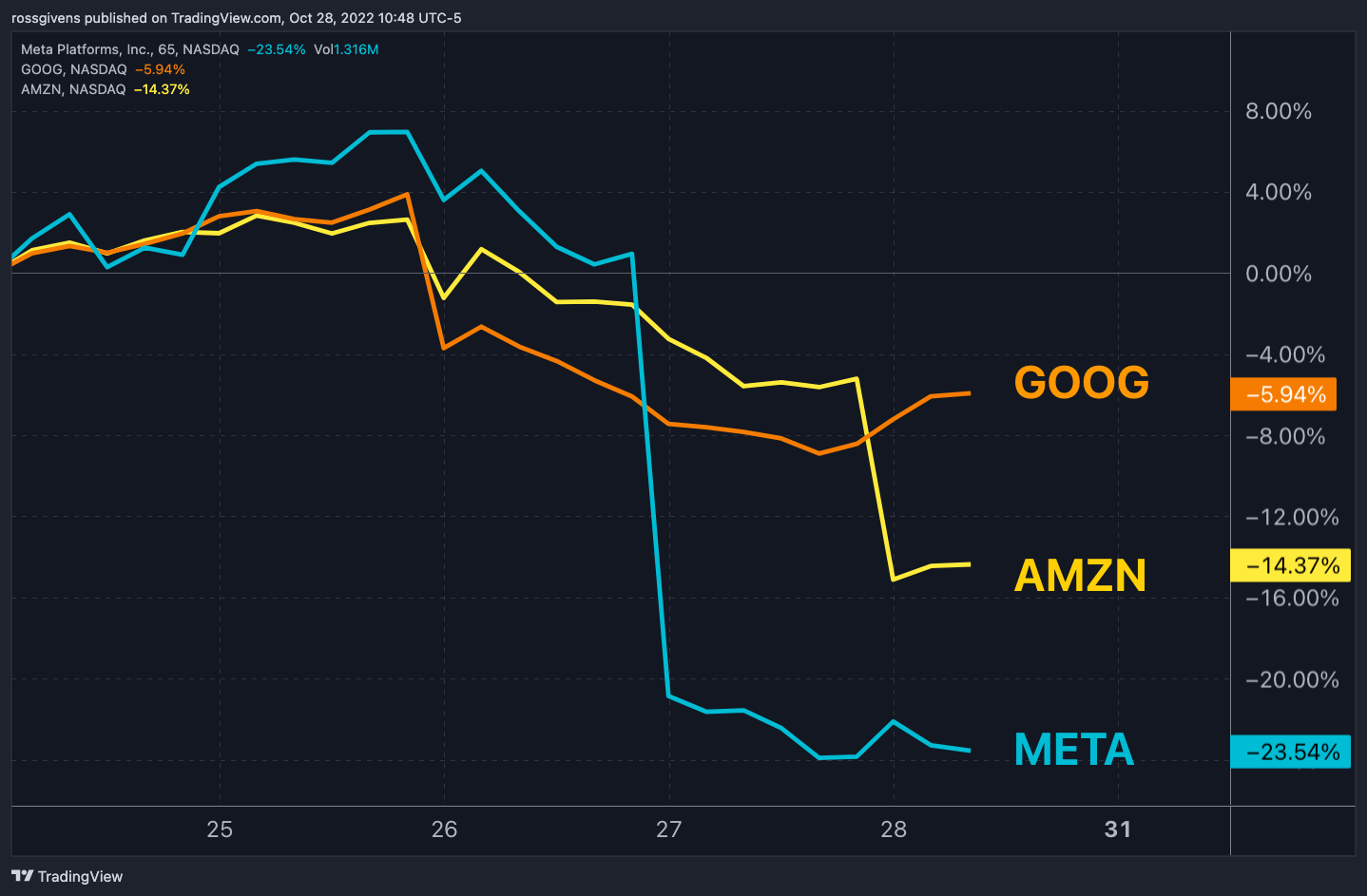

Amazon (AMZN), Alphabet (GOOGL) and Meta Platforms (META) all fell on poor earnings results.

The chart below shows the performance of those stocks for the week…

Not everything is down, however…

In fact, the indexes managed to shake off these results and hold their ground to close the week.

This is a good sign for stocks. The market’s ability to rally while the previous market leaders fall tells me we are likely near the bottom of this bear market.

Remember that the leaders of one bull market will not lead the next…

That means Meta, Alphabet and Amazon will not be the big winners of the new bull market.

It’ll be smaller companies, many of which you have never heard of, that deliver the biggest gains in the coming years.

That’s why it is important to focus on strength and pay attention to the stocks making new highs when the market is just coming off its lows.

HealthEquity, Inc. (Long Idea)

The health care sector has been strong all year, and HealthEquity, Inc. (HQY) is one stock I’ve been watching in particular.

In the midst of a nasty bear market, HQY has managed to nearly double since the start of the year.

The stock has formed a base over the last several months, with a series of shallowing pullbacks from left to right.

The 200-day moving average has just started to turn up, signaling the start of a new Stage 2 uptrend.

Clean Harbors, Inc. (Long Idea)

Clean Harbors, Inc. (CLH) is a pollution control company. It collects, transports, treats and disposes of hazardous and non-hazardous waste.

After a powerful move higher in late July, shares have consolidated in a tightening pattern, with a pivot near the $120 mark.

Shares began breaking out higher on Friday and are now within pennies of making a new all-time high.

The company is scheduled to report earnings on Wednesday, so be mindful of that.

YPF Sociedad Anónima (Long Idea)

YPF Sociedad Anónima (YPF) is an Argentine energy company engaged in upstream and downstream operations for crude and natural gas.

The stock launched off the lows in July, advancing more than 150% in just eight weeks.

It then consolidated, made a series of shallowing retracements and is now trying to break out for another leg higher.

The volume footprint looks great, moving averages are all trending higher and pullbacks are minimal.

If the oil market holds up, I would expect to see another strong move up for YPF.

Trade Under the Radar

Institutional investors like pension funds, mutual funds, hedge funds and other large players make massive institutional buys that fly under the radar of most individual investors.

But if you know how to spot those buys in real time, you can potentially follow the big money to big gains.

This is what I focus on inside my premium Stealth Trades research service.

Look, if you haven’t been making money in these markets, it’s time to try something new…

Take a few moments to click here and watch my brand-new Stealth Trades video bulletin…

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily