Hey, Ross here:

Welcome back – hope y’all had a fantastic Christmas with your loved ones. I know I did.

It’s another shortened trading week again…

And just like last week, our offices will be closed starting Wednesday.

But that still leaves us two days for this newsletter.

So for today, let’s see why now is the season to be bullish.

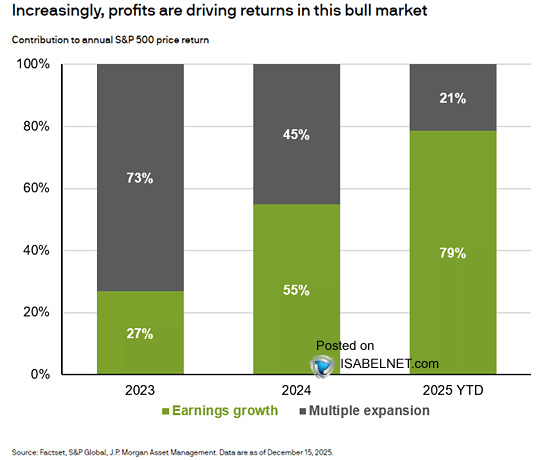

Chart of the Day

Source: @DualityResearch via X

The top part of this chart shows the total YTD return of the S&P 500 at the top – which is roughly 16.2%.

The bottom part shows the earnings per share growth in purple – about 13.6%…

And the growth in price-to-earnings multiples in green – about 2.3%.

In other words, even though there have been a lot of clamorings about “overvaluation” in the markets lately…

This shows that most of the S&P 500’s return this year has come from earnings growth instead of multiples expansion.

This is in contrast to the past two years, where most of the growth came from multiples expansion instead of earnings growth.

And it’s not just the S&P 500. Take a look.

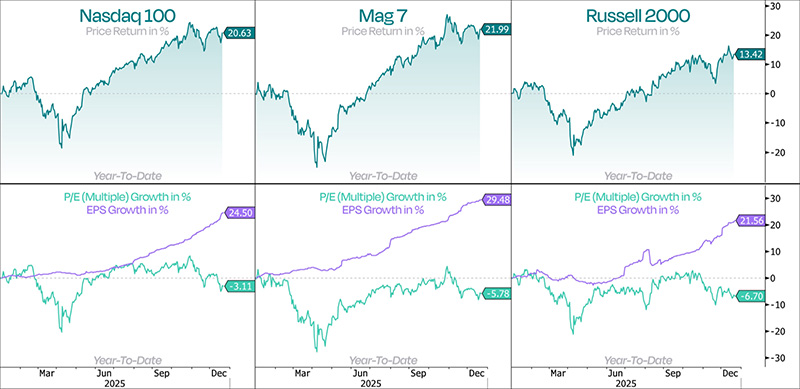

Source: @DualityResearch via X

In fact, the Nasdaq 100, the Mag 7, and the Russell 2000 have seen earnings growth in excess of their total price return this year.

In other words, they’ve experienced valuation contraction…

Even though they’ve all delivered some solid returns this year.

Again, all this is exactly what we want to see.

With so much fear about overvaluation circulating around…

We want to see returns coming from earnings growth instead of multiples expansion as much as possible.

And with the earnings picture for 2026 looking even better than 2025…

Tis the season to be bullish.

But as I elaborate below – how many people will stick to it?

Insight of the Day

This bullish backdrop for stocks is occurring amid an extremely high degree of economic uncertainty.

Take a look at the latest Consumer Sentiment Chart.

According to surveys, consumers are the most pessimistic they’ve ever been in decades.

They’re more pessimistic now than during the pandemic, the 1990 recession, and even the Global Financial Crisis…

Where in case you’ve forgotten, the stock market got chopped nearly in half – and the financial system was literally on the verge of a complete collapse.

Now while I’m not going to pretend that everything is fine and dandy with the economy…

It’s clear that the current consumer sentiment is completely out of sync with the underlying reality.

But I’m not complaining – and you shouldn’t be either…

Because as I’ve said many times before…

This kind of sentiment gap always creates opportunities we can exploit.

That’s why tomorrow, Tuesday December 30, at 11 a.m. Eastern…

I’m hosting a special LIVE State of the Market address.

I’ll dive deep into what’s really moving stocks…

The truth behind the inflation and jobs numbers…

Why I’m still optimistic despite all the noise coming from TV pundits and talking heads…

Where the smart money is positioning right now…

And most importantly…

How to spot the next wave of opportunities before everyone else does.

This exclusive session is free for all members to attend…

But because space is limited, you do need to click here to let me know you’re coming.

This will be my final live session for the year.

So take full advantage of it – and get a headstart on 2026.

Here’s the link to register again.

I’ll see you tomorrow morning at 11 a.m. ET.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses. I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining. Just take the leap and watch your wallet grow!”

Ross Givens

Editor, Stock Surge Daily