Hey, Ross here:

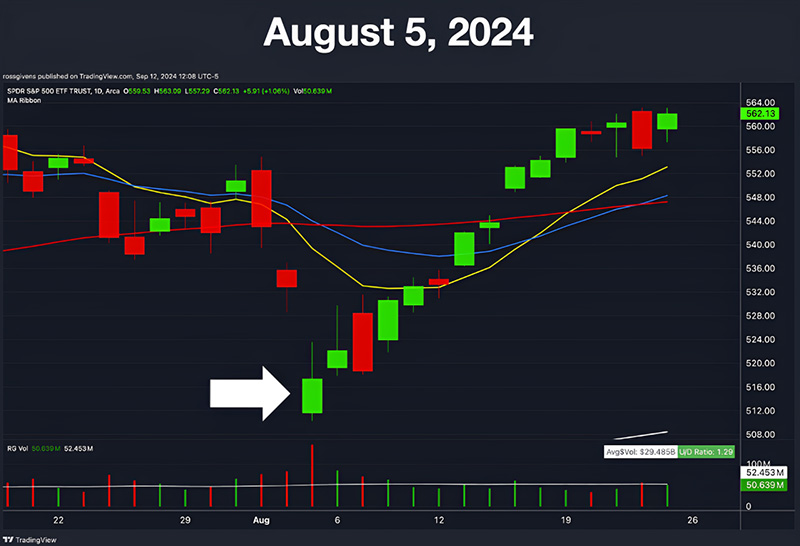

Last week was one of the strongest in the market, and it followed one of the weakest.

So the question is – where will the market go from here?

Here’s one sign that points toward prices being likely to go higher.

Chart of the Day

This is a 5-minute chart of the S&P 500 last Wednesday, when the latest CPI inflation data was released.

At first, there was a large selloff as the report showed no drop in inflation.

But as you can see, the big boys started buying less than two hours later – leading to an epic reversal all the way to the close.

One of the things I look for is anomalous days in the market when stocks rally on bad or mediocre news as this is a strong sign that prices are likely to go higher. Wednesday was just such a day.

We saw similar price action back in May and August – and stocks ripped higher each time.

If history repeats itself, we could see stocks rip higher leading up to the election – regardless of September seasonality.

Insight of the Day

Until serious and credible evidence emerges to the contrary, consider the bull case for stocks to be still very much in play.

Yes, many ordinary Americans are still being squeezed by inflation.

Yes, the labor market is weakening.

But no – this does not mean we’re likely to enter a bear market anytime soon.

Unless serious and credible evidence emerges to the contrary, you should consider the bull case for stocks to still be in play.

If my bull case changes, you’ll find out right here on this newsletter.

In the meantime, don’t confuse spikes in short-term volatility with a breakdown in the stock market.

These volatility spikes create market noise that “masks” bullish opportunities…

But make no mistake – they’re still there.

So, before the Fed concludes its meeting this Wednesday – something that is almost certain to create a significant spike in volatility…

You want to make sure you’re armed with a strategy that can uncover the best bullish opportunities under all that noise.

Customer Story of the Day

“Ross Givens from Trader’s Agency is an awesome resource to help you with your investing needs and investing education.

I waited about three months to write this review to give myself time to see the impact on my portfolio and I have been completely satisfied.

Ross has a no nonsense, simple approach that makes it easy for all investors and he takes the time to answer all questions on a weekly basis.

Thanks, Ross and Traders Agency!”

Ross Givens

Editor, Stock Surge Daily