Hey, Ross here:

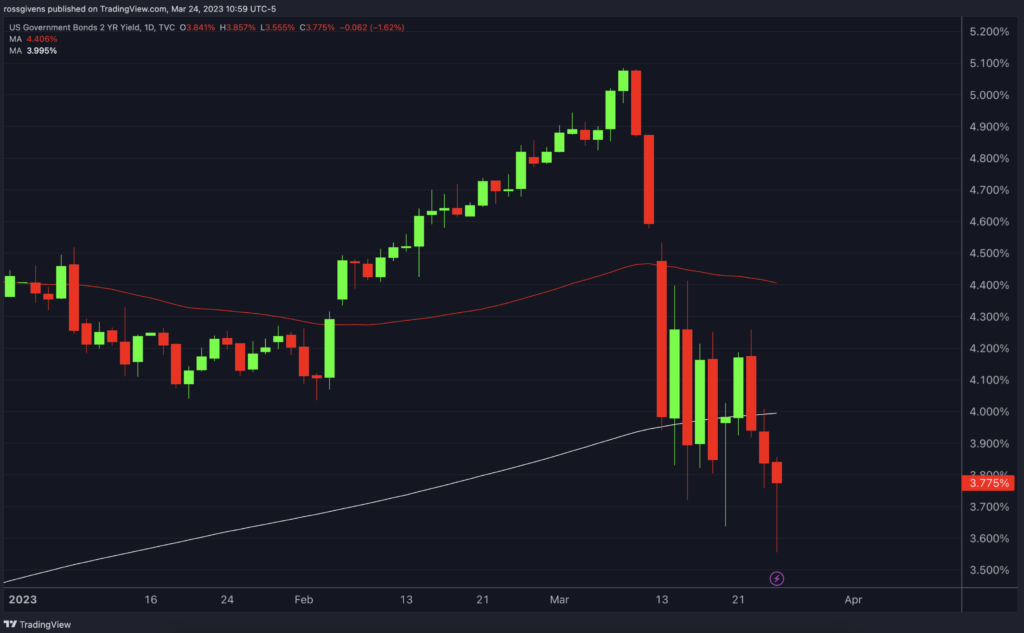

As we start a new trading week, let’s look at a sign from the bond markets.

Chart of the Day

Stocks ended higher last week – but they really didn’t do much.

The bond market, however, is a very different story. The interest rate on 2-year government bonds fell from 5.05% to 3.7% in just two weeks(see above chart) – the fastest drop in recent history.

As a general rule, lower interest rates are good for stocks and higher rates are bad. This is because investors demand a higher earnings yield from stocks compared to bonds to compensate them for the additional risk.

Today, however, the equation is not so simple.

Interest rates were raised aggressively over the last 15 months. In fact, it was the fastest rate hike in history.

The Federal Reserve took these actions to fight inflation. Of course, they are the ones who caused record inflation in the first place, but that’s another story.

So now it is a bit of a balancing act. Don’t raise rates enough, and inflation will continue to run rampant. Raise them too much, and you kill the economy.

It’s a catch-22. And Wall Street is trying to not only forecast interest rates going forward, but at the same time decide what is more important – economic growth or inflationary pressure.

This situation is a new one, and even professionals are finding it hard to navigate.

I believe that is why the stock market is moving so erratically. We continue to see aggressive moves higher on advancing volume followed by quick selloffs that are equally convincing.

What I would like to see for some serious profit potential is the “P-word” – the topic of today’s insight.

P.S. Want me to send you special trade prospects and potential market moves directly to your phone? Text the word ross to 74121.

Insight of the Day

More participation will equal more profits.

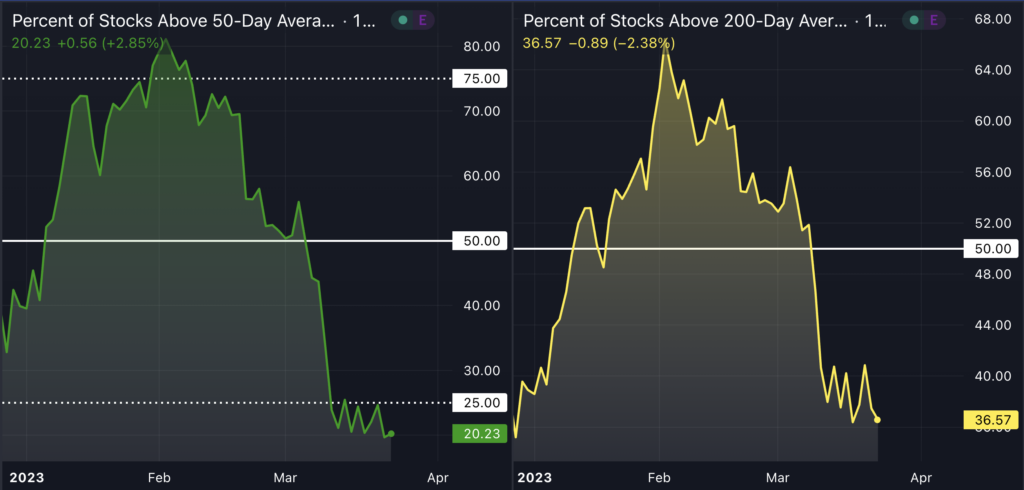

The charts below show the percentage of stocks above their 50- and 200-day moving average.

As of today, only 20% of stocks trade above their 50-day average.

In other words, 80% of stocks are in short-term downtrends.

I’d like to see this number climbing. A move above 50% would be a clear signal that we are getting broad participation across the market.

Once that happens, those who already own the right stocks – companies with big sales and earnings growth, high relative strength, good products/services, and clean charts – will be the ones with the best chance of the highest profits.

And if you want to position yourself before the upward move happens – then make sure to check this out. Because for only $5, you can start adding these high-potential stocks to your portfolio right now.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily