Hey, Ross here:

Welcome back to a new trading week.

Trump’s trade negotiations with China continue.

I believe both parties are looking for a rational and productive way forward.

And though of course anything can happen, today’s chart shows that markets are expecting a favorable outcome.

Chart of the Day

This is the Volatility Index (VIX) posting an intraday drop of over 28% last Friday.

This was the biggest intraday drop in the VIX since the market lows right after Liberation Day (where it dropped 45%).

In short, volatility just got flattened – which is a positive sign for the markets.

And while it’s true that volatility still remains elevated compared to the past few months…

The trajectory – volatility trending downward – seems promising.

But volatility isn’t the only thing getting flattened.

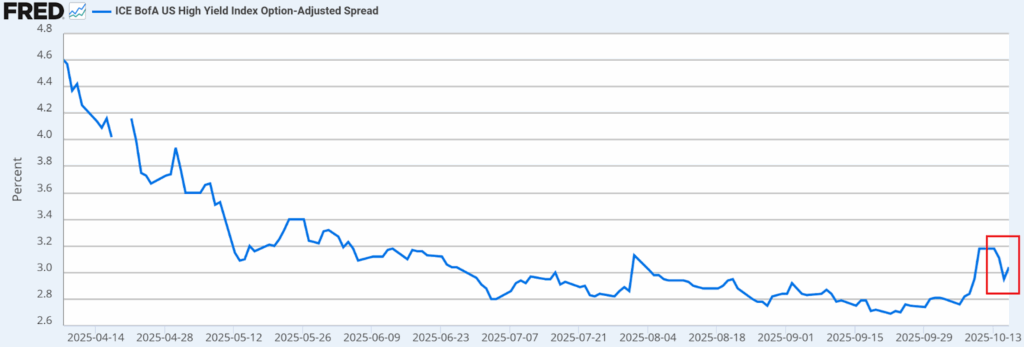

High-yield bond spreads – aka the premium that financial institutions are demanding to lend to NON-investment grade corporates – also pulled back over the week.

In other words, they’re expecting risks to fall – not increase.

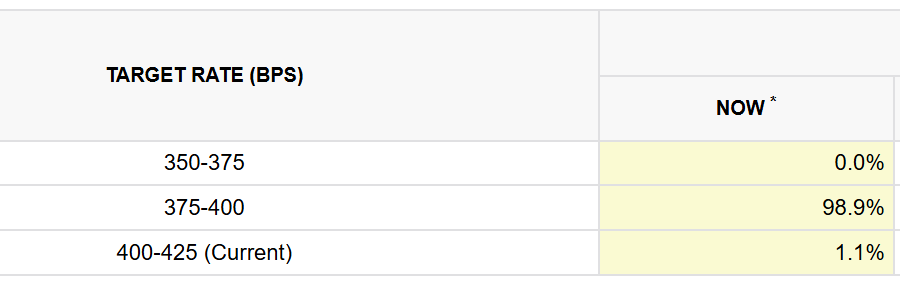

Finally, it looks like it’s game on for another rate cut next month, with almost 99% of options traders expecting a second rate cut.

Taken as a whole, all this just keeps supporting what I’ve been saying.

Stay in the game… stay long… and stay focused.

I explain what I mean by that last part in the Insight of the Day below.

P.S. My next edition of 2 Trades in 2 Minutes drops tomorrow. If you want to take advantage of this fast-moving market, make sure you get on the SMS priority list by texting the word “trade” to 87858. We’ll send those trades to your mobile the second they’re released.

Insight of the Day

We want to stay focused on buying pullbacks in the strongest stocks in the strongest sectors.

Stocks never go up in a straight line.

And with the still-elevated market volatility we’re seeing…

Even the strongest stocks could be stalling or even pulling back.

That’s the buying opportunity.

Now one question some people have asked me is – why doesn’t everybody just do that when it’s relatively simple?

Well, there are two things that make buying these pullback stocks so difficult.

The first is that these stocks don’t always shoot up immediately – they can keep chopping sideways and bumping against resistance for a while.

So a lot of traders buy in – don’t see immediate gains – and dump their positions in search of something “better”.

This is even more evident when uncertainty is high, when there’s a lot of noise in the market (like now).

Then, by the time these stocks explode higher… when everybody notices them – it’s already too late.

Now, while we’re not waiting around for years or months to profit – some patience is necessary.

And patience is always in short supply in the market.

The second thing that makes it so difficult?

Identifying these stocks in the first place.

Because most traders only know the big mega-cap names – which are already the most crowded trades on the market.

Meanwhile, they’re ignoring the smaller – yet still strong – stocks with far more explosive potential.

These two things are what make buying strong stocks on pullbacks much easier said than done.

That’s why tomorrow, Tuesday October 21, at 11 a.m. Eastern…

I’m going LIVE to reveal how to implement my top “pullback buying” strategy for yourself…

A strategy that will automatically solve both problems described above.

You see, what makes this strategy tick is that it helps us identify when the “smart money” is moving in on a stock…

And that inherently means two things:

- The stock has a high chance of shooting upwards simply because of the sheer volume of institutional capital moving in…

- And we can immediately filter down our list of targets (for instance, by removing all the biggest names from these stocks and then focusing on the smaller names with greater upside potential)

Can you see how that solves both problems at once?

I’ll walk you through the entire strategy step-by-step tomorrow…

And also share more detailed thoughts on the state of the market right now.

You don’t want to miss it…

Because one of the pullback stocks this strategy identified a few months ago? It’s now up 564%.

So click here to secure your seat for my live strategy walkthrough tomorrow…

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses. I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining. Just take the leap and watch your wallet grow!”

Ross Givens

Editor, Stock Surge Daily