Hey, Ross here:

The Fed hiked rates by 25 points as expected. And although Powell tried to inject some hawkishness into his speech, the market still rallied hard.

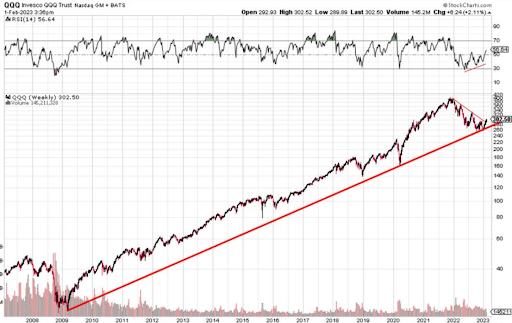

And as the Chart of the Day shows, there’s evidence that despite a horrible 2022, the decade-long bull market we’ve been in might still be on track.

Chart of the Day

Here’s an interesting chart of an ETF that tracks the NASDAQ-100 I saw from financial Twitter recently.

As you can see, despite a dramatic drop in 2022, even its lowest point still fits the pattern of 10+-year uptrend – the so-called secular bull market we’ve been in since 2009.

To me, this is just a single chart, so I won’t be placing too much importance on it. But it does lend support to my thesis that we’re in the beginnings of a bull market – regardless of whether it’s a “new” bull market or just a continuation of a long-term one.

Insight of the Day

Missing rallies can be lethal to your bottom line. But at the same time, don’t overextend yourself in an attempt to “get ahead” of the rally.

Traders who miss the first rally in a bull market often sit on the sidelines waiting for the big correction – which never comes. This causes them to miss out on the most profitable opportunities. And that’s why missing rallies can be such a big hit.

At the same time, you never want to let yourself become overextended by trying to “get ahead” of the rally. Because if a correction does come, it’ll hit you harder than it needs to. So, always play it smart and manage your risk properly.

Also, remember that playing things smart does not mean giving up profits. As I’ve shown before, “stacking” smaller individual profits can generate truly spectacular results – even potentially multiplying your starting capital by over 100 times. See the proof here.

Embrace the surge,

Ross Givens