Hey, Ross here:

Markets dipped a little bit yesterday after a strong performance on Wednesday.

Here’s a key level I’m watching.

This is the 10-year U.S. Treasury yield, and it typically moves in the opposite direction to the stock market.

As you can see, the 10-year yield has been falling steadily since May – but has now run into technical support, temporarily halting its decline.

Whether it will be able to fall back past this support could be key in how the market moves from here.

Based on the pattern, I think there’s a very good chance the 10-year yield falls below support – allowing the market to surge higher.

But until this happens (which could be as soon as Monday) – we have an opportunity widow

Insight of the Day

The market has yet to resume to full bullishness – meaning now is the time to strike

It’s not just the 10-year Treasury yield that has yet to fall below key support.

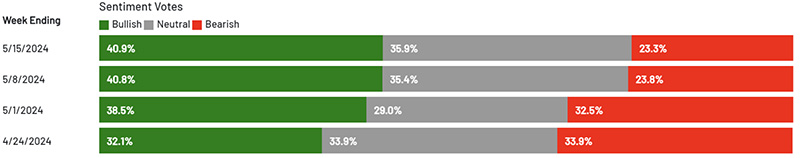

Market sentiment has also yet to return to full bullishness – as seen by the American Association of Individual Investors’ weekly sentiment survey – with bullish levels flat from last week.

Once this changes, though, it’ll be like throwing gasoline on a small fire…

And those who waited for it to happen will likely miss out on the biggest gains – which always occur at the beginning of a blistering rally.

That’s why tomorrow morning at 11 a.m. Eastern…

I’m going LIVE for a very special weekend masterclass…

Where I’ll show you exactly how to target the stocks that could surge the fastest and highest as the market returns to full bullishness.

The secret of these stocks? Hidden price-moving catalysts most of the public doesn’t know about – yet…

But that the corporate insiders most definitely do.

After tomorrow’s masterclass, you’ll know:

- How to position yourself in stocks with these hidden catalysts by following the trail of the insider money…

- The key mistakes traders make when following these insider trades..

- And the 3 counterintuitive insider buying signals you must know about.

I’ll also be spotlighting a fast-moving insider opportunity you don’t want to miss…

And I’m also bringing on a very special guest for this masterclass, who I know you’ll love.

So make sure you click here to secure your spot for tomorrow’s special weekend masterclass…

And I’ll see you tomorrow, Saturday morning at 11 a.m. ET sharp.

Ross Givens

Editor, Stock Surge Daily