Hey, Ross here:

Yesterday, I showed you how the earnings cycle is like bottoming – providing an ideal entry opportunity for savvy traders.

So, if you were surprised by the market dipping yesterday because of “disappointing” Big Tech earnings – don’t be.

Today, let’s look at how the individual investors are still being way too bearish.

Chart of the Day

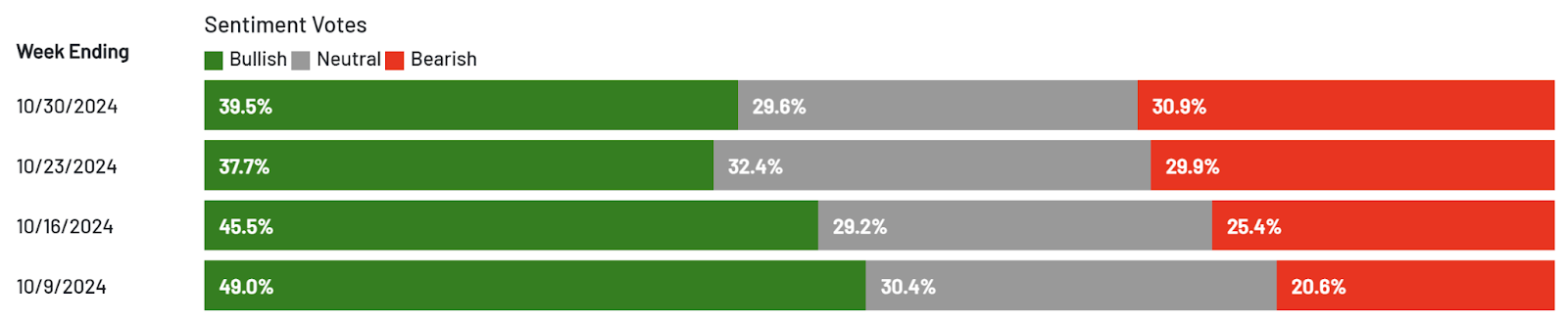

This is the results of the weekly survey conducted by the American Association of Individual Investors (AAII).

Last week saw a massive dip in bullish sentiment and a spike in bearish sentiment.

This week, bullish sentiment has increased slightly – but so has bearish sentiment.

Individual investors are way too bearish.

Meanwhile, the “smart money” – the institutional investors – are becoming increasingly bullish.

In Wednesday’s edition of this newsletter, I referred to this as the “sentiment divergence opportunity” – and it’s still very much in play.

Don’t wait for the election to be over to exploit it.

Insight of the Day

In periods of uncertainty, those with superior information are even more advantaged.

In the markets, those with superior information already have a powerful advantage.

But in times of heightened uncertainty – like the period we’re in now – the power of this informational advantage is amplified even further.

Couple this with the fact that we’re smack in the middle of earnings season…

And I believe there’s no better time than to follow the company insiders – high-ranking executives exploiting a legal loophole to trade their own company stock.

They know far more about the prospects of their own companies than any Wall Street analyst could hope to…

And they don’t hesitate to profit from their inside information.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE for a masterclass to demo my complete strategy for following these insider moves.

I’ll hand you my complete insider playbook, including:

- What compels these insiders to buy…

- The warning signs you need to know when following the insiders…

- The most powerful – yet counterintuitive – insider buying signals there are.

This strategy has never had a losing year – even in the 2022 bear market…

Has generated a compounded return of over 1,900% since inception…

And one recent insider pick has surged over 80% in just over a month.

But with all the uncertainty swirling around right now, gains like these could just be the start.

So, if you haven’t yet, click here now to “lock in” your spot for my LIVE insider masterclass later this morning…

And keep an eye out for the login info in your inbox shortly.

I’ll see you in just a bit at 11 a.m. ET.

Customer Story of the Day

“I just started learning about trading using Traders Agency.

Great teachers with live instructional webinars and recorded videos to re-watch at my leisure, and I am able to talk with someone on the phone when I have questions.

So far I have made more money than I have lost, which is a great way learn about trading.”

Ross Givens

Editor, Stock Surge Daily