Hey, Ross here:

There are many kinds of divergences in trading.

All of them lead to some sort of opportunity.

So today, let’s look at a divergence opportunity forming thanks to investor sentiment.

Chart of the Day

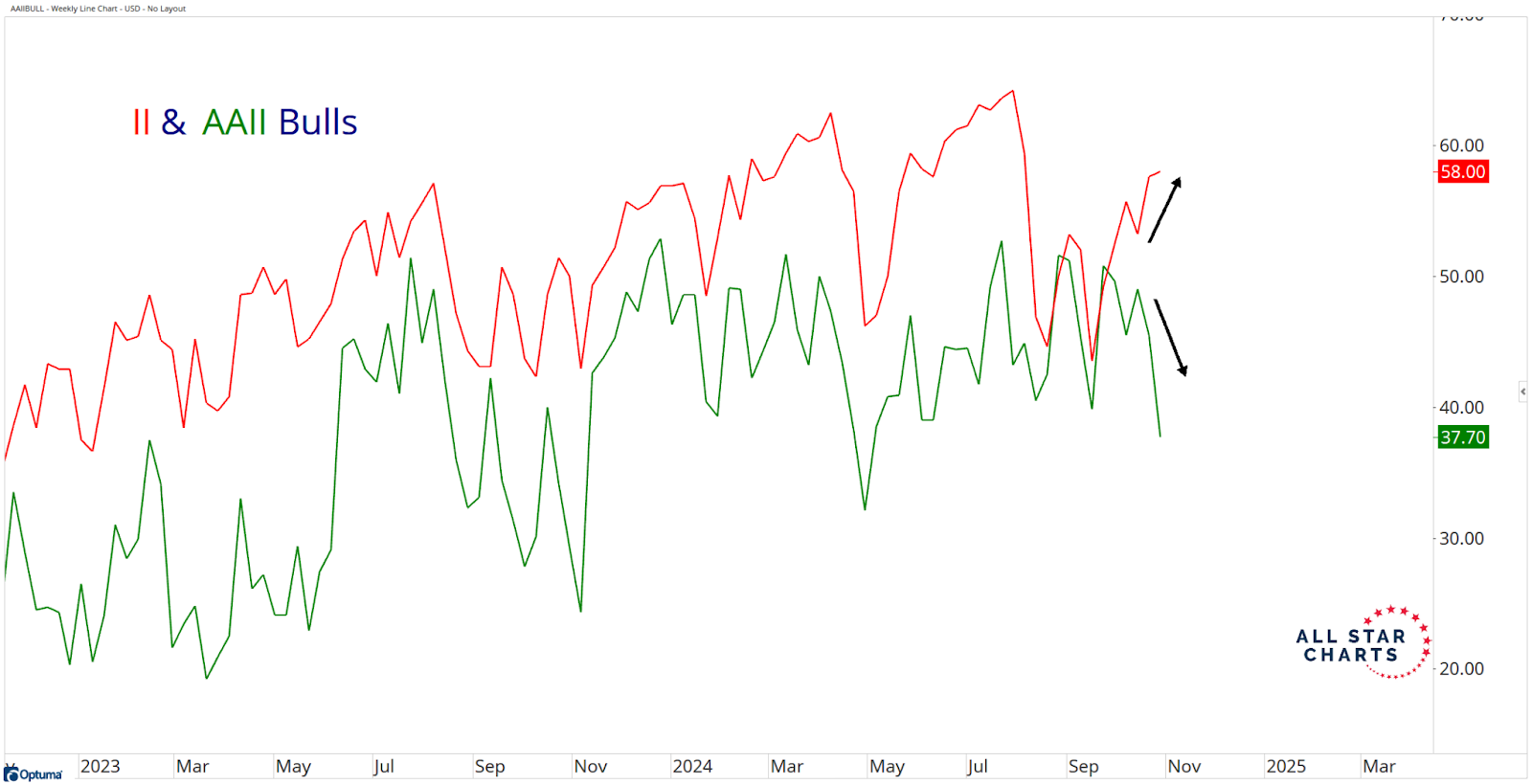

The green line shows the percentage of bulls among surveyed individual investors.

The red line shows the percentage of bulls among surveyed institutional investors.

As you can see, institutional investors – aka the “smart money” – is becoming more bullish…

While the individual investors are becoming more bearish.

Who would you trust?

I explain more in the Insight of the Day below.

Insight of the Day

The history of the market is just institutional investors exploiting the individual investors.

That’s the sad but harsh reality.

I saw it first-hand working at one of the biggest banks on Wall Street.

Institutional investors manipulating prices to scare retail traders and “flush” them out of specific stocks – it’s nothing new.

And since it’s all technically legal, it’s not going to change anytime soon (no matter who wins next week).

All we can do is use the system to our advantage.

As you’ve just seen, right now, many individual investors and retail traders are being “flushed out” – all while the “smart money” positions themselves in the highest-potential bullish opportunities.

And one of the most bullish areas of the market right now is one specific corner of the AI market…

One that is absolutely critical to keeping the entire AI sector alive.

The “smart money” is already positioning themselves in this sector.

And thanks to our Halloween special…

You can get all the details about my #1 opportunity in this sector – plus a year’s membership in my flagship Stealth Trades service – for just 99 CENTS.

There’s no catch – just a great deal that expires in a couple days.

So click here to take advantage of it now.

Customer Story of the Day

“Dear Ross,

Christian here from Durban, South Africa. I discovered you through Turley Talks which I am an avid follower of.

I find your programs thoroughly informative yet made very simple, highly professional and your approach amazingly accommodating.

I look forward to putting to great use the knowledge and understanding of trading dynamics I am garnering through your program.

Many thanks & God Bless!”

Ross Givens

Editor, Stock Surge Daily