Hey, Ross here:

With big jobs and inflation data due to come out before the Fed meets this month…

Brace yourself for a choppy ride as the market keeps adjusting their rate cut expectations.

My advice for riding out this turbulence?

Follow the smart money.

Chart of the Day

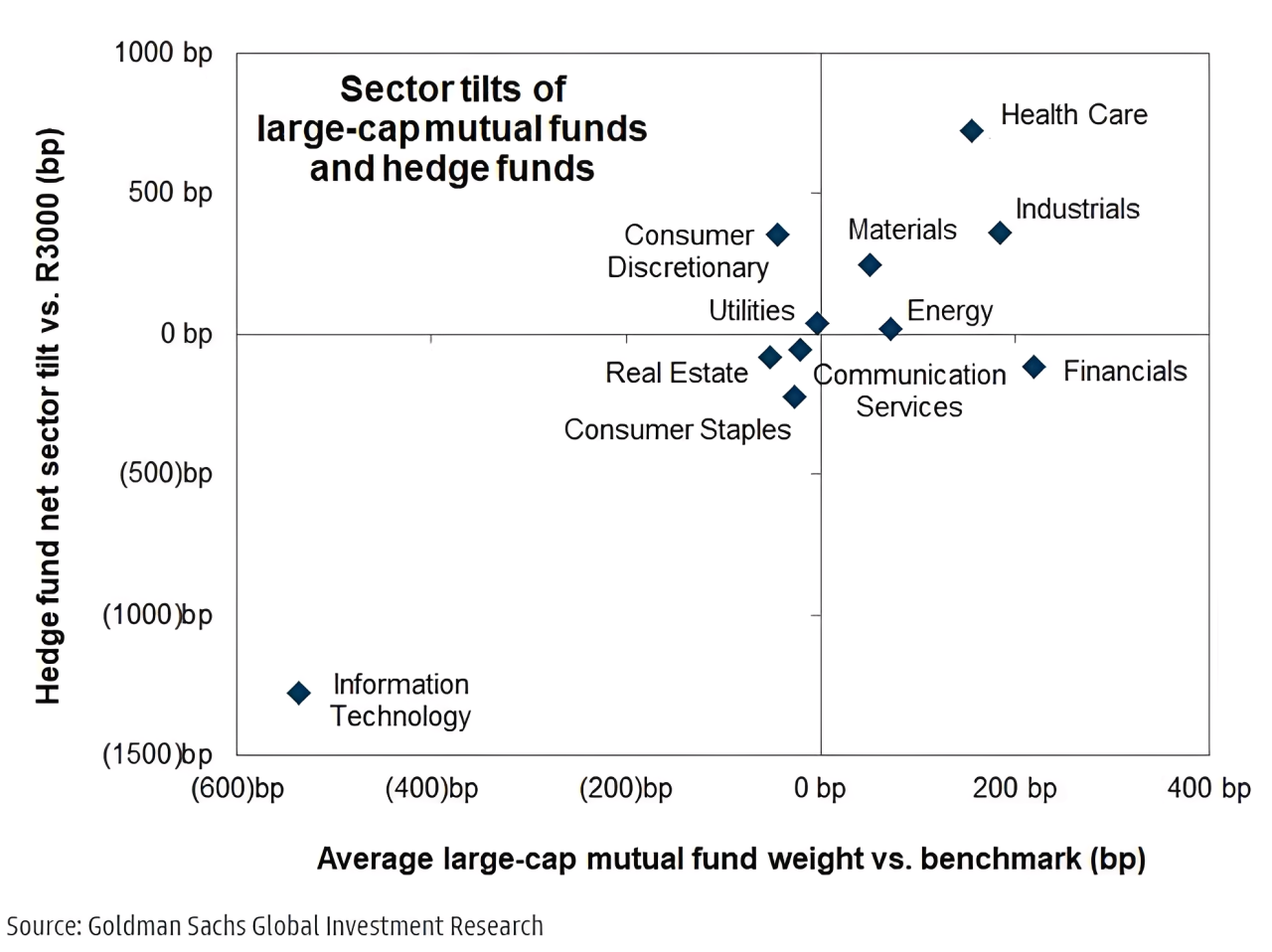

This chart by Goldman Sachs shows the current “sector tilts” of the institutional investors.

Sectors in the top right section of the chart above are being overweighted by both the large-cap mutual funds and the hedge funds.

And as you can see, the “favorite” sector of these two types of major institutional players right now is healthcare.

Information technology? Firmly at the bottom left of the chart…

Meaning that this sector is the most underweighted by these big players.

If that surprises you, you haven’t been paying enough attention.

Just because the media can’t stop talking about the tech sector…

Doesn’t mean that’s where the “smart money” is focusing.

In fact, it’s usually the opposite.

P.S. With the market so choppy this month, you don’t want to fall behind. Text the word “trade” to 87858 and get this newsletter straight to your mobile every morning.

Insight of the Day

Don’t confuse opportunity with attention

The masses pay a lot of attention to certain sectors and stocks.

You know the ones I’m talking about. Most of them are in the tech sector.

And don’t get me wrong – they’re important, especially as a barometer of overall market direction.

But that doesn’t mean they hold the biggest opportunities.

In fact, as you just saw above, the “smart money” thinks these stocks hold the least amount of opportunities…

And they’re focusing on healthcare instead – a sector the financial media rarely even bothers to mention (too boring).

Where the masses’ attention is flowing…

And where actual opportunities are flowing are NOT the same at all.

As I said, in this choppy month – let the “smart money” be your North Star.

That’s why tomorrow, Friday September 5, at 11 a.m. Eastern…

I’m going LIVE to show you a time-tested strategy for tracking these “smart money” moves…

So you can follow them to explosive opportunities regardless of the headline drama.

It’s a strategy that’s led to wins of 51% in 15 days… 77% in three weeks… and even 87% in just 24 hours.

I’ll walk you through it step-by-step tomorrow…

And even share details of some fresh opportunities the “smart money” is piling into right now.

So click here to secure your seat for my live session tomorrow…

And I’ll see you Friday morning at 11 a.m. ET sharp.

It looks like we’ve got a turbulent month ahead of us…

So make sure you know how to follow the clearest North Star there is.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross and the Traders Agency team are trustworthy.

I watched from the sidelines for several months, before joining. My wife was still skeptical after I signed up.

But now, after a month in, she sees the gains I am getting and she’s becoming much more optimistic.

This is important to me, because I have signed up for other services that didn’t work.

Ross’ strategy is the best (and most consistent) I have ever used.

I appreciate his straightforward approach to teaching. He’s clear and easy to understand.

I currently have The Insider Effect and Alpha Stocks. I am looking forward to the future, when I can also sign up for The Black Edge and Fire Traders.

Thank you Traders Agency for helping me and all the other “little guys” out there.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily