Hey, Ross here:

Yesterday, I talked about how we are in a target-rich environment for taking trades.

Today, I want to show another chart that supports this thesis…

Because it shows that the money is pouring in.

Chart of the Day

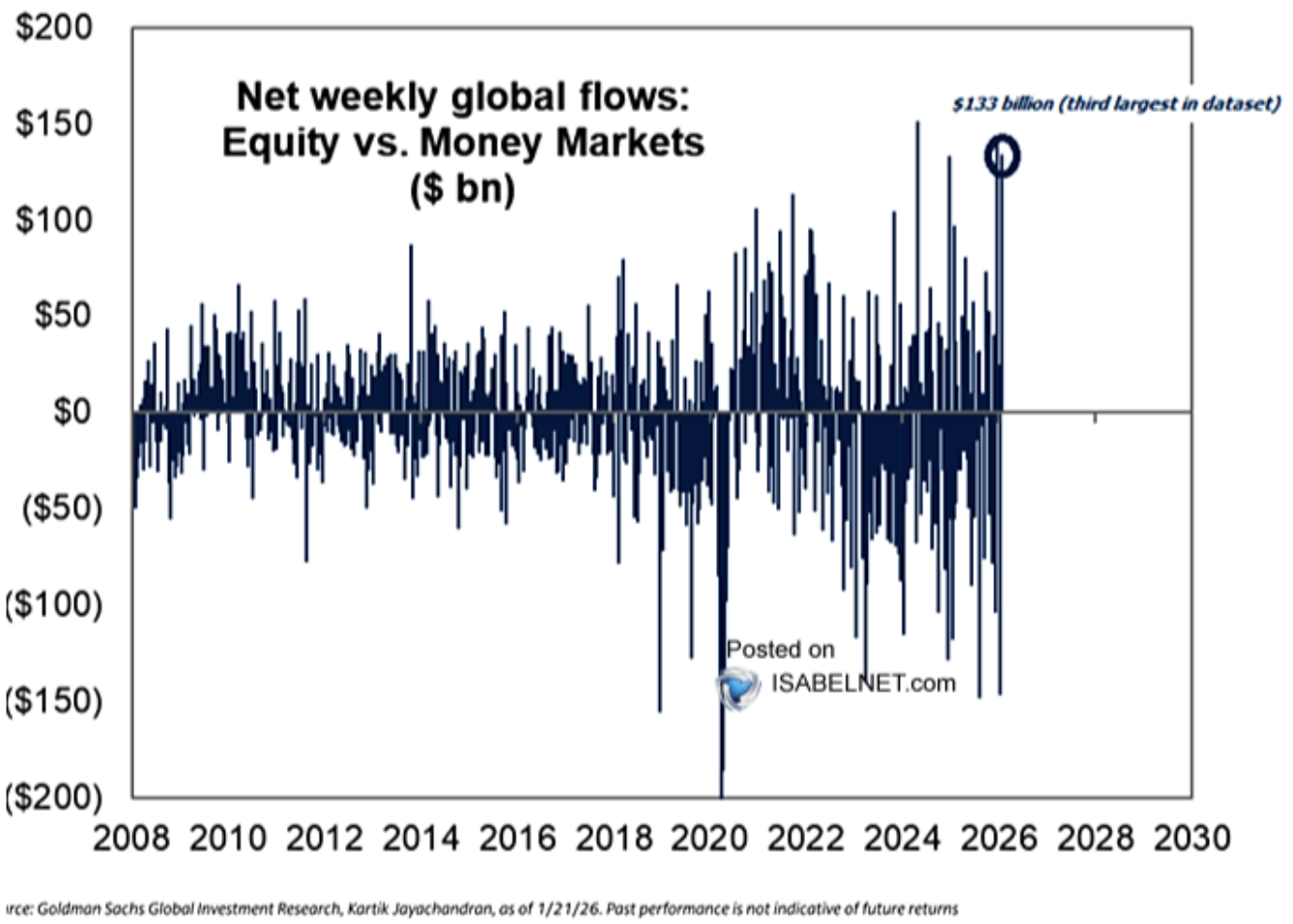

This chart shows the weekly global money flows into stocks (aka risk assets) versus money-market funds (aka risk-free assets).

Basically any spike below the zero midline is a weekly outflow from stocks and into money-market funds…

While anything above the midline is a weekly outflow from money-market funds and into stocks.

As of last week, Goldman Sachs data records a net $133 billion inflow into stocks versus money-market funds.

That is the third-largest net inflow into stocks dating back to 2008.

In other words – the money is pouring into risk assets.

And that leads to the most important question to ask yourself right now.

I elaborate on that question below.

Insight of the Day

When a trade gets too crowded, the “smart money” leaves in search of greener pastures.

The past few years have bid up the valuations of these mega-cap tech stocks to historic levels.

And while there are good fundamental reasons why these stocks deserve to be at the top of the heap…

The fact is that, in 2026 – the mega-cap tech trade has simply gotten too crowded.

And at their current size, their upside potential is necessarily limited.

Are these still great – even excellent – companies that will most likely continue to generate billions in profit for years to come?

Absolutely.

But remember, in trading – everything carries an opportunity cost.

Every dollar allocated to a Big Tech trade is a dollar not allocated elsewhere.

The smart money is always acutely aware of this – because their performance is always benchmarked.

So, when they see a trade is getting too crowded, they’re often the first to rotate away in search of greener pastures

And because they are the “big money” that moves stocks…

When they rotate away, it shifts the entire market.

We need to move with that rotation, so we can use their big money flows to our advantage (instead of getting stuck in yesterday’s trades, which many retail traders tend to do).

That’s why tomorrow, Tuesday January 27, at 11 a.m. Eastern…

I’m going LIVE to show you exactly how to track these institutional flows into today’s – not yesterday’s – most lucrative trades.

Just this month alone…

Every single trade this strategy has spotted is up double-digits – with one trade up over 70%.

This is all in a matter of weeks or days.

That’s the potential of following these big money flows.

I’ll walk you through everything in tomorrow’s free live session.

So just click here to let me know you’re coming…

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross and his team are very knowledgeable about swing trading successfully, and are honest about how to get there.

Super grateful for Ross’s insight into market activity, I swear the guy doesn’t sleep, constantly providing videos and educating any one who wants to make money in the market!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily