Hey, Ross here:

Yesterday I talked about the possible resumption of a calm uptrend in the markets…

A rising tide that will help lift all boats.

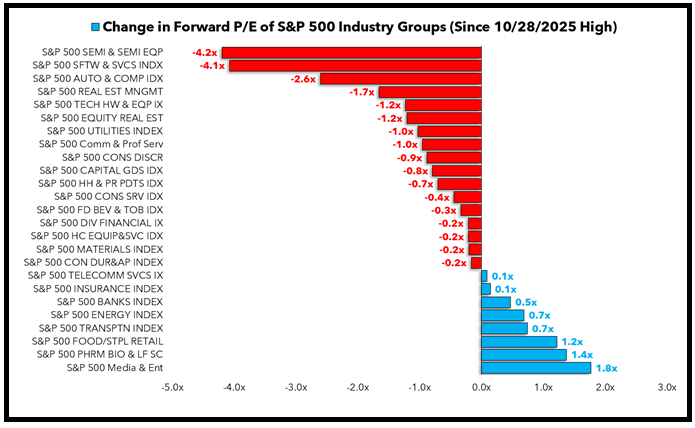

Today, let’s look at a chart that shows how much healthier the market is right now compared to end-October.

Chart of the Day

This chart shows the difference in the forward price-to-earnings ratio of the various S&P 500 industry groups as of last Friday versus the end of October.

If you recall, there was a LOT of talk during that time (and in the following weeks) about extended valuations and the possibility of a bubble.

Well, as you can see from today’s chart…

The vast majority of industry groups have seen their forward P/E ratios pull back…

While the market itself is just spitting distance away from the end-October high.

This means that multiples have contracted while underlying earnings have improved – a good sign of a healthier market.

And there’s one benefit of this “multiples contraction” we’ve seen over the past few weeks…

A benefit that could be very profitable if you play your cards right.

I elaborate below.

Insight of the Day

As sentiment improves, expect market exuberance to push valuation multiples higher again.

It’s easier to make money in a bull market than a bear market.

And it’s easier to make money in a calm uptrend than in a choppy environment.

Now, don’t get me wrong…

I’m not saying that you can’t make money in a bear market or in a choppy environment.

In fact, my strategies could have paid out both when the market was tanking in April…

As well as during the seriously choppy action in October and November.

But that doesn’t change the fact that it’s much easier to make money in a calm uptrend than almost any other kind of market environment.

And that means, when the environment lines up like this, we need to take full advantage of it.

Or as Warren Buffett is fond of saying, when opportunity comes – put out the bucket, not the thimble.

That’s why tomorrow, Tuesday December 9, at 11 a.m. Eastern…

I’m hosting a FREE live presentation to show you my top method to track down the most explosive, high-conviction setups…

Even amid this “calm” market.

The simple yet powerful system I’ll be demonstrating has helped us identify moves like 163% in seven weeks… 270% in 10 weeks… and a massive 177% in just 11 days.

But with the resumption of such a favorable market environment…

Not to mention the Fed likely cutting on Wednesday…

The opportunity window to pocket gains like these is now wide open.

So don’t miss your chance.

Click here to save your spot for my free live system reveal tomorrow…

And I’ll see you Tuesday morning at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses. I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining. Just take the leap and watch your wallet grow!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily